startup-ecosystem-mapping-report

startup-ecosystem-mapping-report

startup-ecosystem-mapping-report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

South East Queensland 2014<br />

STARTUP ECOSYSTEM REPORT<br />

1

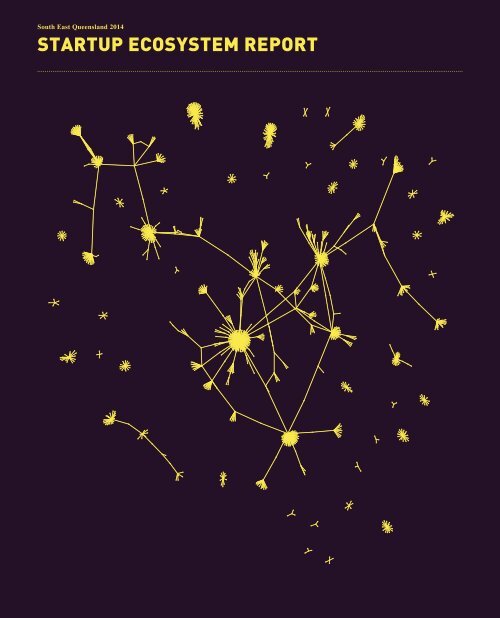

A simplified network map of the<br />

ECOSYSTEM<br />

AMMA<br />

RMSS<br />

Blue Sky<br />

Retail Express<br />

Guvera<br />

Techspace<br />

Tappr<br />

Silicon<br />

Lakes<br />

Budding<br />

Entrepreneurs<br />

Grant<br />

iLab<br />

CA<br />

Transition Level<br />

Investments<br />

Halfbrick<br />

Liquid State<br />

Griffith<br />

Enterprise<br />

SwipeAds<br />

River<br />

City<br />

Labs<br />

Ollo<br />

Mobile<br />

Brisbane Angels<br />

Innovation<br />

Centre<br />

QUT Creative<br />

Enterprise<br />

Australia<br />

Right<br />

Pedal<br />

QUT<br />

bluebox<br />

Nimble<br />

RedEye<br />

UniQuest<br />

Fitgenes<br />

ZOVA<br />

Euclideon

CONTENTS<br />

Foreword 4<br />

Dashboard 5<br />

About 6<br />

Context 7<br />

Breeding Unicorns & Building Ecosystems 10<br />

Formation 12<br />

Organisations 14<br />

Funding 16<br />

Groups 20<br />

Incubation 21<br />

Key Nodes 22<br />

Location 24<br />

Regional Data 26<br />

Markets 28<br />

People 34<br />

Community Ideas 38<br />

References 40<br />

3

FOREWORD<br />

I am pleased to present the South East<br />

Queensland Startup Ecosystem Report which<br />

the Queensland Government commissioned<br />

in partnership with Brisbane Marketing, the<br />

City of Gold Coast and the Sunshine Coast<br />

Regional Council.<br />

The <strong>report</strong> estimates South East Queensland<br />

currently has more than 220 <strong>startup</strong>s,<br />

employing 1,900 people and since 2009, has<br />

raised $126 million in funds.<br />

This <strong>report</strong> provides valuable data about the<br />

contribution <strong>startup</strong>s make to Queensland’s<br />

economy. It quantifies the <strong>ecosystem</strong> around<br />

early stage digital technology companies –<br />

identifying key people, organisations, events<br />

and hubs which drive innovation.<br />

I thank all those who supported and<br />

contributed to this project. It highlights the<br />

value of collaboration as we work together<br />

towards the <strong>startup</strong> community’s goal<br />

for Queensland: By 2033, Queensland is<br />

recognised for its entrepreneurial culture,<br />

with the <strong>startup</strong> sector contributing four<br />

per cent to Gross State Product, injecting<br />

$20 billion and 100,000 new jobs into our<br />

economy, through the global impact of home<br />

grown <strong>startup</strong>s.<br />

The <strong>report</strong>’s findings indicate Queensland’s<br />

<strong>startup</strong> <strong>ecosystem</strong> has a solid foundation<br />

to build a strong, vibrant sector that will<br />

exploit new technologies to build a stronger<br />

economy by creating new industries and<br />

generating more jobs for Queenslanders.<br />

The Honourable Ian Walker MP<br />

Minister for Science, Information Technology,<br />

Innovation and the Arts<br />

It’s an in-depth insight into the diversity and<br />

unique aspects of the South East Queensland<br />

<strong>startup</strong> environment and associated<br />

infrastructure which contributes to a robust<br />

<strong>ecosystem</strong>.<br />

4

Summary statistics as at July 2014<br />

DASHBOARD<br />

No. STARTUPS<br />

226+<br />

Estimated number of <strong>startup</strong>s within SEQ.*<br />

No. FOUNDERS<br />

500+<br />

Estimated number of <strong>startup</strong> founders within SEQ.<br />

PEOPLE: COMMON SKILLS<br />

Strategy<br />

Marketing<br />

Leadership<br />

Business Development<br />

Start-ups<br />

Entrepreneurship<br />

Management<br />

Project Management<br />

Social Media<br />

Management Consulting<br />

18%<br />

13%<br />

8%<br />

7%<br />

7%<br />

7%<br />

7%<br />

6%<br />

6%<br />

6%<br />

No. CO. TEAM SIZE<br />

40%<br />

1%<br />

1 2-10<br />

31%<br />

11-50<br />

2%<br />

51-200<br />

No. PEOPLE<br />

~1,900<br />

Estimated number of SEQ <strong>startup</strong> employees.<br />

No. MEETUP GROUPS<br />

107<br />

Associated with <strong>startup</strong>s, tech and entrepreneurship.<br />

#STARTUPS BY MARKET FOCUS (TOP 10 ONLY)* PEOPLE: AGE %<br />

****<br />

Arts & Recreation Services**<br />

19% 41.0<br />

41<br />

Information Media & Telecommunications 19%<br />

36<br />

Other & Unknown Services***<br />

15% 32.8<br />

Health Care & Social Assistance<br />

8%<br />

Professional, Scientific & Technical Services 5% 24.6<br />

Finance & Insurance Services<br />

5%<br />

Retail Trade<br />

5% 16.4<br />

Advertising Services<br />

4%<br />

11<br />

8.2 9<br />

Administrative & Support Services<br />

3%<br />

5<br />

Education & Training<br />

3%<br />

0.0<br />

18-24 25-34 35-44 45-54 55+<br />

.<br />

No. SUPPORTING COMPANIES<br />

~550<br />

Estimated number of companies involved in the <strong>startup</strong><br />

<strong>ecosystem</strong>.<br />

No. STARTUPS & GROUPS BY YEAR FOUNDED<br />

60<br />

Startups<br />

55<br />

Groups<br />

50<br />

40<br />

****Number of Startup Companies founded by calendar<br />

year in the “No. Startups & Groups by Year Founded”<br />

graph does not equal the total “No. Startups” as the<br />

founding dates of some <strong>startup</strong>s within SEQ were not<br />

identified.<br />

.<br />

No. ASSOCIATED PEOPLE<br />

10,000+<br />

Based on the number of members of technology Meetup<br />

groups and employees of <strong>startup</strong>s & supporting entities.<br />

30<br />

20<br />

10<br />

0<br />

23<br />

13<br />

8 8<br />

2009 2010<br />

26<br />

10<br />

2011<br />

29<br />

23<br />

2012<br />

28<br />

2013<br />

25<br />

2014<br />

TOTAL FUNDING RAISED BY STARTUPS<br />

$<br />

37M<br />

Estimated total amount of funding raised by Queensland<br />

Startups between January 2009 and July 2014.<br />

TOTAL FUNDING RAISED<br />

$<br />

126M<br />

Total funding raised from January 2009 to July 2014<br />

by Queensland Startups and Established Digital<br />

Technology companies.<br />

*Note, while the <strong>report</strong> uses the Australia New Zealand<br />

Industrial Classification (ANZIC) to classify the<br />

“Market Focus” of companies, this does not represent<br />

their industry classification, but rather the target market<br />

of a <strong>startup</strong> company - the market they are addressing.<br />

**Arts & Recreation Services includes Digital<br />

Game studios and developers. Further detail on this<br />

classification can be found in the footnote on page 31.<br />

***Other & Unknown Services is predominately made<br />

up of unclassified companies.<br />

5

How and why.<br />

ABOUT<br />

PROJECT AIMS<br />

This project aims to quantify the <strong>ecosystem</strong> around<br />

early-stage high growth digital technology companies<br />

(<strong>startup</strong>s for short) from South East Queensland (SEQ)<br />

- identifying key people, organisations, events and<br />

innovation hubs within the community around which<br />

innovative activity is centralised. The <strong>report</strong> aims to<br />

measure its comparative strength, identify critical issues<br />

within the <strong>ecosystem</strong>, and identify potential areas for<br />

government intervention and collaboration.<br />

SCOPE<br />

In terms of scope, the <strong>report</strong> maps the primary people<br />

(founders, angels and other participants), organisations<br />

(<strong>startup</strong>s, venture capital firms, co-working spaces,<br />

incubators and government agencies), groups (angel and<br />

community groups) and events (awards, conferences,<br />

programs) involved in or supporting early-stage<br />

technology <strong>startup</strong>s within South East Queensland.<br />

The <strong>report</strong> only includes those companies and people<br />

that have made a direct tangible contribution to the<br />

development of high growth <strong>startup</strong>s – whether that be<br />

through mentoring, sponsorship, investment, grants or<br />

space, etc.<br />

The <strong>report</strong> attempts to quantify in detail the fund flows<br />

to <strong>startup</strong>s based in SEQ. However it does not quantify<br />

the amount of investment flowing out of the state into<br />

external <strong>startup</strong>s.<br />

A seperate <strong>report</strong> <strong>mapping</strong> the regional Queensland<br />

