READ MORE - Jade Invest

READ MORE - Jade Invest

READ MORE - Jade Invest

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

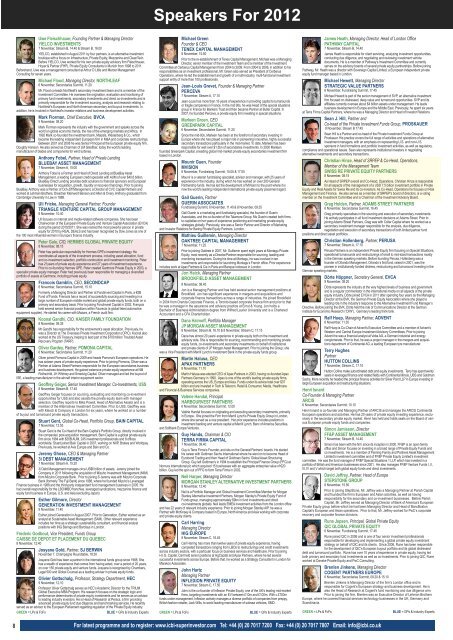

Speakers For 2012<br />

Uwe Fleischhauer, Founding Partner & Managing Director<br />

YIELCO INVESTMENTS<br />

7 November, Stream B, 14.40 & Stream B, 16.00<br />

YIELCO, established in August 2011 by four partners, is an alternative investment<br />

boutique with a focus on Infrastructure, Private Equity, Mezzanine and CleanTech.<br />

Before YIELCO, Uwe worked for his own private equity advisory firm Fleischhauer,<br />

Hoyer & Partner (FHP), Private Equity Consultants in Munich from 1998 to 2011.<br />

Beforehand, Uwe was a management consultant at Arthur D Little and Mercer Management<br />

Consulting for seven years.<br />

Michael Flood, Managing Director, NORTHLEAF<br />

6 November, Secondaries Summit, 11.20<br />

Mr. Flood co-leads Northleaf’s secondary investment team and is a member of the<br />

<strong>Invest</strong>ment Committee. He oversees the origination, evaluation and monitoring of<br />

primary fund investments, secondary investments and direct co-investments and is<br />

primarily responsible for the investment sourcing, analysis and research relating to<br />

Northleaf’s European and North American secondary and buyout investments. In<br />

addition, he is involved in Northleaf’s investor relations and business development activities.<br />

Mark Florman, Chief Executive, BVCA<br />

9 November, 08.20<br />

Mark Florman represents the industry with the government and speaks across the<br />

world on global economic trends, the rise of the emerging markets and Africa. In<br />

1992 Mark co-founded the investment bank, Maizels, Westerberg & Co., which<br />

became the leading independent European firm in M&A and corporate restructurings.<br />

Between 2001 and 2008 he was Senior Principal at the European private equity firm,<br />

Doughty Hanson. He also served as Chairman of LM Glasfiber, today the world’s leading<br />

manufacturer of blades and components for wind turbines.<br />

Anthony Fobel, Partner, Head of Private Lending<br />

BLUEBAY ASSET MANAGEMENT<br />

7 November, Stream A, 15:00<br />

Anthony Fobel is a Partner and Head of Direct Lending at BlueBay Asset<br />

Management, a leading European credit specialist with AUM of over $40.6 billion.<br />

BlueBay Direct Lending provides debt solutions to financial sponsors and European<br />

businesses for acquisition, growth, liquidity or recovery financings. Prior to joining<br />

BlueBay, Anthony was a Partner of Och-Ziff Management, a Director at CVC Capital Partners and<br />

worked at Lehman Brothers, Dresdner Kleinwort Benson and Allen & Overy. Anthony graduated from<br />

Cambridge University in Law in 1988.<br />

Uli Fricke, Managing General Partner, Founder<br />

TRIANGLE VENTURE CAPITAL GROUP MANAGEMENT<br />

8 November, 10.40<br />

Uli focuses on internet and media-related software companies. She has been<br />

Chairwoman of the European Private Equity and Venture Capital Association (EVCA)<br />

during the period 2010/2011. She was named the most powerful person in private<br />

equity for 2010 by REAL DEALS and has been recognised by Dow Jones as one of<br />

the 100 most influential women in Europe’s finance industry.<br />

Peter Gale, CIO, HERMES GLOBAL PRIVATE EQUITY<br />

8 November, 08.15<br />

Peter has particular responsibility for Hermes GPE's investment strategy. He<br />

coordinates all aspects of the investment process, including asset allocation, fund<br />

and co-investment selection, portfolio construction and investment monitoring. Peter<br />

has 21years of private equity experience and 27 years of investment experience.<br />

