Save PDF - Manutencoop

Save PDF - Manutencoop

Save PDF - Manutencoop

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

175<br />

17. Provisions for risks and charges<br />

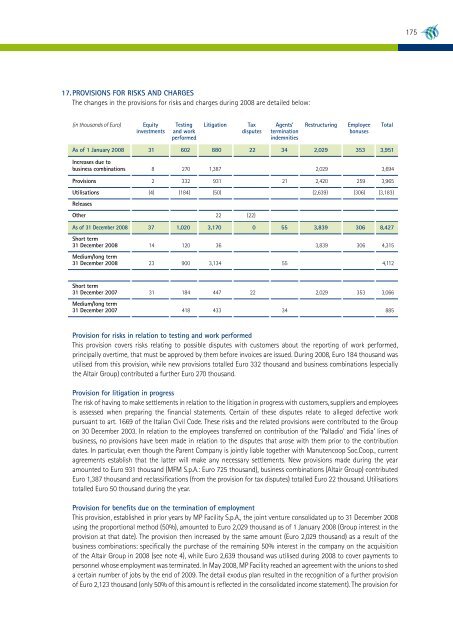

The changes in the provisions for risks and charges during 2008 are detailed below:<br />

(in thousands of Euro) Equity Testing Litigation Tax Agents’ Restructuring Employee Total<br />

investments and work disputes termination bonuses<br />

performed<br />

indemnities<br />

As of 1 January 2008 31 602 880 22 34 2,029 353 3,951<br />

Increases due to<br />

business combinations 8 270 1,387 2,029 3,694<br />

Provisions 2 332 931 21 2,420 259 3,965<br />

Utilisations (4) (184) (50) (2,639) (306) (3,183)<br />

Releases<br />

Other 22 (22)<br />

As of 31 December 2008 37 1,020 3,170 0 55 3,839 306 8,427<br />

Short term<br />

31 December 2008 14 120 36 3,839 306 4,315<br />

Medium/long term<br />

31 December 2008 23 900 3,134 55 4,112<br />

Short term<br />

31 December 2007 31 184 447 22 2,029 353 3,066<br />

Medium/long term<br />

31 December 2007 418 433 34 885<br />

Provision for risks in relation to testing and work performed<br />

This provision covers risks relating to possible disputes with customers about the reporting of work performed,<br />

principally overtime, that must be approved by them before invoices are issued. During 2008, Euro 184 thousand was<br />

utilised from this provision, while new provisions totalled Euro 332 thousand and business combinations (especially<br />

the Altair Group) contributed a further Euro 270 thousand.<br />

Provision for litigation in progress<br />

The risk of having to make settlements in relation to the litigation in progress with customers, suppliers and employees<br />

is assessed when preparing the financial statements. Certain of these disputes relate to alleged defective work<br />

pursuant to art. 1669 of the Italian Civil Code. These risks and the related provisions were contributed to the Group<br />

on 30 December 2003. In relation to the employees transferred on contribution of the ‘Palladio’ and ‘Fidia’ lines of<br />

business, no provisions have been made in relation to the disputes that arose with them prior to the contribution<br />

dates. In particular, even though the Parent Company is jointly liable together with <strong>Manutencoop</strong> Soc.Coop., current<br />

agreements establish that the latter will make any necessary settlements. New provisions made during the year<br />

amounted to Euro 931 thousand (MFM S.p.A.: Euro 725 thousand), business combinations (Altair Group) contributed<br />

Euro 1,387 thousand and reclassifications (from the provision for tax disputes) totalled Euro 22 thousand. Utilisations<br />

totalled Euro 50 thousand during the year.<br />

Provision for benefits due on the termination of employment<br />

This provision, established in prior years by MP Facility S.p.A., the joint venture consolidated up to 31 December 2008<br />

using the proportional method (50%), amounted to Euro 2,029 thousand as of 1 January 2008 (Group interest in the<br />

provision at that date). The provision then increased by the same amount (Euro 2,029 thousand) as a result of the<br />

business combinations: specifically the purchase of the remaining 50% interest in the company on the acquisition<br />

of the Altair Group in 2008 (see note 4), while Euro 2,639 thousand was utilised during 2008 to cover payments to<br />

personnel whose employment was terminated. In May 2008, MP Facility reached an agreement with the unions to shed<br />

a certain number of jobs by the end of 2009. The detail exodus plan resulted in the recognition of a further provision<br />

of Euro 2,123 thousand (only 50% of this amount is reflected in the consolidated income statement). The provision for