<strong>startup</strong> <strong>ecosystem</strong> will be available in November 2014.<br />

METHODOLOGY<br />

The <strong>report</strong> was compiled in partnership with several<br />

community organisations and government agencies.<br />

Information was gathered through workshops in<br />

Brisbane, on the Gold Coast and the Sunshine Coast,<br />

and from interviews with over 35 people within<br />

the community. Information on people, events and<br />

companies was also gathered using data from online<br />

platforms including Linkedin, AngelList, ASSOB,<br />

CrunchBase, Gust, Twitter, Eventbrite, Kickstarter,<br />

Pozible and Meetup, and complemented with internet<br />

research.<br />

Combining several data sources gives a more<br />

comprehensive view than one in which information is<br />

taken from any one individual source. For example,<br />

looking at funding events during the previous 5 years<br />

Crunchbase gives only 20 or so events out of the 100+<br />

events identified using additional sources.<br />

However while all attempts have been made to be<br />

comprehensive, some critical people and organisations<br />

in this rapidly growing sector may have been missed.<br />

DEFINITIONS<br />

Startups<br />

There are varied definitions of high growth early stage<br />

digital technology <strong>startup</strong>s. Whilst any type of earlystage<br />

business can be called a <strong>startup</strong>, for the purposes<br />

of this project the definition used by StartupAus,<br />

Google Australia and PwC Australia was adopted: a<br />

‘<strong>startup</strong>’ is a company primarily focused on developing<br />

innovative digital technology, with a high leverage on<br />

labour, an innovative scalable business model, capable of<br />

rapid growth, and under five and half years in age.<br />

Digital<br />

The project focused on companies that create value<br />

primarily around digital technologies such as developing<br />

software products or services, scalable hardware<br />

based products and services such as drones, sensors,<br />

autonomous vehicle technology, Internet of Things<br />

(IoT) technology, and wearables.<br />

Exclusions<br />

Digital technologies are being deployed across all<br />

industries and permeate all aspects of our society. The<br />

borders between industries are being eroded making<br />

it increasingly difficult to say whether a new company<br />

like Uber is a transport company, software company, or<br />

a labour hire company. The reality is that an increasing<br />

(majority) proportion of Australian businesses have<br />

digital technology as a core component of their<br />

business.<br />

Consulting: The project excluded non-scalable<br />

companies engaged with digital technology, such as<br />

those with a high reliance on manual labour such as<br />

digital design studios, digital marketing, software<br />

development houses and computer consulting<br />

companies. Technology support, networking, and<br />

computer repair businesses were also excluded.<br />

Similarly excluded were design and development<br />

companies providing IP development as a service purely<br />

for other firms such as advertising agencies that build<br />

mobile and web apps for clients or gaming studios that<br />

purely work for clients. However, many companies<br />

build potentially scalable digital products (e.g. iPhone<br />

apps) alongside their consulting services, in which case<br />

they have been included.<br />

Established Technology: the <strong>report</strong> excludes digital<br />

technology companies established prior to 2009 from<br />

the definition of a ‘<strong>startup</strong>’. However in some cases the<br />

<strong>report</strong> mentions companies, investment figures or entity<br />

numbers for more mature digital technology companies.<br />

In these cases the <strong>report</strong> refers to these as Established,<br />

Mature or Later stage digital technology companies, or<br />

Tech companies for short. Data that encapsulates both<br />

Startups and established Digital Technology companies<br />

is always referenced as such.<br />

Support Entities<br />

Key organisations that support the development of<br />

<strong>startup</strong>s such as incubators, accelerators, meetup groups<br />

and venture capital firms were included.<br />

Incubator: an organisation that offers mentoring, office<br />

space, and other resources to help <strong>startup</strong>s grow. Whilst<br />

incubators assist <strong>startup</strong>s in raising funding they do not<br />

provide investment in return for equity. Their programs<br />

are generally open, longer in duration and relatively<br />

unstructured.<br />

Accelerator: accelerators or seed accelerators are<br />

similar to incubators, but differ in that they take an<br />

equity portion of their participating <strong>startup</strong>s in return<br />

for investing seed capital - where incubators do not.<br />

Accelerators generally have a structured program that<br />

runs over a discrete period of time (often 3 to 6 months)<br />

after which the <strong>startup</strong> ‘graduates’.<br />

Groups: community groups or meetup.com groups<br />

that meet together in fairly informal circumstances to<br />

discuss digital technology, <strong>startup</strong>s or entrepreneurship.<br />

This data is almost entirely based on meetup.com<br />

groups which is a worldwide platform for organising<br />

community groups and widely adopted within <strong>startup</strong><br />

communities worldwide.<br />

Funding & Investment<br />

The <strong>report</strong> captures information on the money raised<br />

by technology companies and <strong>startup</strong>s to fund company<br />

and product development. Startups secure funding in<br />

multiple ways: private investment, government grants,<br />

crowdfunding, public investment, prizes and loans. The<br />

<strong>report</strong> excludes money flowing out of the state into<br />

<strong>startup</strong>s from other states or countries.<br />

When the <strong>report</strong> refers to Funding, Investment or<br />

Matched Funding it means:<br />

Funding: the <strong>report</strong> means all types of funding<br />

including private investment, government grants,<br />

matched funding, crowdfunding, public investment,<br />

prizes and loans. While crowdfunding is technically a<br />

way for customers to pre-order a product or service the<br />

<strong>report</strong> includes it within the analysis of <strong>startup</strong> funding<br />