Prior to co-founding Hermes GPE, Peter created Gartmore Private Equity in 2003, a<br />

specialist private equity manager. Peter had previously been responsible for managing a diversified<br />

portfolio of assets at Gartmore, including private equity.<br />

Francois Gamblin, CEO, SECONDCAP<br />

6 November, Secondaries Summit, 15.10<br />

Formerly a Managing Director and Partner at Fondinvest Capital in Paris, a €2B<br />

Fund of Funds. Francois has a record of successfully sourcing and investing in a<br />

large number of European middle market and global private equity funds, both on a<br />

primary and secondary basis. Prior to joining Fondinvest Capital in 2002, François<br />

held several senior financial positions within Faurecia (a global listed automotive<br />

equipment supplier). He started his career with Mazars, a French audit firm.<br />

Koonal Gandhi, CIO, KAISER FAMILY FOUNDATION<br />

8 November, 09.35<br />

Mr Gandhi has responsibility for the endowment’s asset allocation. Previously, he<br />

was a Director at The Overseas Private <strong>Invest</strong>ment Corporation (OPIC). Koonal also<br />

worked at the US Treasury, helping to lead part of the $700 billion Troubled Asset<br />

Recovery Program (TARP).<br />

Oliver Gardey, Partner, POMONA CAPITAL<br />

6 November, Secondaries Summit, 11.20<br />

Oliver joined Pomona Capital in 2009 and heads Pomona's European operations. He<br />

has sixteen years of private equity experience. Prior to joining Pomona, Oliver was a<br />

Partner at Adams Street Partners responsible for the European secondaries business<br />

and business development. He gained extensive private equity experience at NM<br />

Rothschild, JH Whitney and Smedvig Capital. Oliver managed and led the buyout of<br />

ISE, a leading manufacturer in the aircraft interior equipment sector.<br />

Geoffrey Geiger, Senior <strong>Invest</strong>ment Manager, Co-<strong>Invest</strong>ments, USS<br />

8 November, Stream B, 17.45<br />

Geoffrey Geiger focuses on sourcing, evaluating and monitoring co-investment<br />

opportunities for USS and also assists the private equity team with manager<br />

selection. Geoffrey reports to Mike Powell, Head of Alternative Assets and is a<br />

member of the Alternatives <strong>Invest</strong>ment Committee. Prior to USS, Geoffrey was<br />

with Klesch & Company in London for six years, where he worked on a number<br />

of buyout and turnaround private equity transactions.<br />

Stuart Gent, Global Co-Head, Portfolio Group, BAIN CAPITAL<br />

7 November, 12.55<br />

Stuart Gent is the Co-Head of the Bain Capital’s Portfolio Group, directly involved in<br />

the companies’ post-acquisition management. Bain Capital is a global private equity<br />

firm since 1984 with $35B AUM, 245 investment professionals and 8 offices<br />

worldwide. Stuart joined Bain Capital in 2007, working on NXP, Brakes and Worldpay.<br />

Previously, he worked at Avis Europe and Bain and Co.<br />

Jeremy Ghose, CEO & Managing Partner<br />

3i DEBT MANAGEMENT<br />

7 November, Stream A, 15.20<br />

3i Debt Management manages circa US$6 billion of assets. Jeremy joined the<br />

Company in 2011 following the acquisition of Mizuho <strong>Invest</strong>ment Management (MIM)<br />

from Mizuho Corporate Bank. Prior to joining 3i Jeremy was with Mizuho Corporate<br />

Bank (formerly The Fuji Bank) since 1988, where he founded Mizuho’s Leveraged<br />

