Consolidated Financial Statements and Independent Auditors' Report

Consolidated Financial Statements and Independent Auditors' Report

Consolidated Financial Statements and Independent Auditors' Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the <strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong><br />

31 December 2010<br />

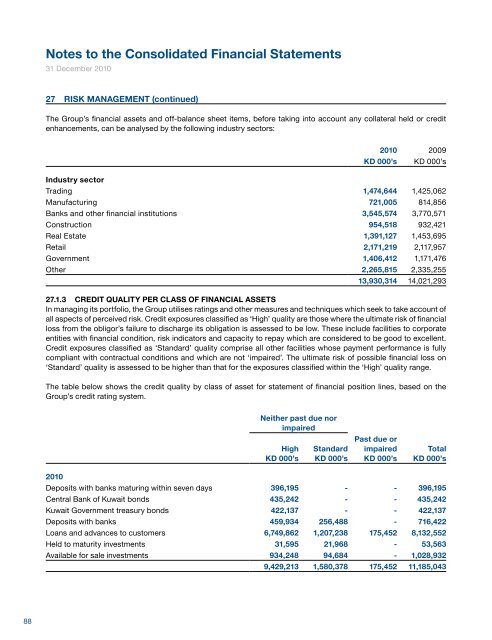

27 RISK MANAGEMENT (continued)<br />

The Group’s financial assets <strong>and</strong> off-balance sheet items, before taking into account any collateral held or credit<br />

enhancements, can be analysed by the following industry sectors:<br />

2010 2009<br />

KD 000’s KD 000’s<br />

Industry sector<br />

Trading 1,474,644 1,425,062<br />

Manufacturing 721,005 814,856<br />

Banks <strong>and</strong> other financial institutions 3,545,574 3,770,571<br />

Construction 954,518 932,421<br />

Real Estate 1,391,127 1,453,695<br />

Retail 2,171,219 2,117,957<br />

Government 1,406,412 1,171,476<br />

Other 2,265,815 2,335,255<br />

13,930,314 14,021,293<br />

27.1.3 CREDIT QUALITY PER CLASS OF FINANCIAL ASSETS<br />

In managing its portfolio, the Group utilises ratings <strong>and</strong> other measures <strong>and</strong> techniques which seek to take account of<br />

all aspects of perceived risk. Credit exposures classified as ‘High’ quality are those where the ultimate risk of financial<br />

loss from the obligor’s failure to discharge its obligation is assessed to be low. These include facilities to corporate<br />

entities with financial condition, risk indicators <strong>and</strong> capacity to repay which are considered to be good to excellent.<br />

Credit exposures classified as ‘St<strong>and</strong>ard’ quality comprise all other facilities whose payment performance is fully<br />

compliant with contractual conditions <strong>and</strong> which are not ‘impaired’. The ultimate risk of possible financial loss on<br />

‘St<strong>and</strong>ard’ quality is assessed to be higher than that for the exposures classified within the ‘High’ quality range.<br />

The table below shows the credit quality by class of asset for statement of financial position lines, based on the<br />

Group’s credit rating system.<br />

Neither past due nor<br />

impaired<br />

High<br />

KD 000’s<br />

St<strong>and</strong>ard<br />

KD 000’s<br />

Past due or<br />

impaired<br />

KD 000’s<br />

Total<br />

KD 000’s<br />

2010<br />

Deposits with banks maturing within seven days 396,195 - - 396,195<br />

Central Bank of Kuwait bonds 435,242 - - 435,242<br />

Kuwait Government treasury bonds 422,137 - - 422,137<br />

Deposits with banks 459,934 256,488 - 716,422<br />

Loans <strong>and</strong> advances to customers 6,749,862 1,207,238 175,452 8,132,552<br />

Held to maturity investments 31,595 21,968 - 53,563<br />

Available for sale investments 934,248 94,684 - 1,028,932<br />

9,429,213 1,580,378 175,452 11,185,043<br />

Neither past due nor<br />

impaired<br />

High<br />

KD 000’s<br />

St<strong>and</strong>ard<br />

KD 000’s<br />

Past due or<br />

impaired<br />

KD 000’s<br />

Total<br />

KD 000’s<br />

2009<br />

Deposits with banks maturing within seven days 417,674 - - 417,674<br />

Central Bank of Kuwait bonds 281,489 - - 281,489<br />

Kuwait Government treasury bills 32,477 - - 32,477<br />

Kuwait Government treasury bonds 373,202 - - 373,202<br />

Deposits with banks 473,514 249,995 - 723,509<br />

Loans <strong>and</strong> advances to customers 6,903,537 990,658 219,131 8,113,326<br />

Held to maturity investments 22,719 12,824 - 35,543<br />

Available for sale investments 794,970 125,658 - 920,628<br />

9,299,582 1,379,135 219,131 10,897,848<br />

27.1.4 AGEING ANALYSIS OF PAST DUE OR IMPAIRED LOANS AND ADVANCES<br />

Corporate Retail Total<br />

Past due<br />

<strong>and</strong> not<br />

impaired<br />

KD 000’s<br />

Past due<br />

<strong>and</strong><br />

impaired<br />

KD 000’s<br />

Past due<br />

<strong>and</strong> not<br />

impaired<br />

KD 000’s<br />

Past due<br />

<strong>and</strong><br />

impaired<br />

KD 000’s<br />

Past due<br />

<strong>and</strong> not<br />

impaired<br />

KD 000’s<br />

Past due<br />

<strong>and</strong><br />

impaired<br />

KD 000’s<br />

2010<br />

Up to 30 days 7,151 - 20,250 - 27,401 -<br />

31 - 60 days 6 - 7,154 - 7,160 -<br />

61 - 90 days 6,854 - 255 - 7,109 -<br />

91-180 days - 4,558 - 10,995 - 15,553<br />

More than 180 days - 66,412 - 51,817 - 118,229<br />

14,011 70,970 27,659 62,812 41,670 133,782<br />

Corporate Retail Total<br />

Past due<br />

<strong>and</strong> not<br />

impaired<br />

KD 000’s<br />

Past due<br />

<strong>and</strong><br />

impaired<br />

KD 000’s<br />

Past due<br />

<strong>and</strong> not<br />

impaired<br />

KD 000’s<br />

Past due<br />

<strong>and</strong><br />

impaired<br />

KD 000’s<br />

Past due<br />

<strong>and</strong> not<br />

impaired<br />

KD 000’s<br />

Past due<br />

<strong>and</strong><br />

impaired<br />

KD 000’s<br />

2009<br />

Up to 30 days 6,252 - 49,747 - 55,999 -<br />

31 - 60 days 173 - 9,721 - 9,894 -<br />

61 - 90 days 10,487 - 216 - 10,703 -<br />

91-180 days - 2 - 11,059 - 11,061<br />

More than 180 days - 86,182 - 45,292 - 131,474<br />

16,912 86,184 59,684 56,351 76,596 142,535<br />

Of the aggregate amount of gross past due or impaired loans <strong>and</strong> advances to customers, the fair value of collateral<br />

that the Group held as at 31 December 2010 was KD 13,079 thous<strong>and</strong> (2009: KD 22,701 thous<strong>and</strong>).<br />

88 National Bank of Kuwait - Annual <strong>Report</strong> 2010 89