READ MORE - Jade Invest

READ MORE - Jade Invest

READ MORE - Jade Invest

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

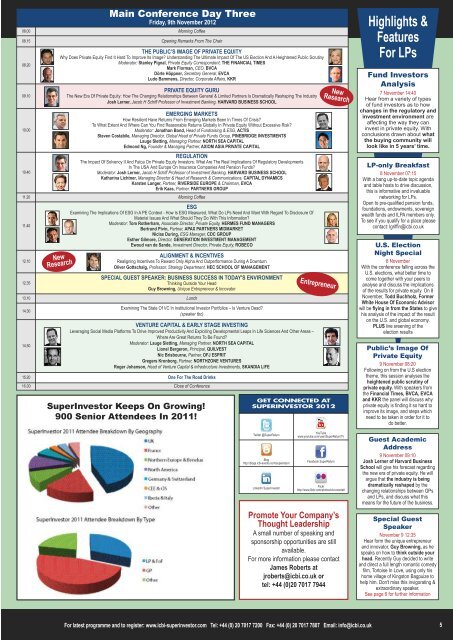

Main Conference Day Three<br />

Friday, 9th November 2012<br />

08.00 Morning Coffee<br />

08.15 Opening Remarks From The Chair<br />

08.20<br />

09.10<br />

10.00<br />

10.40<br />

THE PUBLIC’S IMAGE OF PRIVATE EQUITY<br />

Why Does Private Equity Find It Hard To Improve Its Image? Understanding The Ultimate Impact Of The US Election And A Heightened Public Scrutiny<br />

Moderator: Stanley Pignal, Private Equity Correspondent, THE FINANCIAL TIMES<br />

Mark Florman, CEO, BVCA<br />

Dörte Höppner, Secretary General, EVCA<br />

Ludo Bammens, Director, Corporate Affairs, KKR<br />

PRIVATE EQUITY GURU<br />

The New Era Of Private Equity: How The Changing Relationships Between General & Limited Partners Is Dramatically Reshaping The Industry<br />

Josh Lerner, Jacob H Schiff Professor of <strong>Invest</strong>ment Banking, HARVARD BUSINESS SCHOOL<br />

EMERGING MARKETS<br />

How Resilient Have Returns From Emerging Markets Been In Times Of Crisis?<br />

To What Extent And Where Can You Find Reasonable Returns Globally In Private Equity Without Excessive Risk?<br />

Moderator: Jonathon Bond, Head of Fundraising & ESG, ACTIS<br />

Steven Costabile, Managing Director, Global Head of Private Funds Group, PINEBRIDGE INVESTMENTS<br />

Lauge Sletting, Managing Partner, NORTH SEA CAPITAL<br />

Edmond Ng, Founder & Managing Partner, AXIOM ASIA PRIVATE CAPITAL<br />

REGULATION<br />

The Impact Of Solvency II And Fatca On Private Equity <strong>Invest</strong>ors: What Are The Real Implications Of Regulatory Developments<br />

In The USA And Europe On Insurance Companies And Pension Funds?<br />

Moderator: Josh Lerner, Jacob H Schiff Professor of <strong>Invest</strong>ment Banking, HARVARD BUSINESS SCHOOL<br />

Katharina Lichtner, Managing Director & Head of Research & Communications, CAPITAL DYNAMICS<br />

Karsten Langer, Partner, RIVERSIDE EUROPE & Chairman, EVCA<br />

Erik Kaas, Partner, PARTNERS GROUP<br />

11.20 Morning Coffee<br />

11.40<br />

12.10<br />

12.35<br />

ESG<br />

Examining The Implications Of ESG In A PE Context - How Is ESG Measured, What Do LPs Need And Want With Regard To Disclosure Of<br />

Material Issues And What Should They Do With This Information?<br />

Moderator: Tom Rotherham, Associate Director, Private Equity, HERMES FUND MANAGERS<br />

Bertrand Pivin, Partner, APAX PARTNERS MIDMARKET<br />

Niclas During, ESG Manager, CDC GROUP<br />

Esther Gilmore, Director, GENERATION INVESTMENT MANAGEMENT<br />

Ewoud van de Sande, <strong>Invest</strong>ment Director, Private Equity, ROBECO<br />

ALIGNMENT & INCENTIVES<br />

Realigning Incentives To Reward Only Alpha And Outperformance During A Downturn<br />

Oliver Gottschalg, Professor, Strategy Department, HEC SCHOOL OF MANAGEMENT<br />