Finance business in 1988 and the third-party independent fund management business in 2005. He<br />

had overall responsibility for the LBO/MBO franchise, leveraged syndications, mezzanine finance and<br />

equity fund business in Europe, U.S. and Asia (excluding Japan).<br />

Esther Gilmore, Director<br />

GENERATION INVESTMENT MANAGEMENT<br />

9 November, 11.40<br />

Esther joined Generation in August 2007. Prior to Generation, Esther worked as an<br />

analyst at Sustainable Asset Management (SAM). Other relevant experience<br />

includes her time as a strategic sustainability consultant, and financial analyst<br />

positions with ING Barings and Barclays in London.<br />

Frederic Godbout, Vice President, Funds Group<br />

CAISSE DE DEPOT ET PLACEMENT DU QUEBEC<br />

8 November, 12:40<br />

Josyane Gold, Partner, SJ BERWIN<br />

November 7, Champagne Roundtable, 18:30<br />

Josyane Gold has been a partner in the international funds group since 1988. She<br />

has a wealth of experience that comes from having acted, over a period of 20 years,<br />

on over 150 private equity and venture funds. Josyane is recognised by Chambers,<br />

Legal 500 and Global Counsel as a leading adviser in private equity funds.<br />

Olivier Gottschalg, Professor, Strategy Department, HEC<br />

9 November, 12.10<br />

Professor Oliver Gottschalg serves as HEC’s Academic Director for the TRIUM<br />

Global Executive MBA Program. His research focuses on the strategic logic and<br />

performance determinants of private equity investments and he serves as an advisor<br />

to leading industry investors. He is Head of Research at Peracs, a firm providing<br />

advanced private equity fund due diligence and benchmarking services. He recently<br />

served as an advisor to the European Parliament regarding regulation of the Private Equity industry.<br />

GREEN = LPs & FoFs<br />

BLUE = GPs & Industry Experts<br />

Michael Green<br />

Founder & CEO<br />

TENEX CAPITAL MANAGEMENT<br />

8 November, 15.50<br />

Prior to the re-establishment of Tenex Capital Management, Michael was a Managing<br />

Director, senior member of the <strong>Invest</strong>ment Team and a member of the <strong>Invest</strong>ment<br />

Committee at Cerberus Capital Management from 2004 to 2009. From 2004 to 2006, in addition to his<br />

responsibilities as an investment professional, Mr. Green also served as President of Cerberus<br />

Operations, where he led the establishment and growth of a multi-industry, multi-functional investment<br />

support entity of more than 100 professionals.<br />

Jean-Louis Grevet, Founder & Managing Partner<br />

PERCEVA<br />

7 November, Stream A, 17.10<br />

Jean-Louis has more than 16 years of experience in providing capital to turnarounds<br />

or fragile companies in France. In the mid 90s, he was Head of the special situations<br />

group in France for Bankers Trust and then became Partner at Butler Capital. In<br />

2007, he founded Perceva, a private equity firm investing in special situations.<br />

Marleen Groen, CEO<br />

GREENPARK CAPITAL<br />

6 November, Secondaries Summit, 11:20<br />

Since the mid-90s, Marleen has been at the forefront of secondary investing in<br />

Europe where she has played a major role in pioneering innovative, highly successful<br />

secondary transactions particularly in the mid-market. To date, Marleen has been<br />

responsible for well over $1.5bn of secondaries investments. In 2000 Marleen<br />

founded Greenpark Capital, a leading global mid-market private equity secondaries investment firm<br />

based in London.<br />

Mounir Guen, Founder<br />

MVISION<br />

6 November, Fundraising Summit, 15.05 & 17.05<br />

Mounir is a veteran fundraising specialist, advisor and manager, with 25 years of<br />

experience in the industry, during which he has worked on over 200 General<br />

Partnership funds. He has led the development of MVision to the point where it is<br />

now the world’s leading independent international private equity placement agent.<br />

Gail Guerin, Partner<br />

GUERIN ASSOCIATES<br />

Fundraising Summit, 6 November, 11.40 & 8 November, 09.35<br />

Gail Guerin is a marketing and fundraising specialist, the founder of Guerin<br />

Associates, and the co-founder of the Talamore Group. Ms Guerin created both firms<br />

to capitalise on her years of experience positioning and marketing private equity<br />

strategies globally. Previously, she was a Senior Partner and Director of Marketing<br />

and <strong>Invest</strong>or Relations for Baring Private Equity Partners, London.<br />

Mathieu Guillemin, Managing Director<br />

OAKTREE CAPITAL MANAGEMENT<br />

7 November, 11.25<br />

Prior to joining Oaktree in 2007, Mr. Guillemin spent eight years at Montagu Private<br />

Equity, most recently as a Director/Partner responsible for sourcing, leading and<br />

monitoring transactions. During his time at Montagu, he was involved in ten<br />

investments and responsible for launching Montagu’s French office. Prior experience<br />

includes work at Apax Partners & Cie in Paris and Banque Indosuez in London.<br />

