(Jamaica) Limited - FirstCaribbean International Bank

(Jamaica) Limited - FirstCaribbean International Bank

(Jamaica) Limited - FirstCaribbean International Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

notes to the Financial Statements<br />

Year Ended 31 October 2009<br />

(Expressed in <strong>Jamaica</strong>n dollars unless otherwise indicated)<br />

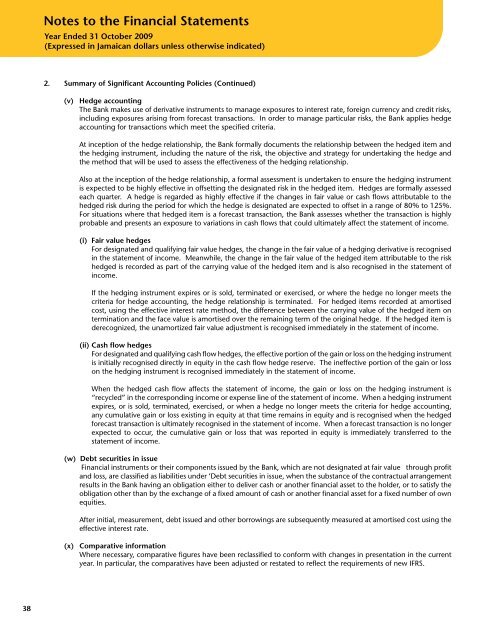

2. Summary of Significant Accounting Policies (Continued)<br />

(v) Hedge accounting<br />

The <strong>Bank</strong> makes use of derivative instruments to manage exposures to interest rate, foreign currency and credit risks,<br />

including exposures arising from forecast transactions. In order to manage particular risks, the <strong>Bank</strong> applies hedge<br />

accounting for transactions which meet the specified criteria.<br />

At inception of the hedge relationship, the <strong>Bank</strong> formally documents the relationship between the hedged item and<br />

the hedging instrument, including the nature of the risk, the objective and strategy for undertaking the hedge and<br />

the method that will be used to assess the effectiveness of the hedging relationship.<br />

Also at the inception of the hedge relationship, a formal assessment is undertaken to ensure the hedging instrument<br />

is expected to be highly effective in offsetting the designated risk in the hedged item. Hedges are formally assessed<br />

each quarter. A hedge is regarded as highly effective if the changes in fair value or cash flows attributable to the<br />

hedged risk during the period for which the hedge is designated are expected to offset in a range of 80% to 125%.<br />

For situations where that hedged item is a forecast transaction, the <strong>Bank</strong> assesses whether the transaction is highly<br />

probable and presents an exposure to variations in cash flows that could ultimately affect the statement of income.<br />

(i) Fair value hedges<br />

For designated and qualifying fair value hedges, the change in the fair value of a hedging derivative is recognised<br />

in the statement of income. Meanwhile, the change in the fair value of the hedged item attributable to the risk<br />

hedged is recorded as part of the carrying value of the hedged item and is also recognised in the statement of<br />

income.<br />

If the hedging instrument expires or is sold, terminated or exercised, or where the hedge no longer meets the<br />

criteria for hedge accounting, the hedge relationship is terminated. For hedged items recorded at amortised<br />

cost, using the effective interest rate method, the difference between the carrying value of the hedged item on<br />

termination and the face value is amortised over the remaining term of the original hedge. If the hedged item is<br />

derecognized, the unamortized fair value adjustment is recognised immediately in the statement of income.<br />

(ii) Cash flow hedges<br />

For designated and qualifying cash flow hedges, the effective portion of the gain or loss on the hedging instrument<br />

is initially recognised directly in equity in the cash flow hedge reserve. The ineffective portion of the gain or loss<br />

on the hedging instrument is recognised immediately in the statement of income.<br />

When the hedged cash flow affects the statement of income, the gain or loss on the hedging instrument is<br />

“recycled” in the corresponding income or expense line of the statement of income. When a hedging instrument<br />

expires, or is sold, terminated, exercised, or when a hedge no longer meets the criteria for hedge accounting,<br />

any cumulative gain or loss existing in equity at that time remains in equity and is recognised when the hedged<br />

forecast transaction is ultimately recognised in the statement of income. When a forecast transaction is no longer<br />

expected to occur, the cumulative gain or loss that was reported in equity is immediately transferred to the<br />

statement of income.<br />

(w) Debt securities in issue<br />

Financial instruments or their components issued by the <strong>Bank</strong>, which are not designated at fair value through profit<br />

and loss, are classified as liabilities under ‘Debt securities in issue, when the substance of the contractual arrangement<br />

results in the <strong>Bank</strong> having an obligation either to deliver cash or another financial asset to the holder, or to satisfy the<br />

obligation other than by the exchange of a fixed amount of cash or another financial asset for a fixed number of own<br />

equities.<br />

After initial, measurement, debt issued and other borrowings are subsequently measured at amortised cost using the<br />

effective interest rate.<br />

(x) Comparative information<br />

Where necessary, comparative figures have been reclassified to conform with changes in presentation in the current<br />

year. In particular, the comparatives have been adjusted or restated to reflect the requirements of new IFRS.<br />

38