2011 Hampton Roads Real Estate Market Review - College of ...

2011 Hampton Roads Real Estate Market Review - College of ...

2011 Hampton Roads Real Estate Market Review - College of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

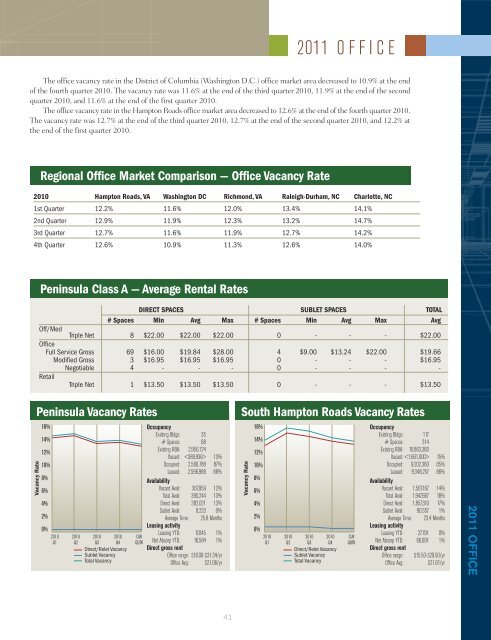

<strong>2011</strong> O F F I C E<br />

The <strong>of</strong>fice vacancy rate in the District <strong>of</strong> Columbia (Washington D.C.) <strong>of</strong>fice market area decreased to 10.9% at the end<br />

<strong>of</strong> the fourth quarter 2010. The vacancy rate was 11.6% at the end <strong>of</strong> the third quarter 2010, 11.9% at the end <strong>of</strong> the second<br />

quarter 2010, and 11.6% at the end <strong>of</strong> the first quarter 2010.<br />

The <strong>of</strong>fice vacancy rate in the <strong>Hampton</strong> <strong>Roads</strong> <strong>of</strong>fice market area decreased to 12.6% at the end <strong>of</strong> the fourth quarter 2010.<br />

The vacancy rate was 12.7% at the end <strong>of</strong> the third quarter 2010, 12.7% at the end <strong>of</strong> the second quarter 2010, and 12.2% at<br />

the end <strong>of</strong> the first quarter 2010.<br />

Regional Office <strong>Market</strong> Comparison — Office Vacancy Rate<br />

2010 <strong>Hampton</strong> <strong>Roads</strong>, VA Washington DC Richmond, VA Raleigh-Durham, NC Charlotte, NC<br />

1st Quarter 12.2% 11.6% 12.0% 13.4% 14.1%<br />

2nd Quarter 12.9% 11.9% 12.3% 13.2% 14.7%<br />

3rd Quarter 12.7% 11.6% 11.9% 12.7% 14.2%<br />

4th Quarter 12.6% 10.9% 11.3% 12.6% 14.0%<br />

Peninsula Class A — Average Rental Rates<br />

DIRECT SPACES SUBLET SPACES TOTAL<br />

# Spaces Min Avg Max # Spaces Min Avg Max Avg<br />

Off/Med<br />

Triple Net 8 $22.00 $22.00 $22.00 0 - - - $22.00<br />

Office<br />

Full Service Gross 69 $16.00 $19.84 $28.00 4 $9.00 $13.24 $22.00 $19.66<br />

Modified Gross 3 $16.95 $16.95 $16.95 0 - - - $16.95<br />

Negotiable 4 - - - 0 - - - -<br />

Retail<br />

Triple Net 1 $13.50 $13.50 $13.50 0 - - - $13.50<br />

Vacancy Rate<br />

Peninsula Vacancy Rates<br />

16%<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

2010<br />

Q1<br />

2010<br />

Q2<br />

2010 2010<br />

Q3 Q4<br />

Direct/Relet Vacancy<br />

Sublet Vacancy<br />

Total Vacancy<br />

CUR<br />

QUTR<br />

Occupancy<br />

Existing Bldgs: 35<br />

# Spaces: 88<br />

Existing RBA: 2,956,724<br />

Vacant: 13%<br />

Occupied: 2,566,788 87%<br />

Leased: 2,596,988 88%<br />

Availability<br />

Vacant Avail: 367,959 12%<br />

Total Avail: 390,244 13%<br />

Direct Avail: 382,021 13%<br />

Sublet Avail: 8,223 0%<br />

Average Time: 25.8 Months<br />

Leasing activity<br />

Leasing YTD: 17,045 1%<br />

Net Absorp YTD: 16,584 1%<br />

Direct gross rent<br />

Office range: $16.00-$31.34/yr<br />

Office Avg: $21.06/yr<br />

South <strong>Hampton</strong> <strong>Roads</strong> Vacancy Rates<br />

Vacancy Rate<br />

16%<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

2010<br />

Q1<br />

2010<br />

Q2<br />

2010 2010<br />

Q3 Q4<br />

Direct/Relet Vacancy<br />

Sublet Vacancy<br />

Total Vacancy<br />

CUR<br />

QUTR<br />

Occupancy<br />

Existing Bldgs: 117<br />

# Spaces: 314<br />

Existing RBA: 10,863,360<br />

Vacant: 15%<br />

Occupied: 9,202,360 85%<br />

Leased: 9,348,257 86%<br />

Availability<br />

Vacant Avail: 1,567,167 14%<br />

Total Avail: 1,947,667 18%<br />

Direct Avail: 1,857,310 17%<br />

Sublet Avail: 90,357 1%<br />

Average Time: 23.4 Months<br />

Leasing activity<br />

Leasing YTD: 27,791 0%<br />

Net Absorp YTD: 66,691 1%<br />

Direct gross rent<br />

Office range: $15.50-$29.50/yr<br />

Office Avg: $21.61/yr<br />

<strong>2011</strong> OFFICE<br />

41