Save PDF - Manutencoop

Save PDF - Manutencoop

Save PDF - Manutencoop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

146 Accounting policies and explanatory notes<br />

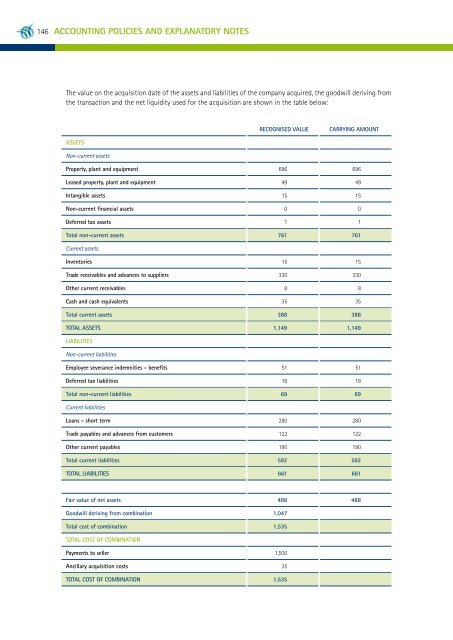

The value on the acquisition date of the assets and liabilities of the company acquired, the goodwill deriving from<br />

the transaction and the net liquidity used for the acquisition are shown in the table below:<br />

Recognised value<br />

Carrying amount<br />

Assets<br />

Non-current assets<br />

Property, plant and equipment 696 696<br />

Leased property, plant and equipment 49 49<br />

Intangible assets 15 15<br />

Non-current financial assets 0 0<br />

Deferred tax assets 1 1<br />

Total non-current assets 761 761<br />

Current assets<br />

Inventories 15 15<br />

Trade receivables and advances to suppliers 330 330<br />

Other current receivables 8 8<br />

Cash and cash equivalents 35 35<br />

Total current assets 388 388<br />

Total assets 1,149 1,149<br />

Liabilities<br />

Non-current liabilities<br />

Employee severance indemnities - benefits 51 51<br />

Deferred tax liabilities 18 18<br />

Total non-current liabilities 69 69<br />

Current liabilities<br />

Loans - short term 280 280<br />

Trade payables and advances from customers 122 122<br />

Other current payables 190 190<br />

Total current liabilities 592 592<br />

Total liabilities 661 661<br />

Fair value of net assets 488 488<br />

Goodwill deriving from combination 1,047<br />

Total cost of combination 1,535<br />

Total cost of combination<br />

Payments to seller 1,500<br />

Ancillary acquisition costs 35<br />

Total cost of combination 1,535