Jon Haick, Managing Partner<br />

BROOKFIELD ASSET MANAGEMENT<br />

8 November, 08.45<br />

Jon is a Managing Partner and has held several senior management positions at<br />

Brookfield. Jon has significant experience in mergers and acquisitions and<br />

corporate finance transactions across a range of industries. He joined Brookfield<br />

in 2004 from Orenda Corporate Finance, a Toronto-based corporate finance firm and prior to that<br />

he was a manager in the assurance and advisory practice at Ernst & Young. Jon holds a<br />

Bachelor of Business Administration degree from Wilfred Laurier University and is a Chartered<br />

Accountant and a CFA Charterholder.<br />

Dana Haimoff, Portfolio Manager<br />

JP MORGAN ASSET MANAGEMENT<br />

8 November, Stream B, 16.10 & 8 November, Stream C, 17.15<br />

Dana has almost 20 years’ experience in private equity both on the investment and<br />

advisory side. She is responsible for sourcing, recommending and monitoring private<br />

equity funds, co-investments and secondary investments on behalf of institutional<br />

and private clients of JP Morgan Asset Management. Prior to joining the Group, she<br />

was a Vice President with Merrill Lynch’s <strong>Invest</strong>ment Bank in the private equity funds group.<br />

Martin Halusa, CEO<br />

APAX PARTNERS<br />

8 November, 11.10<br />

Martin Halusa was elected CEO of Apax Partners in 2003, having co-founded Apax<br />

Partners Germany in 1990. Apax is one of the world's leading private equity firms,<br />

operating across the US, Europe and Asia. Funds under its advice total over $37<br />

billion and are invested in Tech & Telecom, Retail & Consumer, Media, Healthcare<br />

and Financial & Business Services companies.<br />

Valérie Handal, Principal<br />

HARBOURVEST PARTNERS<br />

6 November, Secondaries Summit, 12.00<br />

Valérie Handal focuses on originating and executing secondary investments, primarily<br />

in Europe. She joined the Firm from Merrill Lynch’s Private Equity Group in London,<br />

where she served as a vice president. Her prior experience includes positions in<br />

investment banking and venture capital at Merrill Lynch, Banc of America Securities,<br />

and Softbank Europe Ventures.<br />

Guy Hands, Chairman & CIO<br />

TERRA FIRMA CAPITAL<br />

7 November, 09.40<br />

Guy is Terra Firma’s Founder, and sits on the General Partners’ boards. He started<br />

his career with Goldman Sachs International where he went on to become Head of<br />

Eurobond Trading and then Head of Goldman Sachs’ Global Asset Structuring<br />

Group. Guy left Goldman’s in 1994 to establish the Principal Finance Group (PFG) at<br />

Nomura International plc which acquired 15 businesses with an aggregate enterprise value of €20<br />

billion. Guy led the spin out of PFG to form Terra Firma in 2002.<br />

Neil Harper, Managing Director<br />

MORGAN STANLEY ALTERNATIVE INVESTMENT PARTNERS<br />

8 November, 12.40<br />

Neil is a Portfolio Manager and Global <strong>Invest</strong>ment Committee Member for Morgan<br />

Stanley Alternative <strong>Invest</strong>ment Partners, Morgan Stanley's Private Equity Fund of<br />

Funds group, managing approximately $9bn in fund investments and direct<br />

co-investments globally. Neil leads EMEA investment activities from the London office<br />

and has 22 years of relevant industry experience. Prior to joining Morgan Stanley AIP, he was a<br />

Partner with McKinsey & Company based in Europe, North America and Asia working with corporate<br />

and private equity clients.<br />

Carl Harring<br />

Managing Director<br />

HIG EUROPE<br />

8 November, Stream C, 16.45<br />

Carl Harring has more than twelve years of private equity experience, having<br />

completed transactions ranging from LBOs to restructurings and credit investments<br />

across industry sectors, with a particular focus on business services and healthcare. Prior to joining<br />

H.I.G. Capital, Carl held senior positions at HgCapital and Apax Partners, where he led several<br />

successful investments across Europe. Before that, he worked as a Strategy Consultant in London for<br />

