General Guidance for Developing Differential Premium Systems

General Guidance for Developing Differential Premium Systems

General Guidance for Developing Differential Premium Systems

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

October 31, 2011<br />

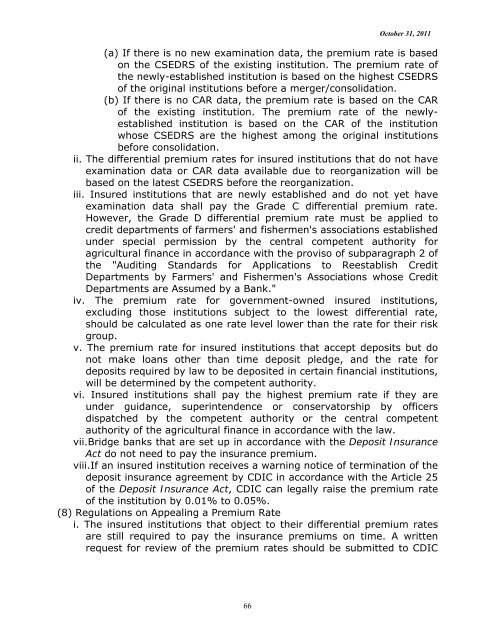

(a) If there is no new examination data, the premium rate is based<br />

on the CSEDRS of the existing institution. The premium rate of<br />

the newly-established institution is based on the highest CSEDRS<br />

of the original institutions be<strong>for</strong>e a merger/consolidation.<br />

(b) If there is no CAR data, the premium rate is based on the CAR<br />

of the existing institution. The premium rate of the newlyestablished<br />

institution is based on the CAR of the institution<br />

whose CSEDRS are the highest among the original institutions<br />

be<strong>for</strong>e consolidation.<br />

ii. The differential premium rates <strong>for</strong> insured institutions that do not have<br />

examination data or CAR data available due to reorganization will be<br />

based on the latest CSEDRS be<strong>for</strong>e the reorganization.<br />

iii. Insured institutions that are newly established and do not yet have<br />

examination data shall pay the Grade C differential premium rate.<br />

However, the Grade D differential premium rate must be applied to<br />

credit departments of farmers' and fishermen's associations established<br />

under special permission by the central competent authority <strong>for</strong><br />

agricultural finance in accordance with the proviso of subparagraph 2 of<br />

the "Auditing Standards <strong>for</strong> Applications to Reestablish Credit<br />

Departments by Farmers' and Fishermen's Associations whose Credit<br />

Departments are Assumed by a Bank."<br />

iv. The premium rate <strong>for</strong> government-owned insured institutions,<br />

excluding those institutions subject to the lowest differential rate,<br />

should be calculated as one rate level lower than the rate <strong>for</strong> their risk<br />

group.<br />

v. The premium rate <strong>for</strong> insured institutions that accept deposits but do<br />

not make loans other than time deposit pledge, and the rate <strong>for</strong><br />

deposits required by law to be deposited in certain financial institutions,<br />

will be determined by the competent authority.<br />

vi. Insured institutions shall pay the highest premium rate if they are<br />

under guidance, superintendence or conservatorship by officers<br />

dispatched by the competent authority or the central competent<br />

authority of the agricultural finance in accordance with the law.<br />

vii.Bridge banks that are set up in accordance with the Deposit Insurance<br />

Act do not need to pay the insurance premium.<br />

viii.If an insured institution receives a warning notice of termination of the<br />

deposit insurance agreement by CDIC in accordance with the Article 25<br />

of the Deposit Insurance Act, CDIC can legally raise the premium rate<br />

of the institution by 0.01% to 0.05%.<br />

(8) Regulations on Appealing a <strong>Premium</strong> Rate<br />

i. The insured institutions that object to their differential premium rates<br />

are still required to pay the insurance premiums on time. A written<br />

request <strong>for</strong> review of the premium rates should be submitted to CDIC<br />

66