as it serves a similar role to other funding methods. This<br />

definition excludes the Tax office’s R&D Tax Incentive.<br />

Investment: the <strong>report</strong> means private or public equity<br />

investment in a company in exchange for shares in the<br />

company, including convertible notes, options and other<br />

financial tools for purchasing shares.<br />

Matched-Funding: a large portion of <strong>startup</strong> funding<br />

in Queensland came from the Australian Government’s<br />

Commercialisation Australia (CA) grant program,<br />

established in 2009. The grant offered to match private<br />

funding for successful applicant companies on a<br />

80:20 to 50:50 basis - depending on the grant type.<br />

By matched funding the <strong>report</strong> refers to the portion<br />

provided by the applicant, and excluding the portion<br />

provided by the government - the government grant.<br />

All currencies used within this <strong>report</strong> are in $AUD<br />

unless otherwise stated.<br />

6

Why is digital technology important?<br />

CONTEXT<br />

SOCIAL IMPACT OF TECHNOLOGY<br />

Information and communications technology is pervasive<br />

and soon to be ubiquitous. New technologies that evolved<br />

from the cumulative innovations of the past 80 years have<br />

dramatically changed the way people create, consume<br />

and communicate - transforming societies and economies<br />

at unprecedented rates.<br />

While the process of innovation is never ending, the<br />

development of the first transistor, microprocessor and<br />

computer in the late 40s initiated a wave of computing<br />

innovation. It brought the first satellite in 1957, the<br />

linking of computers into large-scale networks in 1969,<br />

the first Japanese smartphones to achieve mass adoption<br />

in 1999, and the first touch screen in 2007.<br />

Of the 7b+ people on the planet, 5.5b watch TV, 2.7b use<br />

the internet, 1 1.8b use smartphones, 2 and 1.7b use those<br />

smartphones at least monthly. 3<br />

In 1986 less than 1% of the world’s capacity to store<br />

information was digital. In 2002 humanity was able to<br />

store more information in digital than analog format –<br />

launching the “digital age”. And by 2007 over 94% of<br />

humanity’s knowledge was stored digitally. 4<br />

Networked digital technology is being rapidly adopted<br />

and will soon be ubiquitous. Somewhere during 2008<br />

the number of connected electronic sensors on the planet<br />

exceeded the number of people; this will have grown to<br />

26b+ devices by 2020. 5<br />

ECONOMIC IMPACT OF TECHNOLOGY<br />

These innovations have facilitated an enormous new<br />

capacity to create, capture, analyse, disseminate<br />

information and release a flood of <strong>startup</strong>s, many of<br />

which are revolutionising production and distribution<br />

systems on a global scale.<br />

Outsourcing white-collar tasks to more efficient or<br />

productive economies is now the norm, enabling<br />

developing economies to provide services to developed<br />

nations at scale and on demand.<br />

When historians look back at the last 80 years they<br />

will conclude we are living through a pivotal period<br />

in humanity’s history. The question for Australia and<br />

Queensland is whether they want to be creators of<br />

technological innovation, or just simply consumers.<br />

The largest companies of the last century were industrial<br />

corporations, born of the industrial revolution in the<br />

1800s: mass-production companies such as Ford,<br />

Volkswagen, Toyota, GE, Bayer; and the suppliers of raw<br />

materials such as Exxon, Shell, BP and BHP.<br />

But over the recent decades computer, software and<br />

now internet companies such as Apple, Google, IBM,<br />

Microsoft and Facebook have been vying with more<br />

traditional corporations to lead the pack. PwC’s 2014<br />

<strong>report</strong> on the Global Top 100 Companies by Market<br />

Capitalisation showed that Technology and Financials<br />

are the leading sectors to have grown market cap in the<br />

Top 100 (+149% and +136% respectively) - driven by<br />

innovation and recovery from the financial crisis. 6<br />

Apple – the largest by market cap – having almost<br />

quadrupled in value during the past five years.<br />

And this is just the beginning. In the coming decades<br />

virtually every industry can expect to face disruptions<br />

rivalling those of the industrial revolution. Some<br />

industries will face extinction; new sectors will be<br />

created; and others are being transformed beyond<br />

recognition.<br />

In 2013, in reference to the long-term economic<br />

potential of technology, US Federal Reserve chairman<br />

Ben Bernanke stated:<br />

“Some would say that we are still in the early days of the<br />

IT revolution... even as the basic technologies improve,<br />

the commercial applications of these technologies have<br />

arguably thus far only scratched the surface.” 7<br />

CREATIVE DESTRUCTION<br />

During the early 20th century economist Joseph<br />

Schumpeter observed that the most significant advances<br />

in economies are often accompanied by a process<br />

of “creative destruction” which shifts profit pools,<br />

rearranges industry structures, and replaces incumbent<br />

businesses. This process is often driven by technological<br />

innovation at the hands of entrepreneurs.<br />

According to IBIS World’s white-paper A Snapshot<br />

of Australia’s Digital Future to 2050, 15 different<br />

industry sub-sectors face extinction due to factors such<br />

as size, international competitiveness, the potential for<br />

displacement, and technology.<br />

“Casualties may include: newspaper, magazine,<br />

book and directory publishing – substituted by their<br />

online versions; radio, free-to-air TV and cable TV<br />

broadcasting – absorbed into internet distribution; and<br />

video rental.” 8<br />

Entrepreneurs, policymakers and societies need to be<br />

at the forefront exploiting these new technologies to<br />

maintain national competitive advantage and global<br />

relevance.<br />

Entrepreneurs need to understand how markets might be<br />

eroded or enhanced by emerging technologies a decade<br />

from now; how technologies might bring new customers<br />

or force them to fight for existing ones. Policymakers<br />

and regulators need to decide how to invest in new<br />

forms of education and infrastructure; protect the rights<br />

and privacy of citizens; and create an environment in<br />

which citizens can continue to prosper even as emerging<br />

technologies disrupt their lives.<br />

McKinsey’s 2013 <strong>report</strong> Disruptive Technologies:<br />

Advances That Will Transform Life, Business, And<br />

The Global Economy identified the top 12 disruptive<br />

technologies that have the greatest potential for economic<br />

impact and disruption by 2025. They estimated the<br />

potential economic impact that each technology would<br />

have by 2025 and concluded that these 12 technologies<br />

alone had “the potential to drive direct economic impact<br />

in the order of $US 14 trillion to $US 33 trillion per year<br />

in 2025.” 9<br />

TOP 12 DISRUPTIVE TECHNOLOGIES<br />

GLOBAL ECONOMIC IMPACT IN 2025 ($T)<br />

Mobile Internet<br />

Automation of knowledge work<br />

The Internet of Things<br />

Cloud technology<br />

Advanced robotics<br />

Autonomous and near- autonomous vehicles<br />

Next-generation genomics<br />

Energy storage<br />

3D printing<br />

Advanced materials<br />

Advanced oil and gas exploration and recovery<br />

Renewable energy<br />

DIGITAL DISRUPTION IN AUSTRALIA<br />

3.7-10.8<br />

5.2-6.7<br />

2.7-6.2<br />

1.7-6.2<br />

1.7-4.5<br />

0.2-1.9<br />

0.7-1.6<br />

0.1-0.6<br />

0.2-0.6<br />

0.2-0.5<br />

0.1-0.5<br />

0.2-0.3<br />

Seven of the twelve disruptive technologies fall within<br />

the purview of the digital <strong>startup</strong> companies outlined<br />

within this <strong>report</strong>: Mobile Internet, Automation of<br />

Knowledge Work, The Internet of Things, Cloud<br />

Technology, Advanced Robotics, Autonomous Vehicles<br />

and 3D Printing.<br />

It should be noted that when McKinsey refers to<br />

economic disruption, this economic potential should<br />

not be equated with market sizes for these technologies;<br />

it could be captured as consumer surplus as well as in<br />

new revenue and GDP growth. McKinsey also mentions<br />

that in the case of Internet-based technologies, value has<br />

tended to shift to consumers; as much as two-thirds of the<br />

value created by new Internet offerings has been captured<br />

as consumer surplus. However, they conclude that:<br />

“It is impossible to predict all the ways in which<br />

technologies will be applied; the value created in 2025<br />

could be far larger than what we estimate here.” 9<br />

Assuming an Australian GDP growth is 3% and<br />

McKinsey’s estimates of the potential economic<br />

impact of these 7 digital technologies along with their<br />

distribution of the impact on Developed economies is<br />

applied, it results in an annual economic impact on the<br />

Australian economy in 2025 of $497b - from these 7<br />

digital technologies alone.<br />

To put that into perspective: 22% of Australia’s GDP in<br />

2025 will be disrupted from the application of these 7<br />

digital technologies alone.<br />

GLOBAL ECONOMIC IMPACT IN 2025 ($US TRILLION) 14 7

Why is digital technology important?<br />

CONTEXT<br />

DIGITAL DISRUPTION IN QUEENSLAND<br />

What does this mean for Queensland’s economy in 2025?<br />

Boundlss’ analysis, using McKinsey’s data, suggests<br />

the impact of these 7 disruptive digital technologies<br />

on Queensland’s economy will be ~$96b per annum<br />

in 2025, or roughly 24% of the state’s projected $396b<br />

economy.<br />

DISRUPTIVE DIGITAL TECHNOLOGIES -<br />

ECONOMIC IMPACT ON QUEENSLAND ($B) ($M)<br />

Automation of knowledge work<br />

Mobile Internet<br />

The Internet of Things<br />

Advanced robotics<br />

Cloud technology<br />

Autonomous and near- autonomous vehicles<br />

3D printing<br />

While these projections may seem high, they are less<br />

than those in Deloitte’s 2012 <strong>report</strong> Digital disruption<br />

Short fuse, big bang? which foresees 33% of the<br />

economy facing disruption from all digital technologies<br />

within the next five years.<br />

“One-third of the Australian economy faces imminent<br />

and substantial disruption by digital technologies and<br />

business models – what we call a ‘short fuse, big bang’<br />

scenario. This presents significant threats, as well as<br />

opportunities, for both business and government.” 10<br />

Applied to Queensland, 33% represents $132b of<br />

economic disruption from 2017 to 2025. That’s $46b<br />

higher than projections based on McKinsey’s <strong>report</strong> on<br />

the most disruptive digital technologies.<br />

In summary, this <strong>report</strong> estimates the economic impact<br />

of digital technology on Queensland’s economy in 2025<br />

will be in the order of $96b per year, and this impact will<br />

be created largely by Mobile Internet, the Automation<br />

of Knowledge work, The Internet of Things, Advanced<br />

Robotics, Cloud technology, Autonomous Vehicles<br />

technology, and 3D Printing.<br />

While this economic disruption should not be equated<br />

with market sizes for these technologies (some will be<br />

captured as consumer surplus, and others as productivity<br />

growth), it does represent an enormous innovation<br />

goldrush.<br />

Up to two-thirds of this value will be captured by<br />

consumer surplus, with the remainder coming from<br />

productivity gains and revenue streams from new<br />

technologies.<br />

34.9<br />

25.9<br />

22.2<br />

17.7<br />

8.4<br />

5.9<br />

1.7<br />

Given the challenges involved with adopting disruptive<br />

technologies it is often <strong>startup</strong> companies that are<br />

best suited to seize new market opportunities. Makers<br />

of horse-drawn carts didn’t catch on to the car, IBM<br />

couldn’t see the opportunity in personal computers, and<br />

the music industry has been pulled into digital streaming<br />

music only reluctantly, worn down by years of music<br />

piracy.<br />

Assuming one third of the $96b in economic value<br />

in 2025 is direct value created by these disruptive<br />

technologies (the other two thirds being retained as<br />

consumer savings as McKinsey has found is the norm<br />

with Internet-based technologies), this <strong>report</strong> estimates<br />

that in 2025 $32b annually will be addressed by either<br />

foreign or local digital technology companies.<br />

Enrico Moretti, Professor of Economics at the University<br />

of California has found that technology companies have a<br />

five-fold impact on the economy. He states:<br />

“Innovative industries bring good jobs and high salaries<br />

to communities where they cluster and their impact on<br />

the local economy is much deeper than their direct effect.<br />

Attracting a scientist or software engineer triggers a<br />

multiplier effect, increasing employment and salaries for<br />

those that provide local services. In essence, a high tech<br />

job is more than a job... research shows for each high<br />

tech job, five additional jobs are created outside the high<br />

tech sector.” 11<br />

Assuming this $32b represents this five-fold impact,<br />

this <strong>report</strong> estimates the direct contribution from digital<br />

