General Guidance for Developing Differential Premium Systems

General Guidance for Developing Differential Premium Systems

General Guidance for Developing Differential Premium Systems

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

October 31, 2011<br />

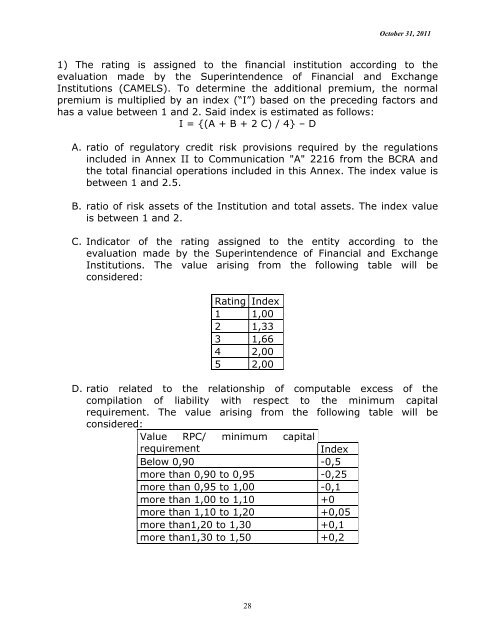

1) The rating is assigned to the financial institution according to the<br />

evaluation made by the Superintendence of Financial and Exchange<br />

Institutions (CAMELS). To determine the additional premium, the normal<br />

premium is multiplied by an index (“I”) based on the preceding factors and<br />

has a value between 1 and 2. Said index is estimated as follows:<br />

I = {(A + B + 2 C) / 4} – D<br />

A. ratio of regulatory credit risk provisions required by the regulations<br />

included in Annex II to Communication "A" 2216 from the BCRA and<br />

the total financial operations included in this Annex. The index value is<br />

between 1 and 2.5.<br />

B. ratio of risk assets of the Institution and total assets. The index value<br />

is between 1 and 2.<br />

C. Indicator of the rating assigned to the entity according to the<br />

evaluation made by the Superintendence of Financial and Exchange<br />

Institutions. The value arising from the following table will be<br />

considered:<br />

Rating Index<br />

1 1,00<br />

2 1,33<br />

3 1,66<br />

4 2,00<br />

5 2,00<br />

D. ratio related to the relationship of computable excess of the<br />

compilation of liability with respect to the minimum capital<br />

requirement. The value arising from the following table will be<br />

considered:<br />

Value RPC/ minimum capital<br />

requirement<br />

Index<br />

Below 0,90 -0,5<br />

more than 0,90 to 0,95 -0,25<br />

more than 0,95 to 1,00 -0,1<br />

more than 1,00 to 1,10 +0<br />

more than 1,10 to 1,20 +0,05<br />

more than1,20 to 1,30 +0,1<br />

more than1,30 to 1,50 +0,2<br />

28