Marakon Associates.<br />

John Hartz<br />

Managing Partner<br />

INFLEXION PRIVATE EQUITY<br />

7 November, Stream C, 17.50<br />

John is the co-founder of Inflexion Private Equity, one of the UK’s leading mid-market<br />

firms, targeting investments with an EV between £10m and £100m. With c.£700m<br />

funds under management, Inflexion actively manages a diverse portfolio of companies from preppy,<br />

British fashion retailer, Jack Wills, to world leading manufacturer of subsea vehicles, SMD.<br />

GREEN = LPs & FoFs<br />

BLUE = GPs & Industry Experts<br />

James Heath, Managing Director, Head of London Office<br />

PATHWAY CAPITAL<br />

7 November, Stream B, 14.40<br />

James Heath is responsible for client servicing, analyzing investment opportunities,<br />

conducting due diligence, and negotiating and reviewing investment vehicle<br />

documents. He is a member of Pathway’s <strong>Invest</strong>ment Committee and currently<br />

serves on the advisory boards of several private equity partnerships. Before joining<br />

Pathway, Mr. Heath was a director with Sovereign Capital Limited, a European independent private<br />

equity fund manager based in London.<br />

Michael Hewett, Managing Director<br />

STRATEGIC VALUE PARTNERS<br />

6 November, Fundraising Summit, 17.45<br />

Michael Hewett is part of the senior management of SVP, an alternative investment<br />

firm focused on distressed, deep value and turnaround opportunities. SVP and its<br />

affiliates currently oversee about $4 billion assets under management. He leads<br />

business development in Europe and the Middle East. Previously, he spent six years<br />

at Terra Firma Capital Partners, where he was a Managing Director and Head of <strong>Invest</strong>or Relations.<br />

Sean J. Hill, Partner and<br />

Co-head of the Private <strong>Invest</strong>ment Funds Group, PROSKAUER<br />

8 November, Stream B 17:45<br />

Sean Hill is a Partner and co-head of the Private <strong>Invest</strong>ment Funds Group at<br />

Proskauer. His practice covers the full range of activities and operations of alternative<br />

investment managers, with an emphasis on representing U.S. and non-U.S.<br />

sponsors in fund formations and portfolio investment activities, as well as regulatory,<br />

compliance and operational issues. Sean also represents institutional investors in negotiating<br />

alternative investments and secondary transactions.<br />

Christian Hinze, Head of SRPEP & Co-Head, Operations,<br />

Member of the Management Team<br />

SWISS RE PRIVATE EQUITY PARTNERS<br />

8 November, 08.15<br />

As Head of SRPEP overall and Co-Head, Operations, Christian Hinze is responsible<br />

for all aspects of the management of a USD 7.5 billion investment portfolio in Private<br />

Equity and Real Assets for Swiss Re and its co-investors. As Co-Head, Operations he focuses on Risk<br />

Management and Finance. He also serves as a member of SRPEP's board of directors, is a voting<br />

member on the <strong>Invest</strong>ment Committee and is Chairman of the <strong>Invest</strong>ment Advisory Board.<br />

Greg Holden, Partner, ADAMS STREET PARTNERS<br />

6 November, Secondaries Summit, 16.45<br />

Greg primarily specialises in the sourcing and execution of secondary investments.<br />

He actively participates in all fund investment decisions at Adams Street. Prior to<br />

joining Adams Street Partners, Greg was with Coller Capital where he worked as a<br />

secondary investment manager responsible for the analysis, due diligence,<br />

negotiation and execution of secondary transactions of both limited partner fund<br />

positions and direct asset portfolios.<br />

Christian Hollenberg, Partner, PERUSA<br />

7 November, Stream A, 17.10<br />

Perusa Partners is an independent Private Equity firm focusing on Special Situations,<br />

operational turnarounds and restructurings of small to mid-sized transactions mostly<br />

in the German speaking markets. Before founding Perusa, Hollenberg was a<br />

founder of Orlando Management. Orlando`s first fund, raised in 2001, was the<br />

pioneer in institutionally funded distress, restructuring and turnaround investing in the<br />

German speaking markets.<br />

Dörte Höppner, Secretary General, EVCA<br />

9 November, 08.20<br />

Dörte represents the industry at the very highest levels of business and government<br />

and is a regular commentator in the international media on all aspects of the private<br />

equity industry. Dörte joined EVCA in 2011 after spending four years as the Managing<br />

Director at the BVK, the German Private Equity Association where she played a<br />

leading role in the industry’s response to the Alternative <strong>Invest</strong>ment Fund Manager’s<br />