SPECIAL GUEST SPEAKER: BUSINESS SUCCESS IN TODAY'S ENVIRONMENT<br />

Thinking Outside Your Head<br />

Guy Browning, Unique Entrepreneur & Innovator<br />

13.10 Lunch<br />

14.30<br />

14.50<br />

New<br />

Research<br />

Examining The State Of VC In Institutional <strong>Invest</strong>or Portfolios – Is Venture Dead?<br />

(speaker tbc)<br />

VENTURE CAPITAL & EARLY STAGE INVESTING<br />

Leveraging Social Media Platforms To Drive Improved Productivity And Exploiting Developmental Leaps In Life Sciences And Other Areas –<br />

Where Are Great Returns To Be Found?<br />

Moderator: Lauge Sletting, Managing Partner, NORTH SEA CAPITAL<br />

Lionel Bergeron, Principal, QUILVEST<br />

Nic Brisbourne, Partner, DFJ ESPRIT<br />

Gregers Kronborg, Partner, NORTHZONE VENTURES<br />

Roger Johanson, Head of Venture Capital & infrastructure <strong>Invest</strong>ments, SKANDIA LIFE<br />

15.20 One For The Road Drinks<br />

16.00 Close of Conference<br />

Super<strong>Invest</strong>or Keeps On Growing!<br />

900 Senior Attendees In 2011!<br />

Entrepreneur<br />

New<br />

Research<br />

GET CONNECTED AT<br />

SUPERINVESTOR 2012<br />

Highlights &<br />

Features<br />

For LPs<br />

Fund <strong>Invest</strong>ors<br />

Analysis<br />

7 November 14:40<br />

Hear from a variety of types<br />

of fund investors as to how<br />

changes in the regulatory and<br />

investment environment are<br />

affecting the way they can<br />

invest in private equity. With<br />

conclusions drawn about what<br />

the buying community will<br />

look like in 5 years’ time.<br />

LP-only Breakfast<br />

8 November 07:15<br />

With a bang up-to-date topic agenda<br />

and table hosts to drive discussion,<br />

this is informative and invaluable<br />

networking for LPs.<br />

Open to pre-qualified pension funds,<br />

foundations, endowments, sovereign<br />

wealth funds and ILPA members only.<br />

To see if you qualify for a place please<br />

contact: lgriffin@icbi.co.uk<br />

U.S. Election<br />

Night Special<br />

8 November<br />

With the conference falling across the<br />

U.S. elections, what better time to<br />

come together with your peers to<br />

analyse and discuss the implications<br />

of the results for private equity. On 8<br />

November, Todd Buchholz, Former<br />

White House Of Economic Advisor<br />

will be flying in from the States to give<br />

his analysis of the impact of the result<br />

on the U.S. and global economy.<br />

PLUS live sreening of the<br />

election results<br />

Public’s Image Of<br />

Private Equity<br />

9 November 08:20<br />

Following on from the U.S election<br />

theme, this session analyses the<br />

heightened public scrutiny of<br />

private equity. With speakers from<br />

the Financial Times, BVCA, EVCA<br />

and KKR the panel will discuss why<br />

private equity is finding it so hard to<br />

improve its image, and steps which<br />

need to be taken in order for it to<br />

do better.<br />

Twitter @SuperReturn<br />

Blog<br />

http://blogs.icbi-events.com/superreturn<br />

LinkedIn Super<strong>Invest</strong>or<br />

YouTube<br />

www.youtube.com/user/SuperReturnTV<br />

Facebook SuperReturn<br />

Flickr<br />

http://www.flickr.com/photos/icbi-events#<br />

Guest Academic<br />

Address<br />

9 November 09:10<br />

Josh Lerner of Harvard Business<br />

School will give his forecast regarding<br />

the new era of private equity. He will<br />

argue that the industry is being<br />

dramatically reshaped by the<br />

changing relationships between GPs<br />

and LPs, and discuss what this<br />

means for the future of the business.<br />

Promote Your Company’s<br />

Thought Leadership<br />

A small number of speaking and<br />

sponsorship opportunities are still<br />

available.<br />

For more information please contact<br />

James Roberts at<br />

jroberts@icbi.co.uk or<br />

tel: +44 (0)20 7017 7944<br />

Special Guest<br />

Speaker<br />

November 9 12:35<br />

Hear form the unique entrepreneur<br />

and innovator, Guy Browning, as he<br />

speaks on how to think outside your<br />

head. Recently Guy decided to write<br />

and direct a full length romantic comedy<br />

film, Tortoise In Love, using only his<br />

home village of Kingston Bagpuize to<br />

help him. Don't miss this invigorating &<br />

extraordinary speaker.<br />

See page 6 for further information<br />

For latest programme and to register: www.icbi-superinvestor.com Tel: +44 (0) 20 7017 7200 Fax: +44 (0) 20 7017 7807 Email: info@icbi.co.uk<br />

5