Consolidated Financial Statements and Independent Auditors' Report

Consolidated Financial Statements and Independent Auditors' Report

Consolidated Financial Statements and Independent Auditors' Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the <strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong><br />

31 December 2010<br />

10 CASH AND SHORT TERM FUNDS<br />

2010 2009<br />

KD 000’s KD 000’s<br />

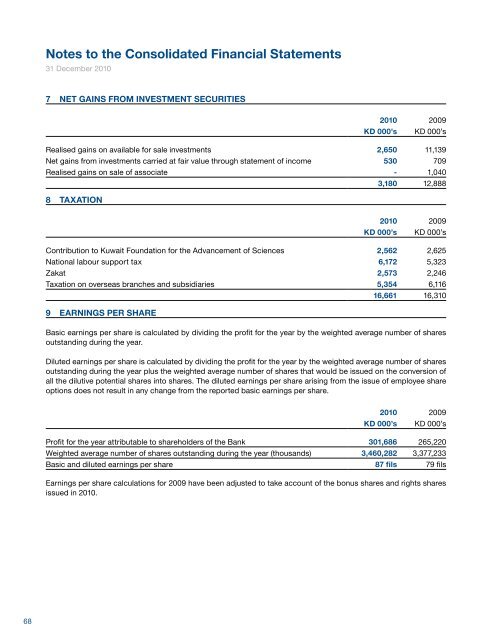

7 NET GAINS FROM INVESTMENT SECURITIES<br />

2010 2009<br />

KD 000’s KD 000’s<br />

Realised gains on available for sale investments 2,650 11,139<br />

Net gains from investments carried at fair value through statement of income 530 709<br />

Realised gains on sale of associate - 1,040<br />

8 TAXATION<br />

3,180 12,888<br />

2010 2009<br />

KD 000’s KD 000’s<br />

Contribution to Kuwait Foundation for the Advancement of Sciences 2,562 2,625<br />

National labour support tax 6,172 5,323<br />

Zakat 2,573 2,246<br />

Taxation on overseas branches <strong>and</strong> subsidiaries 5,354 6,116<br />

16,661 16,310<br />

9 EARNINGS PER SHARE<br />

Basic earnings per share is calculated by dividing the profit for the year by the weighted average number of shares<br />

outst<strong>and</strong>ing during the year.<br />

Diluted earnings per share is calculated by dividing the profit for the year by the weighted average number of shares<br />

outst<strong>and</strong>ing during the year plus the weighted average number of shares that would be issued on the conversion of<br />

all the dilutive potential shares into shares. The diluted earnings per share arising from the issue of employee share<br />

options does not result in any change from the reported basic earnings per share.<br />

Cash on h<strong>and</strong> <strong>and</strong> on current account with other banks 522,072 872,511<br />

Money at call 249,733 289,214<br />

Balances with Central Bank of Kuwait 3,929 42,841<br />

Deposits with banks maturing within seven days 396,195 417,674<br />

11 LOANS AND ADVANCES TO CUSTOMERS<br />

2010<br />

Middle<br />

East <strong>and</strong><br />

North Africa<br />

KD 000’s<br />

North<br />

America<br />

KD 000’s<br />

Europe<br />

KD 000’s<br />

Asia<br />

KD 000’s<br />

1,171,929 1,622,240<br />

Other<br />

KD 000’s<br />

Total<br />

KD 000’s<br />

Corporate 5,485,984 31,758 251,308 85,367 26,704 5,881,121<br />

Retail 2,248,306 - 3,125 - - 2,251,431<br />

Loans <strong>and</strong> advances 7,734,290 31,758 254,433 85,367 26,704 8,132,552<br />

Provision for credit losses (279,227)<br />

2009<br />

Middle<br />

East <strong>and</strong><br />

North Africa<br />

KD 000’s<br />

North<br />

America<br />

KD 000’s<br />

Europe<br />

KD 000’s<br />

Asia<br />

KD 000’s<br />

Other<br />

KD 000’s<br />

7,853,325<br />

Total<br />

KD 000’s<br />

Corporate 5,483,677 36,413 298,719 58,682 43,960 5,921,451<br />

Retail 2,188,859 - 3,012 4 - 2,191,875<br />

Loans <strong>and</strong> advances 7,672,536 36,413 301,731 58,686 43,960 8,113,326<br />

Provision for credit losses (296,216)<br />

7,817,110<br />

2010 2009<br />

KD 000’s KD 000’s<br />

Profit for the year attributable to shareholders of the Bank 301,686 265,220<br />

Weighted average number of shares outst<strong>and</strong>ing during the year (thous<strong>and</strong>s) 3,460,282 3,377,233<br />

Basic <strong>and</strong> diluted earnings per share 87 fils 79 fils<br />

Earnings per share calculations for 2009 have been adjusted to take account of the bonus shares <strong>and</strong> rights shares<br />

issued in 2010.<br />

68 National Bank of Kuwait - Annual <strong>Report</strong> 2010 69