General Guidance for Developing Differential Premium Systems

General Guidance for Developing Differential Premium Systems

General Guidance for Developing Differential Premium Systems

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

October 31, 2011<br />

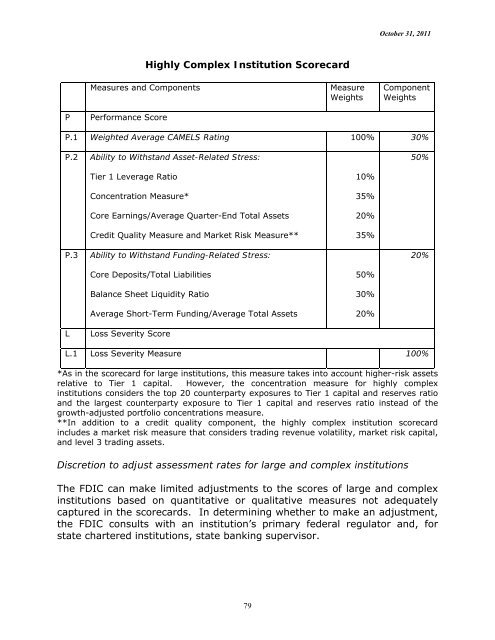

Highly Complex Institution Scorecard<br />

Measures and Components<br />

Measure<br />

Weights<br />

Component<br />

Weights<br />

P<br />

Per<strong>for</strong>mance Score<br />

P.1 Weighted Average CAMELS Rating 100% 30%<br />

P.2 Ability to Withstand Asset-Related Stress: 50%<br />

Tier 1 Leverage Ratio 10%<br />

Concentration Measure* 35%<br />

Core Earnings/Average Quarter-End Total Assets 20%<br />

Credit Quality Measure and Market Risk Measure** 35%<br />

P.3 Ability to Withstand Funding-Related Stress: 20%<br />

Core Deposits/Total Liabilities 50%<br />

Balance Sheet Liquidity Ratio 30%<br />

Average Short-Term Funding/Average Total Assets 20%<br />

L<br />

Loss Severity Score<br />

L.1 Loss Severity Measure 100%<br />

*As in the scorecard <strong>for</strong> large institutions, this measure takes into account higher-risk assets<br />

relative to Tier 1 capital. However, the concentration measure <strong>for</strong> highly complex<br />

institutions considers the top 20 counterparty exposures to Tier 1 capital and reserves ratio<br />

and the largest counterparty exposure to Tier 1 capital and reserves ratio instead of the<br />

growth-adjusted portfolio concentrations measure.<br />

**In addition to a credit quality component, the highly complex institution scorecard<br />

includes a market risk measure that considers trading revenue volatility, market risk capital,<br />

and level 3 trading assets.<br />

Discretion to adjust assessment rates <strong>for</strong> large and complex institutions<br />

The FDIC can make limited adjustments to the scores of large and complex<br />

institutions based on quantitative or qualitative measures not adequately<br />

captured in the scorecards. In determining whether to make an adjustment,<br />

the FDIC consults with an institution’s primary federal regulator and, <strong>for</strong><br />

state chartered institutions, state banking supervisor.<br />

79