technology employees on the Queensland economy to be<br />

over $6b in 2025.<br />

If this value isn’t captured by local digital technology<br />

companies and <strong>startup</strong>s it will certainly be extracted by<br />

companies from interstate and overseas.<br />

HOW MANY STARTUPS<br />

There is a real and substantive opportunity for the <strong>startup</strong><br />

sector within Queensland to grow and play a much larger<br />

role in the local, national and international economy. It<br />

is also reasonable to conclude that the aims outlined by<br />

the Queensland Startup Summit held in 2013 are entirely<br />

achievable if the right infrastructure is put in place to<br />

develop the sector. The Summit’s “Big Hairy Audacious<br />

Goal” (BHAG) states:<br />

‘By 2033, Queensland is recognised for its<br />

entrepreneurial culture, with the <strong>startup</strong> sector<br />

contributing four per cent to Gross State Product,<br />

injecting $20b and 100,000 new jobs into our economy,<br />

through the global impact of home grown <strong>startup</strong>s.’ 12<br />

These estimates also align with PwC’s 2013 <strong>report</strong> The<br />

Startup economy: How to Support Tech Startups and<br />

Accelerate Australian Innovation: “By accelerating<br />

growth the sector could contribute 4% of GDP by 2033<br />

and directly employ 540,000 people.” 13<br />

The Summit’s BHAG equates to ~30,000 employees and<br />

a contribution to Queensland’s Gross State Product of<br />

roughly $5b in 2025.<br />

Compared to the opportunity outlined by McKinsey &<br />

Deloitte there is certainly enough need within the market<br />

to achieve this BHAG given the right environment.<br />

Thus the question: How many technology companies and<br />

<strong>startup</strong>s are needed for Queensland to meet this BHAG<br />

and retain some of the potential economic disruption<br />

within the state? What would Queensland’s <strong>startup</strong><br />

<strong>ecosystem</strong> have to look like in 2025 for this to happen?<br />

One way to answer this is by modelling the distribution<br />

of technology companies using the 80-20 Pareto<br />

distribution – 80% of the value created by 20% of<br />

companies and vice versa. a<br />

Applying this methodology this <strong>report</strong> estimates there<br />

would need to be 3,000 to 4,000 technology companies b<br />

within Queensland by 2025. The vast bulk of these<br />

would be pre-revenue seed stage <strong>startup</strong>s, 300 to 500<br />

with $1m-$10m in revenue, 50+ with $10m-$100m in<br />

revenue, 10+ companies with $100m-$1b in revenue, and<br />

a small number above $1b in revenue.<br />

Assuming a linear increase in productivity for each<br />

increasing tier of company size, from $200k per<br />

employee to $500k per employee, gives an estimate<br />

for the number of employees required across the 5<br />

bands. Resulting in a total number of 25,000 to 30,000<br />

employees working directly within the technology sector<br />

and creating over $5b of value in 2025.<br />

To achieve this target, participation in the sector would<br />

have to grow at approximately 40% each year, with new<br />

company / <strong>startup</strong> formation rates beginning at 10 to 20<br />

new <strong>startup</strong>s per year and reaching a rate of 1,000 per<br />

year by 2025 - a yearly <strong>startup</strong> formation rate of 170 per<br />

million people. c<br />

While these sorts of formation rates may seem large,<br />

they are quite reasonable when you take into account<br />

two things. One, the current yearly <strong>startup</strong> formation<br />

rates per million people within the USA range from an<br />

average of 42 across the USA to between 147 to 387<br />

in technology hubs such as San Francisco and Boulder.<br />

Two: the formation rates for technology companies<br />

will certainly increase over the next ten years - ever<br />

so slightly approaching the average private sector<br />

business formation rate of 1,342 per year per million - as<br />

technology becomes an increasing part of business. 14<br />

Given the network effects of digital technology, the<br />

rapid revenue growth, exponential user acquisition of<br />

successful <strong>startup</strong>s and winner-takes-all structure of these<br />

markets, this <strong>report</strong> estimates that ~20% of these digital<br />

technology companies will create ~80% of the value.<br />

And it is by no means certain that starting a new business<br />

will result in success: the high-risks necessitated by<br />

innovative technology and business models inevitably<br />

leads to a large proportion of <strong>startup</strong>s failing each year<br />

(some estimate the global norm for <strong>startup</strong> failure rates to<br />

be as high as 90%).<br />

Hence this <strong>report</strong> uses a power distribution to estimate<br />

the distribution of digital technology companies (both<br />

mature and <strong>startup</strong>) participating in the sector in 2025<br />

with an increasingly large number of <strong>startup</strong>s being<br />

created each year; of which only a select few will achieve<br />

the high year-on-year growth required to become the new<br />

Australian technology giants by 2025.<br />

a. Startup <strong>ecosystem</strong>s appear to follow this distribution.<br />

b. 4,000 companies employing more than one staff<br />

member. Up to 8,000 including sole-operators.<br />

c. Based on Australian Bureau of Statistics middle<br />

projection for Queensland population numbers in 2025 -<br />

5.9 m.<br />

8

THIS REPORT ESTIMATES THE<br />

POTENTIAL ECONOMIC IMPACT OF<br />

DISRUPTIVE DIGITAL TECHNOLOGIES ON<br />

QUEENSLAND’S ECONOMY IN 2025<br />

IS ~$96 BILLION PER ANNUM,<br />

WITH A DIRECT IMPACT FROM THE<br />

DIGITAL TECHNOLOGY SECTOR OF OVER<br />

$6 BILLION PER YEAR.<br />

TO ENSURE THE MAJORITY OF THIS<br />

VALUE IS CREATED & RETAINED BY<br />

LOCAL COMPANIES, QUEENSLAND WILL<br />

NEED: 3,000+ STARTUPS, HUNDREDS<br />

OF ESTABLISHED TECHNOLOGY<br />

COMPANIES AND A UNICORN OR TWO.<br />

WITHOUT THIS, ECONOMIC GROWTH<br />

WILL BE LOST TO INTERNATIONAL<br />

COMPETITORS.<br />

9

Creating high growth <strong>startup</strong>s.<br />

BREEDING UNICORNS & ECOSYSTEMS<br />

UNICORNS ARE REAL<br />

The term “unicorn” has been adopted worldwide as<br />

a label for high growth technology companies that<br />

achieve significant scale ($US 100m revenue or $US 1b<br />

valuation/market cap). Startups that achieve this scale<br />

are rare but vital to the creation of a vibrant economy.<br />

Unicorns have the ability to spawn hundreds of new<br />

entrepreneurs, many of whom go on to found or invest<br />

in <strong>startup</strong>s. The IPOs of Google, Facebook and Twitter<br />

alone created almost 4,000 new millionaires. Similar<br />

examples can be seen in Sweden (Skype acquired<br />

by Microsoft for $US 8.5b; Spotify has a market cap<br />

of $US 4b), the UK (Betfair IPOd at $US 2.4b and<br />

lastminute.com acquired by Sabre for $US 1.1b), and<br />

Israel (NDS acquired by Cisco for $US 5b). 15<br />

The network effects of the digital economy and ubiquity<br />

of technology mean that they exist in increasingly<br />

winners-take-all markets and grow with astonishing<br />

speed, creating large numbers of jobs both within the<br />

company and as part of the larger <strong>ecosystem</strong>s that<br />

surround them.<br />

According to the UK innovation agency NESTA, the 6<br />

per cent of UK businesses with the highest growth rates<br />

generated half of the new jobs in the UK between 2002<br />

and 2008. 16<br />

“A small number of high-growth businesses are<br />

responsible for the lion’s share of job creation and<br />

prosperity… This has significant implications for the<br />

direction of economic policy. It shows that enabling<br />

innovation is good for growth. Just as importantly, it<br />

shows that focusing attention on growing businesses and<br />

promoting excellence, far from being an elitist policy,<br />

gives rise to widespread job creation and prosperity.”<br />

Jonathan Kestenbaum, CEO NESTA 16<br />

BREEDING UNICORNS<br />

For Queensland to grow a vibrant <strong>startup</strong> <strong>ecosystem</strong> it<br />

