2011/2012 Annual Report - Metro Tasmania

2011/2012 Annual Report - Metro Tasmania

2011/2012 Annual Report - Metro Tasmania

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

Note 23. FINANCIAL INSTRUMENTS<br />

Financial risk management policies<br />

<strong>Metro</strong>’s financial instruments consist mainly of deposits with banks, accounts receivable and payable. It is<br />

not current <strong>Metro</strong> policy to utilise derivative instruments as a means of managing exposure to risks.<br />

<strong>Metro</strong> does not have any derivative instruments in either financial years.<br />

Financial risk exposures and management<br />

The main risks <strong>Metro</strong> is exposed to through its financial instruments are interest rate risk and credit risk.<br />

(a) Credit risk<br />

The maximum exposure to credit risk, excluding the value of any collateral or other security, at balance<br />

date to recognised financial assets, is the carrying amount, net of any provisions for impairment of those<br />

assets, as disclosed in the Statement of Financial Position and Notes to the Financial Statements.<br />

There are no material amounts of collateral held as security in either financial years.<br />

<strong>Metro</strong> does not have any material credit risk exposure to any single receivable or group of receivables<br />

under financial instruments entered into and manages risk with appropriate credit checks, regular review<br />

of balances and structured payment options.<br />

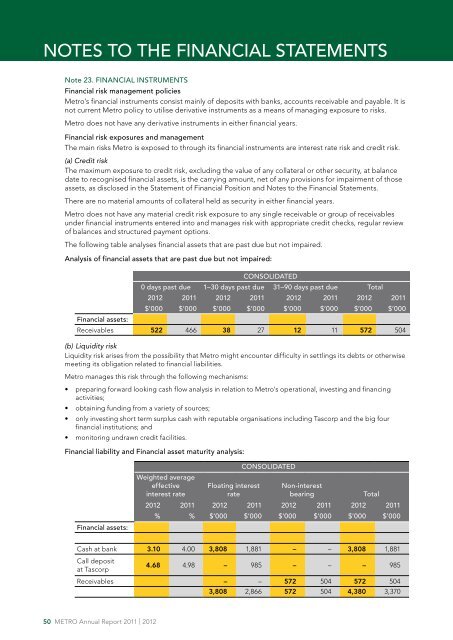

The following table analyses financial assets that are past due but not impaired.<br />

Analysis of financial assets that are past due but not impaired:<br />

CONSOLIDATED<br />

0 days past due 1–30 days past due 31–90 days past due Total<br />

<strong>2012</strong> <strong>2011</strong> <strong>2012</strong> <strong>2011</strong> <strong>2012</strong> <strong>2011</strong> <strong>2012</strong> <strong>2011</strong><br />

$’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000<br />

Financial assets:<br />

Receivables 522 466 38 27 12 11 572 504<br />

(b) Liquidity risk<br />

Liquidity risk arises from the possibility that <strong>Metro</strong> might encounter difficulty in settlings its debts or otherwise<br />

meeting its obligation related to financial liabilities.<br />

<strong>Metro</strong> manages this risk through the following mechanisms:<br />

• preparing forward looking cash flow analysis in relation to <strong>Metro</strong>’s operational, investing and financing<br />

activities;<br />

• obtaining funding from a variety of sources;<br />

• only investing short term surplus cash with reputable organisations including Tascorp and the big four<br />

financial institutions; and<br />

• monitoring undrawn credit facilities.<br />

Financial liability and Financial asset maturity analysis:<br />

Financial assets:<br />

Weighted average<br />

effective<br />

interest rate<br />

Floating interest<br />

rate<br />

CONSOLIDATED<br />

Non-interest<br />

bearing<br />

Total<br />

<strong>2012</strong> <strong>2011</strong> <strong>2012</strong> <strong>2011</strong> <strong>2012</strong> <strong>2011</strong> <strong>2012</strong> <strong>2011</strong><br />

% % $’000 $’000 $’000 $’000 $’000 $’000<br />

Cash at bank 3.10 4.00 3,808 1,881 – – 3,808 1,881<br />

Call deposit<br />

at Tascorp<br />

4.68 4.98 – 985 – – – 985<br />

Receivables – – 572 504 572 504<br />

3,808 2,866 572 504 4,380 3,370<br />

50 METRO <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> | <strong>2012</strong>