2011 Hampton Roads Real Estate Market Review - College of ...

2011 Hampton Roads Real Estate Market Review - College of ...

2011 Hampton Roads Real Estate Market Review - College of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

General Overview<br />

The Virginia Beach-Norfolk-Newport News Apartment Report,<br />

published by <strong>Real</strong> Data, is a detailed analysis <strong>of</strong> the rental market<br />

within conventional apartment communities in the <strong>Hampton</strong> <strong>Roads</strong> region.<br />

The area has been divided into nine submarkets: Chesapeake, <strong>Hampton</strong>,<br />

Newport News, Norfolk, Portsmouth, Suffolk, Virginia Beach,<br />

Williamsburg and York. Combined, these areas contain a survey base <strong>of</strong><br />

over 92,000 units within conventional apartment communities <strong>of</strong> 50 or<br />

more units each.<br />

The Virginia Beach-Norfolk-Newport News market is divided into two<br />

portions by the James River. The Peninsula area is north <strong>of</strong> the James<br />

River and contains <strong>Hampton</strong>, Newport News, Williamsburg and York. The<br />

Southside area is south <strong>of</strong> the James River and contains Chesapeake,<br />

Norfolk, Portsmouth, Suffolk and Virginia Beach. The cities with the<br />

highest concentration <strong>of</strong> units are Virginia Beach and Newport News,<br />

which accounts for nearly one half <strong>of</strong> the region’s apartment units.<br />

Like the rest <strong>of</strong> the country, the <strong>Hampton</strong> <strong>Roads</strong> apartment market<br />

weakened in 2008 and 2009 as the housing bubble collapsed and the<br />

economy entered into a recession. Occupancy rates fell to their lowest level in over ten years in the first quarter <strong>of</strong><br />

2009 and rent growth was stagnant for most <strong>of</strong> 2008 and 2009. Since that time, occupancies have steadily improved<br />

with average occupancy rising to 94.7% in the fourth quarter <strong>of</strong> 2010. The turnaround is due to strengthening demand<br />

for rentals in lieu <strong>of</strong> home ownership and a limited development<br />

pipeline which has kept supply in check.<br />

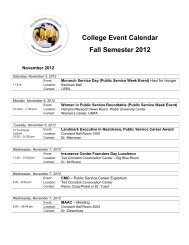

Submarket Percentages<br />

Development activity remains moderate. As <strong>of</strong> October 2010,<br />

2%<br />

there were only 1,100 units under construction; however, there were<br />

4%<br />

York County<br />

more than 4,000 units proposed. Many <strong>of</strong> the proposed projects are<br />

Williamsburg 11%<br />

struggling to obtain financing in the current lending environment even<br />

1%<br />

Chesapeake<br />

Suffolk<br />

though market fundamentals look favorable through 2012.<br />

The average quoted rental rate is $900, with one-bedroom rents 25%<br />

Virginia<br />

averaging $803 per month, two-bedroom units averaging $905 per<br />

Beach<br />

month, and three-bedroom units reporting an average rental rate <strong>of</strong><br />

$1,080 per month. Average rental rates from existing inventory<br />

increased by $15.48 in the last twelve months, while this is a modest<br />

increase over last year, it does indicate an improving market in terms<br />

8%<br />

<strong>of</strong> rent growth. Approximately 20% <strong>of</strong> rental communities are <strong>of</strong>fering<br />

Portsmouth<br />

some type <strong>of</strong> rental concessions, but in terms <strong>of</strong> the market as a whole,<br />

14%<br />

the concessions are only moderate with overall rents rising.<br />

Norfolk<br />

11%<br />

<strong>Hampton</strong><br />

23%<br />

Newport<br />

News<br />

<strong>2011</strong> <strong>Hampton</strong> <strong>Roads</strong> <strong>Real</strong> <strong>Estate</strong> <strong>Market</strong> <strong>Review</strong><br />

68