is essential to create an environment that is conducive<br />

to creating and retaining unicorns on local soil – and<br />

attracting foreign unicorns.<br />

In a global, highly-connected economy, unicorns can<br />

grow in any geographical region and access global<br />

markets with ease. So far most unicorns have come<br />

from the USA, and it is likely that the upcoming<br />

digital disruption will be created by US firms unless<br />

Queensland and Australia invest in united and focussed<br />

efforts to develop some home-grown unicorns.<br />

Governments are increasingly recognising the<br />

importance of entrepreneurship and high growth<br />

technology <strong>startup</strong>s - implementing programs to create,<br />

attract and retain these unique value creators. Examples<br />

include the UK Government’s Future Fifty 17 program;<br />

Startup America; 18 the Singapore Government’s $14b<br />

commitment to the National Framework for Innovation<br />

and Enterprise; and Sweden’s national network of 43<br />

<strong>startup</strong> incubators, 12 seed investment funds and 33<br />

science parks that have been incubating over 950 highgrowth<br />

technology companies per annum for the last 20<br />

years.<br />

These programs focus on the small number of<br />

companies with the highest growth potential rather than<br />

broad support for traditional new businesses and SMEs.<br />

CREATING CLUSTERS<br />

Vibrant industry clusters and <strong>ecosystem</strong>s are critical<br />

for increasing the productivity of companies, driving<br />

innovation, stimulating new business creation and<br />

breeding scalable high-growth companies. 13<br />

The factors that contribute to a flourishing technology<br />

<strong>ecosystem</strong> have been well defined by researchers, policy<br />

makers and entrepreneurs: An entrepreneurial culture<br />

with a large number of active participants; mentoring<br />

from experienced entrepreneurs; a supportive regulatory<br />

environment; a culture of collaboration and networking;<br />

visible successes and role models; risk tolerance; easy<br />

access to risk capital; government policy with a longterm<br />

focus; and access to good technical skills.<br />

Many of these factors are cultural, rather than structural,<br />

and in many ways a strong culture comes prior to<br />

structural changes (e.g. greater access to capital or<br />

supportive regulation). According to PwC’s The Startup<br />

Economy:<br />

“Culture is the key to accelerating the growth of a tech<br />

community. In the 1970s the tech communities of Silicon<br />

Valley and the area around MIT… were similar in size.<br />

But by the 1990s Silicon Valley was dominant. The<br />

accepted explanation for the difference in growth rates<br />

is the open and collaborative culture of the Valley. This<br />

same culture is what is driving growth in both Boulder<br />

Colorado and Israel.” 13<br />

Richard Florida’s work on the rise of the creative class<br />

also demonstrates how critical the culture and liveability<br />

of a city are for the attraction and creation of innovative<br />

<strong>startup</strong>s:<br />

“Despite all the predictions that technology—from the<br />

telephone and the automobile to the computer and the<br />

Internet—would lead to the death of cities, the creative<br />

economy is taking shape around them. Urban density,<br />

the clustering of people and firms, is a basic engine of<br />

economic life. Place is the factor that organically brings<br />

together the economic opportunity and talent, the jobs<br />

and the people required for creativity, innovation, and<br />

growth.” 19<br />

Richard Florida<br />

FUNDING QUEENSLAND’S STARTUP ECOSYSTEM<br />

So the elements required for a flourishing <strong>ecosystem</strong><br />

are well known, but how much effort is required for<br />

Queensland to realise the next decade’s economic<br />

opportunity?<br />

To answer this, this <strong>report</strong> estimated the growth from<br />

the current state of the <strong>ecosystem</strong> to one that meets<br />

the Queensland Startup Summit’s goal. The diagram<br />

opposite shows the various stages of company size, the<br />

number of each in the <strong>ecosystem</strong> both now and in 2025,<br />

and some current examples.<br />

This model also takes into account <strong>startup</strong> failure rates<br />

and the proportion of technology companies that make<br />

it through each stage of growth - extrapolating from<br />

historic data where available.<br />

The <strong>report</strong>’s assumptions are that <strong>startup</strong>s require:<br />

• $50,000 funding to launch a business,<br />

• $250,000 funding to achieve $1m in revenue,<br />

• $2m to achieve $10m in revenue,<br />

• $20m to achieve $100m, and<br />

• $110m funding to achieve $1b.<br />

Given these assumptions, this <strong>report</strong> estimates that<br />

over $2b to $5b in total funding needs to flow into the<br />

sector over the next ten years to support the <strong>ecosystem</strong>’s<br />

growth.With the rate of investment increasing from their<br />

current average of ~$23m per year to between $500m to<br />

$1b per year by 2025.<br />

Approximately 20-30% of these funds would go to seed<br />

stage <strong>startup</strong> activity (generally pre-revenue), and the<br />

majority of these <strong>startup</strong>s will fail, close, or be acquired.<br />

~30% of funding would go to early stage <strong>startup</strong>s in<br />

the $1m-$10m revenue band, ~20% to expansion/<br />

growth stage technology companies in the $10m-$100m<br />

revenue band, and the remaining ~10% to the handful of<br />

mature later stage companies with revenue at $100m+ -<br />

the unicorns of the pack. 23<br />

TOTAL ECOSYSTEM FUNDING REQUIRED 2014-25<br />

Seed Stage:

1 in 1,000<br />

COMPANY STAGES<br />

This diagram separates the <strong>startup</strong> stages by revenue.<br />

From people ‘interested’ in entrepreneurship, to those<br />

that actually found a New Startup, and through to<br />

growing and mature technology companies.<br />

Yellow information represents the current size and<br />

distribution of <strong>startup</strong>s within the <strong>ecosystem</strong>, and<br />

black represents the size and distribution of the<br />

<strong>ecosystem</strong> in 2025.<br />

Developing high growth technology <strong>startup</strong>s is a high<br />

risk endeavour with a small proportion of companies<br />

achieving the growth required to move to the next stage.<br />

Approximately 90% of bootstrapped or angel-funded<br />

<strong>startup</strong>s fail, and between 30% to 40% of venture<br />

backed <strong>startup</strong>s fail. Even fewer digital technology<br />

companies grow beyond $1b in revenue, or reach a $1b<br />

valuation - less than 0.1% for either. 24,25<br />

300+<br />

20-40<br />

50+<br />

10-20<br />

10+<br />

1<br />

1+<br />

0<br />

3,000+<br />

220+<br />

20,000+<br />

1,000<br />

POTENTIAL<br />

FOUNDERS<br />

SEED STAGE<br />

STARTUP<br />

EARLY STAGE<br />

STARTUP<br />

GROWTH STAGE<br />

TECH CO.<br />

LATER STAGE<br />

TECH CO.<br />

UNICORN<br />

TECH CO.<br />

20%<br />

Portion<br />

of people<br />

interested in<br />

entrepreneurship<br />

who start a<br />

company.<br />

Startup formation rates<br />

FORMATION<br />

YEARLY STARTUP FORMATION RATES PER MILLION OF POPULATION - TOP EIGHT US DIGITAL TECHNOLOGY HUBS VS QUEENSLAND<br />

LOCATION YEAR ESTIMATED<br />

#STARTUPS<br />

FORMED<br />

PER YEAR<br />

POPULATION<br />

RATE PER<br />

MILLION<br />

PEOPLE<br />

USA 2010 415,000 309m 1342<br />

Boulder 2010 25 98,815 256<br />

Queensland 2025 1,000 5.9m 170<br />

San Jose 2010 116 955,225 122<br />

Seattle 2010 69 610,409 113<br />

Fort Collins 2010 16 144,348 109<br />

Washington 2010 66 604,453 109<br />

Denver 2010 63 603,497 105<br />

San Francisco 2010 85 805,607 105<br />

Cambridge 2010 10 104,944 97<br />

USA - the year of<br />

the dot-com boom<br />

1999 21,000 279m 75<br />

USA 2010 13,000 309m 42<br />

Queensland 2013 55 4.7m 12<br />

Startup formation rates are based on the Kauffman Foundation’s 2013<br />

<strong>report</strong> “Tech Starts: High-Technology Business Formation and Job<br />

Creation in the United States.” While the numbers are some of the best<br />

available, it is this <strong>report</strong>s opinion that <strong>startup</strong> formation rates are in<br />

