General Guidance for Developing Differential Premium Systems

General Guidance for Developing Differential Premium Systems

General Guidance for Developing Differential Premium Systems

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

October 31, 2011<br />

Methodology used <strong>for</strong> the selection of quantitative indicators<br />

The process of quantitative indicator selection needed to reflect not only the<br />

standard rules of risk analysis, but also specifics of the Kazakhstani economic<br />

environment and its current stage of maturity. In order to choose the most<br />

valuable financial ratios from a broad range of indicators, statistical methods<br />

such as correlation, t-test, and factor analysis were used.<br />

An expert judgement was applied to divide banks into normal and problem<br />

banks due to the lack of reliable and comparable statistics concerning results<br />

of normal and liquidated bank activities. The main reason <strong>for</strong> that is that<br />

Kazakhstan is an emerging market. Statistical methods were then applied to<br />

select the most valuable indicators in order to include them in the testing<br />

process.<br />

For each of the quantitative indicators, an algorithm was developed to justify<br />

the trans<strong>for</strong>mation of the actual values of the indicators into the resulting<br />

“score” as a final output of the model. Use of the indicators’ numerical values<br />

and their weights based on the factor loadings of each indicator is done<br />

through the Factor Analysis. Other methods are based on defining intervals<br />

of actual indicator values that can be achieved.<br />

Quantitative Indicators<br />

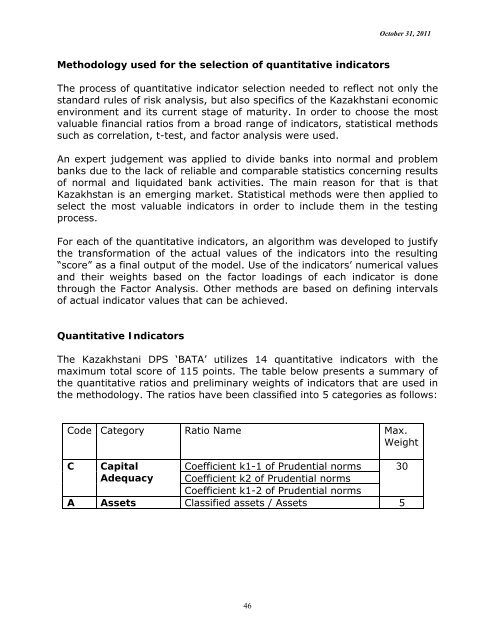

The Kazakhstani DPS ‘BATA’ utilizes 14 quantitative indicators with the<br />

maximum total score of 115 points. The table below presents a summary of<br />

the quantitative ratios and preliminary weights of indicators that are used in<br />

the methodology. The ratios have been classified into 5 categories as follows:<br />

Code Category Ratio Name Max.<br />

Weight<br />

C Capital Coefficient k1-1 of Prudential norms 30<br />

Adequacy Coefficient k2 of Prudential norms<br />

Coefficient k1-2 of Prudential norms<br />

A Assets Classified assets / Assets 5<br />

46