Consolidated Financial Statements and Independent Auditors' Report

Consolidated Financial Statements and Independent Auditors' Report

Consolidated Financial Statements and Independent Auditors' Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the <strong>Consolidated</strong> <strong>Financial</strong> <strong>Statements</strong><br />

31 December 2010<br />

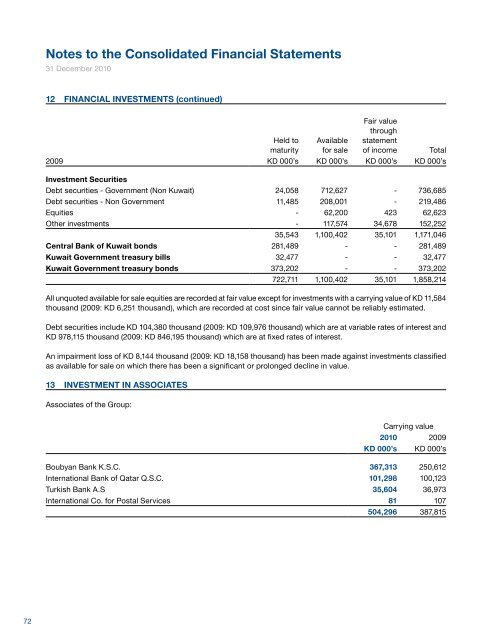

12 FINANCIAL INVESTMENTS (continued)<br />

Held to<br />

maturity<br />

Available<br />

for sale<br />

Fair value<br />

through<br />

statement<br />

of income<br />

Total<br />

2009 KD 000’s KD 000’s KD 000’s KD 000’s<br />

Investment Securities<br />

Debt securities - Government (Non Kuwait) 24,058 712,627 - 736,685<br />

Debt securities - Non Government 11,485 208,001 - 219,486<br />

Equities - 62,200 423 62,623<br />

Other investments - 117,574 34,678 152,252<br />

35,543 1,100,402 35,101 1,171,046<br />

Central Bank of Kuwait bonds 281,489 - - 281,489<br />

Kuwait Government treasury bills 32,477 - - 32,477<br />

Kuwait Government treasury bonds 373,202 - - 373,202<br />

722,711 1,100,402 35,101 1,858,214<br />

All unquoted available for sale equities are recorded at fair value except for investments with a carrying value of KD 11,584<br />

thous<strong>and</strong> (2009: KD 6,251 thous<strong>and</strong>), which are recorded at cost since fair value cannot be reliably estimated.<br />

Debt securities include KD 104,380 thous<strong>and</strong> (2009: KD 109,976 thous<strong>and</strong>) which are at variable rates of interest <strong>and</strong><br />

KD 978,115 thous<strong>and</strong> (2009: KD 846,195 thous<strong>and</strong>) which are at fixed rates of interest.<br />

An impairment loss of KD 8,144 thous<strong>and</strong> (2009: KD 18,158 thous<strong>and</strong>) has been made against investments classified<br />

as available for sale on which there has been a significant or prolonged decline in value.<br />

13 INVESTMENT IN ASSOCIATES<br />

Associates of the Group:<br />

Carrying value<br />

2010 2009<br />

KD 000’s KD 000’s<br />

Boubyan Bank K.S.C. 367,313 250,612<br />

International Bank of Qatar Q.S.C. 101,298 100,123<br />

Turkish Bank A.S 35,604 36,973<br />

International Co. for Postal Services 81 107<br />

504,296 387,815<br />

Name of entities<br />

Country of<br />

incorporation<br />

% Capital held<br />

2010 2009<br />

Boubyan Bank K.S.C. Kuwait 47.3 40<br />

International Bank of Qatar Q.S.C. Qatar 30 30<br />

Turkish Bank A.S Turkey 40 40<br />

International Co. for Postal Services Egypt 20 20<br />

The Group increased its holdings in the equity share capital of Boubyan Bank K.S.C. to 47.3 % (2009: 40%) during<br />

the year for a purchase consideration of KD 116,108 thous<strong>and</strong>. Investments in International Co. for Postal Services<br />

are held through its subsidiary Al Watany Bank of Egypt S.A.E.<br />

Summarised financial information of the associates is as follows:<br />

2010 2009<br />

KD 000’s KD 000’s<br />

Assets 3,312,956 2,919,947<br />

Liabilities 2,818,369 2,578,450<br />

Net operating income 112,111 80,777<br />

Results for the year 42,472 (20,401)<br />

The market value of the Group’s investment in Boubyan Bank K.S.C. at the year end based on the closing share price<br />

amounts to KD 520,811 thous<strong>and</strong> (2009: KD 233,000 thous<strong>and</strong>). All other associates are unlisted.<br />

14 GOODWILL AND OTHER INTANGIBLE ASSETS<br />

Goodwill<br />

Intangible<br />

assets<br />

Total<br />

KD 000’s KD 000’s KD 000’s<br />

Cost<br />

At 1 January 2010 186,982 71,777 258,759<br />

Additions 513 - 513<br />

Exchange adjustments (13,844) (4,074) (17,918)<br />

At 31 December 2010 173,651 67,703 241,354<br />

Accumulated amortisation<br />

At 1 January 2010 - 9,203 9,203<br />

Charge for the year - 4,469 4,469<br />

Exchange adjustments - (904) (904)<br />

At 31 December 2010 - 12,768 12,768<br />

Net book value<br />

At 31 December 2010 173,651 54,935 228,586<br />

72 National Bank of Kuwait - Annual <strong>Report</strong> 2010 73