fact higher in US technology hubs than shown above.<br />

50 100 150<br />

200<br />

250 1,300<br />

0<br />

ENTIRE PRIVATE SECTOR COMPANY TYPE3<br />

50 100 150 200 250 300<br />

DIGITAL TECHNOLOGY STARTUPS<br />

12

Startup formation rates<br />

FORMATION<br />

US TECHNOLOGY HUBS SUCH AS<br />

BOULDER AND SAN FRANCISCO<br />

HAVE YEARLY STARTUP FORMATION<br />

RATES PER MILLION PEOPLE RANGING<br />

BETWEEN 97 TO 256. QUEENSLAND’S<br />

CURRENT RATE IS 12.<br />

FOR THE LOCAL STARTUP ECOSYSTEM<br />

TO REACH 4% OF GSP AND 30K JOBS,<br />

PARTICIPATION IN THE SECTOR WOULD<br />

HAVE TO GROW AT APPROXIMATELY 40%<br />

EACH YEAR, WITH YEARLY STARTUP<br />

FORMATION INCREASING FROM ~12 NEW<br />

STARTUPS PER YEAR TO ~1,000 BY 2025.<br />

A STARTUP FORMATION RATE PER<br />

MILLION PEOPLE OF 170.<br />

13

Startup<br />

ORGANISATIONS<br />

COMPANIES<br />

Startup companies founded after 2009,<br />

along with key support organisations<br />

based in Queensland. (UA) indicates that<br />

the product type has not been identified.<br />

STARTUPS<br />

13 Text (mobile app)<br />

2 Dudez Studios (game)<br />

247 Systems (marketplace)<br />

2CRisk (other)<br />

3 Blokes Studios (game)<br />

6YS (other)<br />

7bithero (game)<br />

Aberrant Entertainment (game)<br />

Adepto (other)<br />

Aerapay (other)<br />

AgDNA (mobile app)<br />

Akro (analytics)<br />

Allotz.com (other)<br />

Always Interactive/Schoolzine (comms)<br />

Ample Entertainment (game)<br />

App-O-Matic (mobile app)<br />

Appenate (mobile app)<br />

AppFactory (mobile app)<br />

Appointuit (mobile health)<br />

Aquiba (electronics)<br />

Athletable (other)<br />

Attract Mode Games (game)<br />

Auditflow (desktop app)<br />

Auditor Training Online (education)<br />

Auran (game)<br />

Bane Games (game)<br />

Barefoot Entrepreneurs (financial)<br />

BDS.com.au (e-commerce)<br />

BidHere.com (e-commerce)<br />

Bill Hero (communication)<br />

Binary Mill, The (game)<br />

Birthday Gorilla (advertising)<br />

Bitcoin Brisbane (desktop app)<br />

Biz Forms (desktop app)<br />

BlackBird Solutions (desktop app)<br />

Bliip (communication)<br />

Blue Quoll Publishing (mobile app)<br />

Blue Tropical (mobile app)<br />

BonzaDat (desktop app)<br />

Booty.com.au (marketplace)<br />

Brandscope (customer relationship)<br />

Brisbane Art (Vegas Spray) (advertising)<br />

Brus Media (advertising)<br />

Business Ready Tool (communication)<br />

Cartesian Co (electronics)<br />

CartHopper (marketplace)<br />

CatchLog Trading (analytics)<br />

CB Aerospace (transportation)<br />

CBO Telecommunications (comms)<br />

Cerebro (mobile app)<br />

Churn.tv (media & news)<br />

Clinicea (other)<br />

Cloubum (other)<br />

Cloud DC (storage)<br />

Cloudsafe365 (other)<br />

Cloudswirl (UA)<br />

Code Heroes (game)<br />

Cohortpay (education)<br />

Commission Factory (advertising)<br />

Composeright Software (other)<br />

CoSituate (advertising)<br />

CouponIce (ecommerce)<br />

Court Record Solutions Group (UA)<br />

Creative Hearts Group (transportation)<br />

Credosity (productivity)<br />

Cribhut.com (other)<br />

CrowdSource Hire (marketplace)<br />

CryptoPhoto (security)<br />

Cupid Media (other)<br />

Curvy Market (marketplace)<br />

Dark Ice Interactive (mobile app)<br />

Daycare Decisions (education)<br />

BDS.com.au (daily deals)<br />

Defiant Development (game)<br />

Dev-Audio (hardware + web)<br />

Devnet (hardware + web)<br />

Dextr (mobile app)<br />

Dialogix (other)<br />

Dimsdale & Kreozot United Games<br />

Distractless (safety)<br />

DivingTheGoldCoast.com.au (other)<br />

Documaps.io (other)<br />

DoseMe (other)<br />

dp dialogue (other)<br />

Drone Hire (marketplace)<br />

Dugong Software (game)<br />

Eat More Pixels (game)<br />

Eclat (UA)<br />

eContent Management (UA)<br />

EcoWise LED (<strong>startup</strong>)<br />

Edgevertise (advertising)<br />

EFTlab (analytics)<br />

ekidnaworld (game)<br />

Elastice (ecommerce)<br />

Ellume (mobile health)<br />

EM Solutions (other)<br />

Ennova (other)<br />

Enthuse (sport)<br />

Euclideon (graphics)<br />

Expat Digital Media (media & news)<br />

Eyecon (game)<br />

Factorial Products (mobile app)<br />

Faraday Media (communication)<br />

Fastabook (advertising)<br />

FathomHQ (analytics)<br />

Fitgenes (education)<br />

Five Faces (communication)<br />

Fizzio Fit (mobile health)<br />

Floor Five (ecommerce)<br />

Food Matters (other)<br />

Footballr (game)<br />

Fortune Innovation Brisbane (app)<br />

Freewill (UA)<br />

Frelk Industries (electronics)<br />

FreshTone Games (mobile app)<br />

Fun Mob Games (game)<br />

Fuzzyeyes Studio (game)<br />

Geek Brain Games (game)<br />

Gen3 Media (advertising)<br />

Geoptima (other)<br />

Geospike (other)<br />

Ghostbox (game)<br />

Gideon Shalwick (video)<br />

Glanton (infrastructure)<br />

goACT (other)<br />

goCatch Taxi App (transportation)<br />

Gold Coast IT Forum (communication)<br />

goStandby (marketplace)<br />

Grapple (productivity)<br />

GrassAds (advertising)<br />

Grid Media (other)<br />

Guiix (mobile app)<br />

Guvera (established music tech)<br />

HandleMyComplaint (other)<br />

Health Industy.com.au (other)<br />

Health Risk Management Systems (other)<br />

Hire Hive (other)<br />

Hitbox Team (game)<br />

HollaNote (mobile app)<br />

Hooked Up (education)<br />

Hotel App (UA)<br />

Human Interactive (advertising)<br />

Hydric Media (mobile app)<br />

Hypermancer (media & news)<br />

iEscape (transportation)<br />

ImagePro Studios (advertising)<br />

ImmersaView (hardware + web)<br />

Infinite Wardrobe (marketplace)<br />

inKind (UA)<br />

Inkive (photography)<br />

Intaserve Group (UA)<br />

Integrated Monitoring Systems (analytics)<br />

Intelligent Automation (electronics)<br />

iOnline (mobile app)<br />

iPledg (financial or payment)<br />

JADES Management Solutions (UA)<br />

JobFit Systems Intnl (marketplace)<br />

JoggaDogg (UA)<br />

JW Shannon Engineers (Argus Acoustic)<br />

(infrastructure)<br />

KaWoW! (game)<br />

KindyHub (mobile app)<br />

Kondoot (UA)<br />

Krome Studios (game)<br />

Krunk (UA)<br />

Language and Learning Steps (education)<br />

LEAPIN Digital Keys (mobile app)<br />

Lightmare Studios (game)<br />

Liquid State (mobile app)<br />

Little Dukkies Enterprises (UA)<br />

Live Nourish Play (UA)<br />

Living Room of Satoshi (UA)<br />

Locatrix Communications (location)<br />

Locatrix International (UA)<br />

Lost n Found (UA)<br />

M2Media (hardware + web)<br />

Machinam (education)<br />

Machine IQ (analytics)<br />

Machinery Safety Systems (hardware)<br />

Mammoth Media (hardware + web)<br />

mandraIT (communication)<br />

Mapely (UA)<br />

MassPay (UA)<br />

MechTech Creations (hardware + web)<br />

memeBig.com (communication)<br />

Mesaplexx (communication)<br />

MetaMunch (other)<br />

Metaset (mobile app)<br />

Miiingle Technologies (UA)<br />

Milaana (other)<br />

Mobile Communications (Qld) (other)<br />

Murry Lancashire (game)<br />

My Import Label (other)<br />

My Sunshine Coast (other)<br />

mypresences (other)<br />

Mystrata (other)<br />

N3V Games (game)<br />

Nano Silicon (Australia) (mobile app)<br />

NeCTAR (communication)<br />

New NRG (3D printing)<br />

Nimble (established fin-tech)<br />

NRG (other)<br />

Oar Inspired (sport)<br />

Ollo Mobile (wearable)<br />

Open Gear (infrastructure)<br />

Opmantek (communication)<br />

Optii Solutions (productivity)<br />

OrderXYZ (marketplace)<br />

OtherLevels (UA)<br />

Outfound (to pay) (Software (offline))<br />

Oz Sonotek (financial or payment)<br />

PayRespect (UA)<br />

PeeP Digital (education)<br />

Pelofy (social)<br />

Pineapple Corp (UA)<br />

Pipe Games (game)<br />

PLF Agritech (UA)<br />

Presentation Sells (advertising)<br />

Preveu (mobile app)<br />

Prevue (other)<br />

