Save PDF - Manutencoop

Save PDF - Manutencoop

Save PDF - Manutencoop

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

202 Accounting policies and explanatory notes<br />

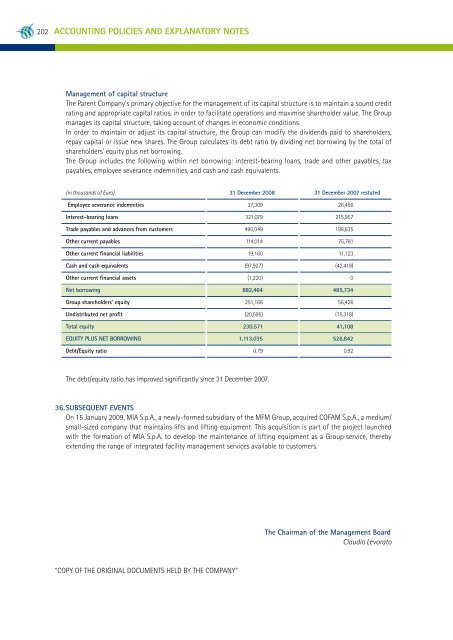

Management of capital structure<br />

The Parent Company's primary objective for the management of its capital structure is to maintain a sound credit<br />

rating and appropriate capital ratios, in order to facilitate operations and maximise shareholder value. The Group<br />

manages its capital structure, taking account of changes in economic conditions.<br />

In order to maintain or adjust its capital structure, the Group can modify the dividends paid to shareholders,<br />

repay capital or issue new shares. The Group calculates its debt ratio by dividing net borrowing by the total of<br />

shareholders' equity plus net borrowing.<br />

The Group includes the following within net borrowing: interest-bearing loans, trade and other payables, tax<br />

payables, employee severance indemnities, and cash and cash equivalents.<br />

(in thousands of Euro) 31 December 2008 31 December 2007 restated<br />

Employee severance indemnities 37,309 26,456<br />

Interest-bearing loans 321,079 215,957<br />

Trade payables and advances from customers 490,049 198,835<br />

Other current payables 114,014 75,781<br />

Other current financial liabilities 19,160 11,123<br />

Cash and cash equivalents (97,927) (42,418)<br />

Other current financial assets (1,220) 0<br />

Net borrowing 882,464 485,734<br />

Group shareholders' equity 251,166 56,426<br />

Undistributed net profit (20,595) (15,318)<br />

Total equity 230,571 41,108<br />

Equity plus net borrowing 1,113,035 526,842<br />

Debt/Equity ratio 0.79 0.92<br />

The debt/equity ratio has improved significantly since 31 December 2007.<br />

36. Subsequent events<br />

On 15 January 2009, MIA S.p.A., a newly-formed subsidiary of the MFM Group, acquired COFAM S.p.A., a medium/<br />

small-sized company that maintains lifts and lifting equipment. This acquisition is part of the project launched<br />

with the formation of MIA S.p.A. to develop the maintenance of lifting equipment as a Group service, thereby<br />

extending the range of integrated facility management services available to customers.<br />

The Chairman of the Management Board<br />

Claudio Levorato<br />

"COPY OF THE ORIGINAL DOCUMENTS HELD BY THE COMPANY"