General Guidance for Developing Differential Premium Systems

General Guidance for Developing Differential Premium Systems

General Guidance for Developing Differential Premium Systems

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

October 31, 2011<br />

There is a Guarantee Fund which is the accumulation of contributions, return<br />

flows and interest income. The assessment base <strong>for</strong> most member<br />

institutions is lending to customers and there is a uni<strong>for</strong>m assessment base<br />

<strong>for</strong> some special institutions (e.g. the Cooperative Central Banks).<br />

Contribution rates established yearly by the BVR differ between 0.5 basis<br />

points to a maximum of 2.0 basis points of the assessment base of the<br />

corresponding bank. Since 2004, banks pay 90 to 140% of the contribution<br />

rate depending on the rating of its soundness. Beginning in January 2010,<br />

80% will apply <strong>for</strong> A++ classified banks, the minimum contribution lowers to<br />

0.4 basis points and the contribution base was expanded to address risks in<br />

bonds and other capital market assets held by the banks. Since then, the<br />

new contribution base is the risk weighted assets as it is more risk oriented,<br />

treats banks more fairly, and there is no additional cost to calculate as the<br />

supervisory authorities require this data by law. The BVR has chosen to use<br />

assets (notwithstanding a general move toward using covered deposits as a<br />

contribution base) as the contribution base because they are the source of<br />

difficulties which may lead to a situation where a member bank may need<br />

the support of the Protection Scheme.<br />

In addition to the Guarantee Fund, the BVR Protection Scheme has a<br />

Guarantee Network , composed of “declarations of guarantees” of each<br />

member bank. The scope of liability of each is limited to a maximum of 5.0<br />

basis points of the assessment base <strong>for</strong> the Guarantee Fund. Drawing on the<br />

Guarantee Network <strong>for</strong> restructuring measures is only possible if it can be<br />

repaid within five years. The Guarantee Network is used only as an ultimate<br />

solution – a kind of internal lender of last resort.<br />

The ex ante funding, and contribution levels, are calculated and fixed yearly<br />

based on expected risks of the following year.<br />

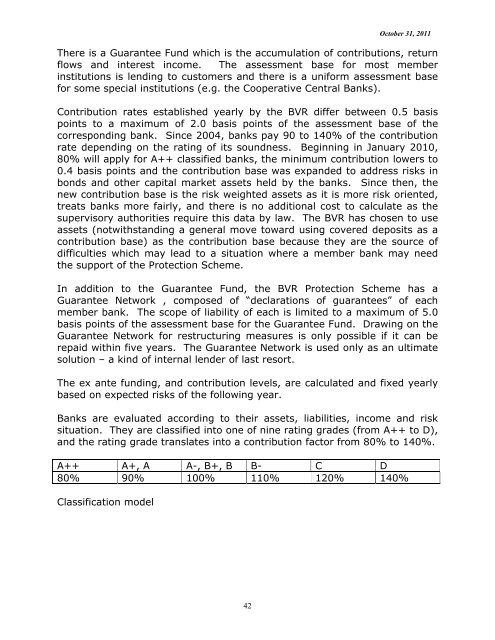

Banks are evaluated according to their assets, liabilities, income and risk<br />

situation. They are classified into one of nine rating grades (from A++ to D),<br />

and the rating grade translates into a contribution factor from 80% to 140%.<br />

A++ A+, A A-, B+, B B- C D<br />

80% 90% 100% 110% 120% 140%<br />

Classification model<br />

42