Qrate.tv (UA)<br />

Quantum Property (UA)<br />

R Fifteen (UA)<br />

Rabotica BVBA (UA)<br />

Red Sprite Studios (game)<br />

RedEye Apps (productivity)<br />

RemarksPDF (mobile app)<br />

Retail Express (ecommerce)<br />

Riff Axelerator (video)<br />

Rinstrum (electronics)<br />

RMSS (electronics)<br />

Rockabilly Kitchen (UA)<br />

RocketBunny Games (game)<br />

RPS/Attract Mode Games (game)<br />

SafetyCulture (mobile app)<br />

Screwtape Studios (game)<br />

Sea Safe (mobile app)<br />

See Out (other)<br />

SellaWhere (UA)<br />

Senath (other)<br />

Sensaware (wearable)<br />

Shovsoft (game)<br />

Siltek (UA)<br />

simPROVAL (infrastructure)<br />

Smooth Operator (financial or payment)<br />

Social Development Company (comms)<br />

Softgineering (other)<br />

SoftPerfect (UA)<br />

Spare Metres (infrastructure)<br />

Splasheo (mobile app)<br />

Splitpack (hardware + web)<br />

Sports Performance Accelerator (game)<br />

Squirrelr (financial or payment)<br />

StartHere (customer relationship)<br />

Startups Australia (infrastructure)<br />

Stats App (UA)<br />

Studio Blimp (game)<br />

Stylegrab (other)<br />

Subarashi (other)<br />

Swipeads (advertising)<br />

T 2 Green (game)<br />

Tagly (communication)<br />

Tappr (financial or payment)<br />

TechHatch (other)<br />

The Allergy Menu (other)<br />

The Core (social)<br />

The Creative Assembly (UA)<br />

The Travel App (UA)<br />

TheyerGFX (3D printing)<br />

Tiger Temple (UA)<br />

Total Range Design (communication)<br />

Tracknology (analytics)<br />

14

TrekTraka (advertising)<br />

Trinity Software Australia (sport)<br />

Tripcover (financial or payment)<br />

Txt4Coffee (financial or payment)<br />

Typefi (other)<br />

Ubegin (other)<br />

UniMap (UA)<br />

V2i (health)<br />

Veilability (marketplace)<br />

Vendle (mobile app)<br />

Victus Health (other)<br />

Volt4 (UA)<br />

Walk Thru Walls Studios (game)<br />

Well Placed Cactus (game)<br />

We Are Hunted (music)<br />

Where2Tonight (UA)<br />

WiFi Ads (UA)<br />

Wikifashion (media & news)<br />

Wildfire Studios (game)<br />

Wishing Well Web Hosting (UA)<br />

Witch Beam (game)<br />

WunderWalk (UA)<br />

XY Gaming (game)<br />

Y2 Investments (UA)<br />

Yackstar (UA)<br />

ZipID (other)<br />

Zippy.com.au (marketplace/deals)<br />

ZOVA (other)<br />

INCUBATION<br />

QUT Creative Enterprise Australia<br />

(seed accelerator / incubator)<br />

iLab (seed accelerator)<br />

Innovation Centre Sunshine Coast (Inc)<br />

Right Pedal Studios (seed accelerator)<br />

Silicon Lakes (incubator)<br />

FUNDING<br />

Accelerate Ideas (Gov grant)<br />

AMMA Private Equity (private equity)<br />

Artesian Capital (vc)<br />

Australian Association of Angel Investors<br />

Australian Small Scale Offerings Board<br />

Blue Sky Alternative Investments (vc)<br />

Brisbane Angels (angel group)<br />

Budding Entrpnrs Grant (Gov grant)<br />

Commercialisation Australia (Gov grant)<br />

Founders Forum (angel group)<br />

Gold Coast Angels (angel group)<br />

One Ventures (venture capital)<br />

Screen Australia (Gov grant)<br />

teQstart (Gov grant)<br />

Transition Level Investments (angel group)<br />

Uniseed (university fund)<br />

CO-WORKING & HACKER SPACES<br />

Co-Spaces (coworking - Gold Coast)<br />

Cojimbo Coworking (coworking - SC)<br />

Gold Coast Tech Space (coworking)<br />

Hackerspace Brisbane (hackerspace)<br />

Mowbraytown Co-Working Space (SC)<br />

Noosa Boardroom (coworking - SC)<br />

River City Labs (coworking - Brisbane)<br />

Thoughtfort (coworking - Brisbane)<br />

Salt House (coworking - Brisbane)<br />

Light Space (coworking - Brisbane)<br />

Rabbit Hole Ideation Cafe (coworking)<br />

Work Club (coworking - Gold Coast)<br />

MEET GROUPS BY NO. MEMBERS*<br />

The Bris. Web Design Group (1661)<br />

Silicon Beach Bris. (1069)<br />

Agile Bris. (858)<br />

Bris. Web Tech (823)<br />

Bris. Internet Business Meetup (705)<br />

BrisJS - Bris. JavaScript (613)<br />

Bris. .Net User Group (587)<br />

Bris. Functional Programming (560)<br />

Barcamp Queensland (541)<br />

The Bris. Ruby and Rails (500)<br />

AWS - Bris. User Group (500)<br />

WordPress Bris. (496)<br />

Silicon Beach Gold Coast (467)<br />

Queensland JVM Group (446)<br />

Bris. SEO (425)<br />

UX Bris. (402)<br />

Gold Coast Techspace (349)<br />

Bris. Joomla Users Group (329)<br />

Bris. Content Strategy Group (298)<br />

Hackerspace Bris. (257)<br />

Bris. Unity Developers (251)<br />

CocoaHeads (244)<br />

Game Technology Bris. (243)<br />

Bris. Python User Group (241)<br />

Bris. Azure User Group (239)<br />

Devops Bris. (233)<br />

The Bris. NoSQL Group (198)<br />

Queensland Bloggers (197)<br />

IT Forum Gold Coast (171)<br />

Bitcoin Bris. (157)<br />

Bris. iOS and Android Group (133)<br />

Project & Program Managers (127)<br />

Gold Coast WordPress Network (126)<br />

Lean Business Strategies (126)<br />

Coding from Beach (125)<br />

Bris. Hacks for Humanity (123)<br />

Drupal Bris. (120)<br />

Young Bris. IT Social (119)<br />

Hack the Evening (116)<br />

Byron Web (53)<br />

Docker Bris., Australia (108)<br />

Queensland C# Mobile Developers (103)<br />

QLD ALM Users Group (95)<br />

Bris. Dynamics CRM User Group (94)<br />

StartUp Mastermind Groups (85)<br />

Bris. Software Testers Meetup (84)<br />

WordPress Gold Coast (82)<br />

Open Knowledge Bris. Group (81)<br />

SAGE Queensland (80)<br />

Bris. Inbound Marketing (78)<br />

Hacks/Hackers Bris. (72)<br />

Rhok Bris. (71)<br />

Web Accessblty & Inclusv Design (69)<br />

GDG - Bris. (69)<br />

Startup Grind Bris. (67)<br />

Cloud Solutions for Modrn Business (65)<br />

Humbug (64)<br />

Data Vault & DWH modeling Group (64)<br />

Bris. Online Marketing Workshops (62)<br />

Big Data Analytics Group Bris. (61)<br />

Queensland Legion of Tech (59)<br />

Bris. OpenShift Group (58)<br />

Bluemix-Developers-in-Bris. (58)<br />

DevExpress User Group Bris. (57)<br />

Sunshine Coast Digital Association (55)<br />

HackerNest Bris. Tech Socials (53)<br />

Bris. Data Scientists Group (51)<br />

Bris. Big Data Analytics (47)<br />

clj-bne (46)<br />

Bris. 3D Printing Meetup (46)<br />

Gold Coast JavaScript Developers (41)<br />

Bris. Coder Club (39)<br />

Queensland SilverStripe Meetup (37)<br />

Drupal Gold Coast (37)<br />

The Data Warehousing Community (36)<br />

Software Architctr & Project Design (36)<br />

Sunshine Coast WordPress Meetup (35)<br />

Northern Rivers Bitcoin enthusiasts (5)<br />

Bris. Tableau User Group (33)<br />

Bitcoin and Beyond (Gold Coast) (33)<br />

Ruxmon Bris. (33)<br />

Bris. R User Group (BrisRUG) (32)<br />

Bris. Game Design & CG Artists (30)<br />

Bris. Adobe User Group (29)<br />

ShopTalk eCommerce Meetup - Bris. (29)<br />

Bris. Evernote Users Group (28)<br />

Sitecore Bris. User Group (28)<br />

dotMaleny (26)<br />

Bris. Spark Group (26)<br />

Queensland Puppet Meetup (26)<br />

Ruby on Rails Gold Coast (22)<br />

Dream. Design. Develop. Deliver. (21)<br />

Bris. ColdFusion (20)<br />

Digital Dialog (17)<br />

Gold Coast WordPress Designers &<br />

Developers (16)<br />

Work@Jelly Noosa (16)<br />

gsummitx - Gamification in Bris. (15)<br />

3D Printing Bris. (15)<br />

THATCamp Bris. (13)<br />

Bris. Business Catalyst User (Partners)<br />

Group Meetup (12)<br />

Bris. Salesforce Dev. Group (12)<br />

Creating an online presence for over 50s (10)<br />

Bris. Salesforce Group (9)<br />

Bris. AppDynamics with RP Data (9)<br />

Startup Mastermind - Gold Coast (8)<br />

Information Server User Group Bris. (3)<br />

Godl Coast Salesforce User Group (3)<br />

Search Factory Content Writers (1)<br />

Ubuntu Bris. Information Group (0)<br />

EDUCATION, SUPPPORT & EVENTS*<br />

Aust Centr for Entrprnrshp Resrch (edu)<br />

Binary Options (education and training)<br />

BizSpark Expressway (event)<br />