Directive. Before joining the BVK, Dörte held the role of Communications Director at the German<br />

Institute for Economic Research (“DIW”), Germany’s leading think tank.<br />

Ralf Huep, Managing Partner, ADVENT<br />

8 November, 11.30<br />

Ralf Huep is Co-Chair of Advent's Executive Committee and a member of Advent’s<br />

Western and Central Europe <strong>Invest</strong>ment Advisory Committees. Prior to joining<br />

Advent he was a financial analyst at Veba AG, a German industrial and energy<br />

conglomerate. Prior to that, he was a project manager in the mergers and acquisitions<br />

department of Continental AG, a leading European tyre manufacturer.<br />

Terry Hughes<br />

Partner<br />

HUTTON COLLINS<br />

7 November, Stream C, 17.10<br />

Hutton Collins make subordinated debt and equity investments. Terry has spent twenty<br />

years in leveraged finance and related fields with Continental Illinois, UBS and Goldman<br />

Sachs. More recently he headed the principal finance activities for Silver Point LLP in Europe investing in<br />

large European acquisition and restructuring situations.<br />

Henri Isnard<br />

Co-Founder & Managing Partner<br />

ARCIS<br />

6 November, Secondaries Summit, 10.10<br />

Henri Isnard is co-founder and Managing Partner of ARCIS and manages the ARCIS Continental<br />

European operations and activities. He has 20 years of private equity investing experience, exclusively<br />

in the secondary private equity market. Henri has held and holds seats on the Board of various<br />

European private equity funds and companies.<br />

Simon Jamieson, Director<br />

FF&P ASSET MANAGEMENT<br />

7 November, Stream B, 14.40<br />

Simon has been with the firm since its inception in 2000. FF&P is an open family<br />

office and Simon focuses on investing in a broad range of Private Equity Funds and<br />

co investments. He is a member of Fleming Family and Partners Asset Management<br />

Limited’s investment committee and of FF&P Private Equity Limited’s investment<br />

committee. He was the fund manager of FF&P Special Situations 1 LLP, which has invested in a<br />

portfolio of British and American businesses since 2001. He also manages FF&P Venture Funds I, II,<br />

III, IV and V which target both global equity funds and direct investments.<br />

David Jeffrey, Partner, Head of Europe<br />

STEPSTONE GROUP<br />

8 November, 15.50<br />

Prior to joining StepStone, Mr. Jeffrey was a Managing Partner at Parish Capital<br />

and founded the firm’s European and Asian activities, as well as having<br />

responsibility for the secondary and co-investment businesses. Before Parish<br />

Capital, Mr. Jeffrey served as Managing Director of Bank of America’s European<br />

Private Equity group before which he had been Managing Director and Head of BancBoston<br />

Capital’s European and Asian operations. Prior to that, Mr. Jeffrey worked for PwC’s corporate<br />

recovery and corporate finance divisions.<br />

Rune Jepsen, Principal, Global Private Equity<br />

QIC GLOBAL PRIVATE EQUITY<br />

6 November, Fundraising Summit, 17.45<br />

Rune joined QIC in 2006 and is one of four senior investment professionals<br />

responsible for developing and implementing a global private equity investment<br />

strategy on behalf of QIC and its clients. Since 2006, Rune has been responsible<br />

for the development of QIC's European buyout portfolio and its global distressed<br />

debt and turnaround portfolio. Rune has over 10 years of experience in private equity, having led<br />

both primary and secondary fund investments as well as co-investments. Prior to joining QIC, Rune<br />

worked at Danske Private Equity and PwC Consulting.<br />

Brenlen Jinkens, Managing Director<br />

COGENT PARTNERS EUROPE<br />

6 November, Secondaries Summit, 09.20 & 15.10<br />

Brenlen Jinkens is Managing Director of the firm’s London office and is<br />

responsible for Cogent’s European strategy and business development. He is<br />

also the Head of Research at Cogent's fund monitoring and due diligence arm.<br />

Prior to joining the firm, Brenlen was an Executive Director of Lehman Brothers<br />

Europe, where he covered financial services technology businesses in the UK, Germany and<br />

Scandinavia.<br />

GREEN = LPs & FoFs<br />

BLUE = GPs & Industry Experts<br />

8<br />

For latest programme and to register: www.icbi-superinvestor.com Tel: +44 (0) 20 7017 7200 Fax: +44 (0) 20 7017 7807 Email: info@icbi.co.uk