Compliance Study_complet - pwc

Compliance Study_complet - pwc

Compliance Study_complet - pwc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

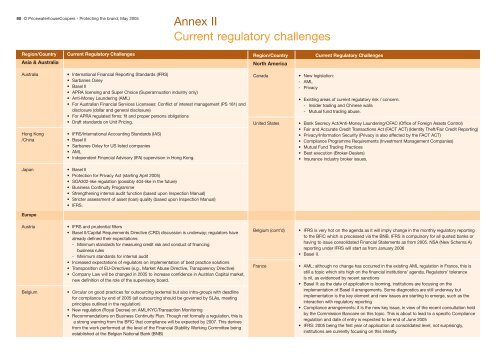

80 © PricewaterhouseCoopers - Protecting the brand, May 2005<br />

Annex II<br />

Current regulatory challenges<br />

Region/Country<br />

Asia & Australia<br />

Current Regulatory Challenges<br />

Region/Country<br />

North America<br />

Current Regulatory Challenges<br />

Australia<br />

Hong Kong<br />

/China<br />

• International Financial Reporting Standards (IFRS)<br />

• Sarbanes Oxley<br />

• Basel II<br />

• APRA licensing and Super Choice (Superannuation industry only)<br />

• Anti-Money Laundering (AML)<br />

• For Australian Financial Services Licensees: Conflict of interest management (PS 181) and<br />

disclosure (dollar and general disclosure)<br />

• For APRA regulated firms: fit and proper persons obligations<br />

• Draft standards on Unit Pricing.<br />

• IFRS/International Accounting Standards (IAS)<br />

• Basel II<br />

• Sarbanes Oxley for US listed companies<br />

• AML<br />

• Independent Financial Advisory (IFA) supervision in Hong Kong.<br />

Canada<br />

United States<br />

• New legislation:<br />

- AML<br />

- Privacy<br />

• Existing areas of current regulatory risk / concern:<br />

- Insider trading and Chinese walls<br />

- Mutual fund trading abuse.<br />

• Bank Secrecy Act/Anti-Money Laundering/OFAC (Office of Foreign Assets Control)<br />

• Fair and Accurate Credit Transactions Act (FACT ACT) (Identity Theft/Fair Credit Reporting)<br />

• Privacy/Information Security (Privacy is also affected by the FACT ACT)<br />

• <strong>Compliance</strong> Programme Requirements (Investment Management Companies)<br />

• Mutual Fund Trading Practices<br />

• Best execution (Broker-Dealers)<br />

• Insurance industry broker issues.<br />

Japan<br />

• Basel II<br />

• Protection for Privacy Act (starting April 2005)<br />

• SOA302-like regulation (possibly 404-like in the future)<br />

• Business Continuity Programme<br />

• Strengthening internal audit function (based upon Inspection Manual)<br />

• Stricter assessment of asset (loan) quality (based upon Inspection Manual)<br />

• IFRS.<br />

Europe<br />

Austria<br />

Belgium<br />

• IFRS and prudential filters<br />

• Basel II/Capital Requirements Directive (CRD) discussion is underway; regulators have<br />

already defined their expectations:<br />

- Minimum standards for measuring credit risk and conduct of financing<br />

business rules<br />

- Minimum standards for internal audit<br />

• Increased expectations of regulators on implementation of best practice solutions<br />

• Transposition of EU-Directives (e.g., Market Abuse Directive, Transparency Directive)<br />

• Company Law will be changed in 2005 to increase confidence in Austrian Capital market,<br />

new definition of the role of the supervisory board.<br />

• Circular on good practices for outsourcing (external but also intra-group) with deadline<br />

for compliance by end of 2005 (all outsourcing should be governed by SLAs, meeting<br />

principles outlined in the regulation)<br />

• New regulation (Royal Decree) on AML/KYC/Transaction Monitoring<br />

• Recommendations on Business Continuity Plan. Though not formally a regulation, this is<br />

a strong warning from the BFIC that compliance will be expected by 2007. This derives<br />

from the work performed at the level of the Financial Stability Working Committee being<br />

established at the Belgian National Bank (BNB)<br />

Belgium (cont’d)<br />

France<br />

• IFRS is very hot on the agenda as it will imply change in the monthly regulatory reporting<br />

to the BFIC which is processed via the BNB. IFRS is compulsory for all quoted banks or<br />

having to issue consolidated Financial Statements as from 2005. NSA (New Schema A)<br />

reporting under IFRS will start as from January 2006<br />

• Basel II.<br />

• AML: although no change has occurred in the existing AML regulation in France, this is<br />

still a topic which sits high on the financial institutions’ agenda. Regulators’ tolerance<br />

is nil, as evidenced by recent sanctions<br />

• Basel II: as the date of application is looming, institutions are focusing on the<br />

implementation of Basel II arrangements. Some diagnostics are still underway but<br />

implementation is the key element and new issues are starting to emerge, such as the<br />

interaction with regulatory reporting<br />

• <strong>Compliance</strong> arrangements: it is the new key issue, in view of the recent consultation held<br />

by the Commission Bancaire on this topic. This is about to lead to a specific <strong>Compliance</strong><br />

regulation and date of entry is expected to be end of June 2005<br />

• IFRS: 2005 being the first year of application at consolidated level, not surprisingly,<br />

institutions are currently focusing on this intently.