Consolidated Financial Statements and Independent Auditors' Report

Consolidated Financial Statements and Independent Auditors' Report

Consolidated Financial Statements and Independent Auditors' Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the <strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong><br />

31 December 2010<br />

18 PROPOSED DIVIDEND<br />

The board of directors recommended distribution of a cash dividend of 40 fils per share (2009: 40 fils per share)<br />

<strong>and</strong> bonus shares of 10% (2009: 10%) on outst<strong>and</strong>ing shares as at 31 December 2010. The proposed dividend, if<br />

approved, shall be payable to the shareholders registered in the Bank’s records as of the date of the annual general<br />

assembly meeting.<br />

19 SHARE BASED PAYMENT<br />

The Bank operates an equity settled share based compensation plan <strong>and</strong> granted share options to its senior executives.<br />

These options will vest if the employees remain in service for a period of three years from the grant date <strong>and</strong> the employees<br />

can exercise the options within one year from the vesting date. If the exercise price is not paid within one year from date of<br />

vesting, the options vested will be cancelled. The exercise price of the granted options is equal to 100 fils per share.<br />

The fair value of options granted during the year as determined using the Black-Scholes valuation model was KD 0.915<br />

(2009: KD 0.957). The significant inputs into the model were a share price of KD 1.120 (2009: KD 1.180) at the grant date,<br />

an exercise price of 100 fils as shown above, a st<strong>and</strong>ard deviation of expected share price returns of 48.7% (2009: 39.4%),<br />

option life disclosed above <strong>and</strong> annual risk free interest rate of 3.00% (2009: 3.75%). The volatility measured at the st<strong>and</strong>ard<br />

deviation of expected share price returns is based on statistical analysis of daily share prices over the last three years.<br />

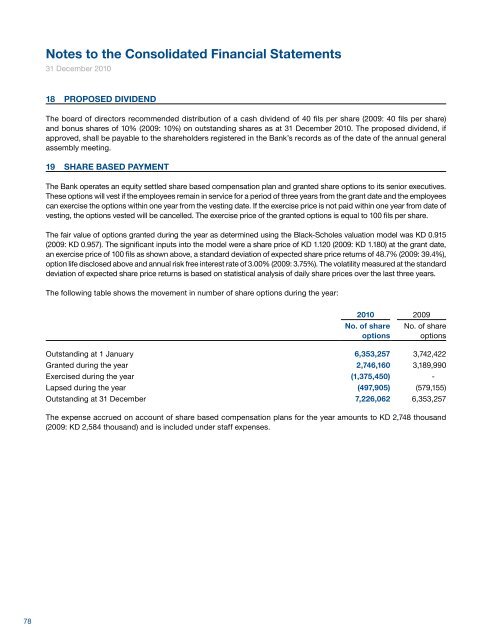

The following table shows the movement in number of share options during the year:<br />

2010 2009<br />

No. of share<br />

options<br />

No. of share<br />

options<br />

Outst<strong>and</strong>ing at 1 January 6,353,257 3,742,422<br />

Granted during the year 2,746,160 3,189,990<br />

Exercised during the year (1,375,450) -<br />

Lapsed during the year (497,905) (579,155)<br />

Outst<strong>and</strong>ing at 31 December 7,226,062 6,353,257<br />

20 FAIR VALUE OF FINANCIAL INSTRUMENTS<br />

Fair value is the amount for which an asset could be exchanged, or a liability settled, between knowledgeable, willing<br />

parties in an arm’s length transaction.<br />

The fair value of investment securities, quoted in an active market (stock exchanges <strong>and</strong> actively traded funds) amounts<br />

to KD 550,860 thous<strong>and</strong> (2009: KD 401,227 thous<strong>and</strong>) for debt securities <strong>and</strong> KD 150,170 thous<strong>and</strong> (2009: KD 144,414<br />

thous<strong>and</strong>) for equities <strong>and</strong> other investments. Investment securities, which are tradable over the counter <strong>and</strong> / or are valued<br />

by using a significant input of observable market data amount to KD 432,285 thous<strong>and</strong> (2009: KD 468,362 thous<strong>and</strong>) for<br />

debt securities <strong>and</strong> KD 9,600 thous<strong>and</strong> (2009: KD 10,171 thous<strong>and</strong>) for equities <strong>and</strong> other investments. Debt securities<br />

under this category mainly include sovereign debt instruments <strong>and</strong> corporate bonds in the MENA region.<br />

Investment securities, for which a significant input of the valuation is not based on observable market data amounts<br />

to KD 45,787 thous<strong>and</strong> (2009: KD 51,039 thous<strong>and</strong>) for debt securities <strong>and</strong> KD 66,194 thous<strong>and</strong> (2009: KD 54,039<br />

thous<strong>and</strong>) for equities <strong>and</strong> other investments. The table below analyses the movement in these investment securities<br />

<strong>and</strong> the income (interest, dividend <strong>and</strong> realised gain) generated during the year.<br />

At 1 January<br />

2010<br />

KD 000’s<br />

Change in<br />

fair value<br />

KD 000’s<br />

Additions<br />

KD 000’s<br />

Sale/<br />

redemption<br />

KD 000’s<br />

Exchange<br />

rate<br />

movements<br />

KD 000’s<br />

At 31<br />

December<br />

2010<br />

KD 000’s<br />

Net gains<br />

in the<br />

consolidated<br />

statement of<br />

income<br />

KD 000’s<br />

Debt securities 51,039 - - (4,053) (1,199) 45,787 881<br />

Equities <strong>and</strong><br />

other<br />

investments 54,039 5,240 12,389 (4,199) (1,275) 66,194 2,095<br />

105,078 5,240 12,389 (8,252) (2,474) 111,981 2,976<br />

The positive <strong>and</strong> negative fair values of derivatives, which are valued using significant inputs of observable market<br />

data, amount to KD 5,744 thous<strong>and</strong> (2009: KD 15,806 thous<strong>and</strong>) <strong>and</strong> KD 16,696 thous<strong>and</strong> (2009: KD 19,861 thous<strong>and</strong>)<br />

respectively (refer note 24 for details).<br />

Other financial assets <strong>and</strong> liabilities are carried at amortized cost <strong>and</strong> the carrying values are not materially different<br />

from their fair values as most of these assets <strong>and</strong> liabilities are of short term maturities or are repriced immediately<br />

based on market movement in interest rates.<br />

The expense accrued on account of share based compensation plans for the year amounts to KD 2,748 thous<strong>and</strong><br />

(2009: KD 2,584 thous<strong>and</strong>) <strong>and</strong> is included under staff expenses.<br />

78 National Bank of Kuwait - Annual <strong>Report</strong> 2010 79