Boardroom Briefings - IC (event)<br />

Bond University (education)<br />

Brisbane Intnl Game Developers Assoc.<br />

Brisbane Startup Pitch Group (event)<br />

Brisbane Writers Festival (event)<br />

Build my Robot (event)<br />

Business Expo (event)<br />

Cleantech Expo (event)<br />

Coder Dojo (education program)<br />

Creative Conference (event)<br />

Culture Hack Gold Coast (hackathon)<br />

Enterprise Connect (events)<br />

Game On Program (event)<br />

Gemini Program (event)<br />

GO423 Symposium (event)<br />

Gov Hack (hackathon)<br />

Gov Open Data (hackathon)<br />

Griffith University (education)<br />

Griffith Enterprise (commercialisation arm)<br />

Insights (education and training)<br />

Institute for Future of the Book (edu)<br />

Investment Incentives (event)<br />

Kids Biz Conference (event)<br />

Lean Launchpad (education)<br />

Lean Startup Machine (education)<br />

Literacy Planet (education program)<br />

Maroochydore Chamber of Commerce<br />

(education and training)<br />

Mentor Blaze (event)<br />

Mentoring 4 Growth (event)<br />

Mobile Mondays (event)<br />

MoboDev (advisor)<br />

NASA Space Apps Challenging (event)<br />

National Angels Conference (event)<br />

Qld Intractv Design Delegation (event)<br />

Queensland University of Technology (edu)<br />

Questions on Capital (event)<br />

QUT Bluebox (commercialisation arm)<br />

RiverPitch (event)<br />

South by Southwest Delegation (event)<br />

Startup Club Meeting (event)<br />

Startup QLD (community enablement)<br />

Startup Weekend - Brisbane (education)<br />

Startup Weekend - Gold Coast (edu)<br />

Startup Weekend - SC (edu)<br />

State Library QLD (community)<br />

Sunday Coder Club (event)<br />

Sunshine Coast Entrepreneurs (commu)<br />

Sunshine Coast TAFE (education)<br />

Sunshine Coast Technorati (community)<br />

Ted x Noosa (event)<br />

The Startup Club (community)<br />

Uniquest (commercialisation arm)<br />

University of Southern Queensland (edu)<br />

University of Sunshine Coast (edu)<br />

UQ - Ideas Network (community)<br />

Wavebreak (advisor)<br />

*Note many of these groups and events<br />

are not directly focused on <strong>startup</strong>s,<br />

but rather support activities around<br />

digital technology. They are included as<br />

an indication of the level of interest in<br />

digital technology, and are often feeders<br />

to people taking the leap into joining or<br />

launching their own <strong>startup</strong>.<br />

15

Investors and Investments<br />

FUNDING RAISED<br />

TOP 35 RAISES AMOUNT YEAR #RNDS REGION EST FUNDING SOURCE<br />

Guvera $45,000,000 09, 10, 12 4 Gold Coast 2008 AMMA Private Equity<br />

Nimble $18,300,000 12,13,14 ~3 Gold Coast 2005 Acorn, Monash Inv, Angels<br />

Euclideon $3,969,304 2010 1 Brisbane 2010 CA, Unknown<br />

SafetyCulture $3,600,000 2013 1 Regional 2004 CA, Blackbird, Angels<br />

Halfbrick Studios $3,000,000 2011 1 Brisbane 2001 NSW Interactive Media Fund<br />

Other Levels $2,528,853 2012 2 Brisbane 2012 Confidential<br />

ImmersaView $2,449,805 2013 2 Brisbane 2006 DIISRTE, CA, Unknown<br />

Tappr $2,420,000 2013 2 Brisbane 2012 Unknown<br />

EM Solutions $2,397,984 1 Brisbane 1997 CA<br />

Mesaplexx $1,849,804 2012 1 Brisbane 2007 CA, Unknown<br />

Rinstrum $1,824,370 1 Brisbane 2005 CA, Unknown<br />

V2i $1,716,126 2011 1 Gold Coast 2000 CA, Unknown<br />

Cloud DC $1,600,000 13 & 14 2 Sunshine 2012 Angels, CA, Unknown<br />

Out of Credit Solutions $1,500,000 2012 1 Brisbane 2012 AMMA<br />

Opmantek $1,500,000 2013 1 Gold Coast 2010 ASSOB, Confidential<br />

From Concept To Completion $1,004,800 1 Brisbane 2010 CA, Unknown<br />

Right Pedal Studios (accelratr) $1,000,000 2012 1 Brisbane 2012 Steven Baxter<br />

Fitgenes $934,888 2012 1 Brisbane 2007 CA, Unknown<br />

Qs Semiconductor Australia $924,000 2009 1 Brisbane 2009 CA, Unknown<br />

JobFit Systems Intnl $900,000 2012 1 Brisbane 2013 CA, Unknown<br />

Court Record Solutions $839,280 2011 1 Brisbane 2010 CA, Unknown<br />

5 Lives Studios $830,400 2013 1 Brisbane 2013 Kickstarter<br />

mandraIT $830,080 2013 1 Sunshine 2012 CA, Unknown<br />

Liquid State $805,000 2013 2 Brisbane 2011 Confidential, CA<br />

Kondoot $800,000 2012 1 Brisbane 2010 ASSOB<br />

Health Risk Management Sys. $767,402 1 Brisbane 2009 CA, Unknown<br />

CatchLog Trading $745,198 2011 1 Regional 2005 CA, Unknown<br />

Art $71,791<br />

Event<br />

$44,184<br />

Photography<br />

$40,532<br />

Social Enterprise<br />

$37,160<br />

Comics<br />

$30,360<br />

Video<br />

$30,046<br />

Fashion<br />

$24,849<br />

Food & Drink<br />

$24,045<br />

Other<br />

$12,226<br />

Journalism<br />

$11,640<br />

TOTAL Technology FUNDING RAISED - ALL TECH $5,737<br />

Research<br />

$<br />

126M<br />

$3,480<br />

Craft<br />

$160<br />

Total venture capital, private equity, government grants,<br />

crowdfunding and angel funding raised by <strong>startup</strong>s<br />

and established digital technology companies located<br />

in Queensland, from 2009 to July 2014. Based on data<br />

from COMPUTER Crunchbase, GAME Angel SALES List, research and interviews.<br />

$3B<br />

TOTAL FUNDING RAISED - STARTUPS<br />

$2B<br />

$<br />

$1.5B<br />

37M<br />

$1.61B<br />

2011 2012 2013 2017<br />

Total funding raised in Queensland from 2009 to July<br />

2014 by Startups established after 2009.<br />

No. STARTUPS THAT RAISED FUNDING<br />

99/136<br />

TOP COMMUNITY ISSUES: RANKED BY WEIGHTED VOTES<br />

Raise Awareness<br />

1<br />

Number Education of Queensland <strong>startup</strong>s (99) out of all digital 2<br />

technology Culture companies (136) that raised funding. 3<br />

Funding<br />

4<br />

No. Government ROUNDSPolicy<br />

5<br />

116/165<br />

Collaboration & Networking<br />

6<br />

Procurement<br />

7<br />

Infrastructure<br />

8<br />

Number Talent & of Skills funding rounds for <strong>startup</strong>s (116) out of the 9<br />

total Leadership number for all digital technology companies (165). 10<br />

MEDIAN FUNDING - STARTUPS<br />

$<br />

100,000<br />

TOP COMMUNITY ACTIONS: RANKED BY WEIGHTED VOTES<br />

Education Program<br />

1<br />

Form Leadership Group<br />

2<br />

Median amount of total funding raised in Queensland<br />

for<br />

Startup<br />

<strong>startup</strong>s.<br />

Apprentice<br />

Median for all digital technology<br />

3<br />

companies Highlight Success was $200,000. Stories<br />

4<br />

Collaboration & Networking<br />

5<br />

Attract Talent<br />

6<br />

AVERAGE FUNDING - STARTUPS<br />

Communication Hub<br />

7<br />

$<br />

371,000<br />

Govt Incentive - Investment<br />

8<br />

Hub<br />

9<br />

NBN Advocacy Group<br />

10<br />

Average amount of total funding raised in Queensland<br />

for <strong>startup</strong>s. Average raised for all digital technology<br />

companies was $928,000.<br />

Sea Safe $742,400 2013 2 Gold Coast 2004 CA, Unknown<br />

TOTAL RAISED BY YEAR - ALL DIGITAL CO. ($)<br />

Defiant Development $704,095 2013 x2 2 Brisbane 2010 Screen Australia, Kickstarter<br />

35000000<br />

34M<br />

Yackstar $667,836 1 Brisbane 2009 CA, Unknown 30000000<br />

27M<br />

27M<br />

TrekTraka $650,000 12 & 13 2 Brisbane 2011 Confidential<br />

Trinity Software Australia $601,600 1 Regional 2010 CA, Unknown<br />

Txt4Coffee $600,000 11 & 12 2 Brisbane 2010 Confidential<br />

13M<br />

10M<br />

15M<br />

goACT $600,000 1 Gold Coast 2010 CA, Unknown<br />

Appointuit $503,911 12 & 13 2 Brisbane 2010 Brisbane Angels<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

16

1500000<br />

35000000<br />

30000000<br />

Investors and Investments<br />

TOP COMMUNITY ISSUES: RANKED BY WEIGHTED VOTES<br />

FUNDING<br />

Raise Awareness<br />

1<br />

Education<br />

2<br />

Culture<br />

3<br />

Funding CURRENT FUNDING LEVELS<br />