Save PDF - Manutencoop

Save PDF - Manutencoop

Save PDF - Manutencoop

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

176 Accounting policies and explanatory notes<br />

the restructuring of MP Facility S.p.A. therefore amounts to Euro 3,542 thousand as of 31 December 2008. MCB and<br />

Servizi Ospedalieri also implemented redundancy plans during 2008, albeit on a smaller scale. These plans resulted in<br />

the recognition of additional provisions totalling Euro 297 thousand. As a consequence, the provision for restructuring<br />

recorded in the consolidated financial statements of the MFM Group as of 31 December 2008 amounts to Euro 3,839<br />

thousand.<br />

Employee bonuses<br />

Following utilisations of Euro 306 thousand, the provision for employee bonuses was increased by Euro 259 thousand<br />

euro during the year. This reflects an estimate of the management performance bonuses to be paid, although the exact<br />

amounts have not yet been determined.<br />

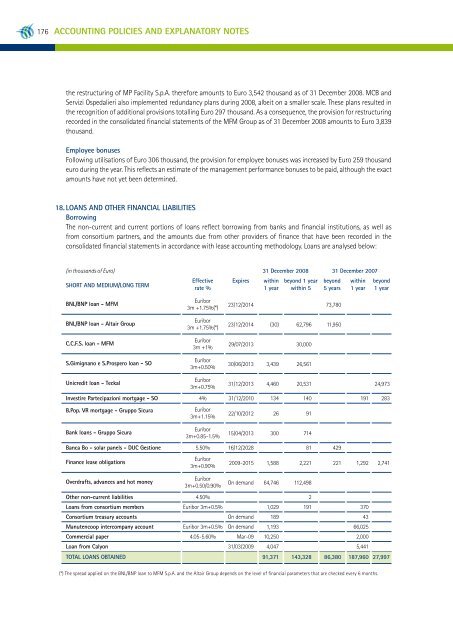

18. Loans and other financial liabilities<br />

Borrowing<br />

The non-current and current portions of loans reflect borrowing from banks and financial institutions, as well as<br />

from consortium partners, and the amounts due from other providers of finance that have been recorded in the<br />

consolidated financial statements in accordance with lease accounting methodology. Loans are analysed below:<br />

(in thousands of Euro) 31 December 2008 31 December 2007<br />

Effective Expires within beyond 1 year beyond within beyond<br />

SHORT AND MEDIUM/LONG TERM<br />

rate % 1 year within 5 5 years 1 year 1 year<br />

BNL/BNP loan - MFM<br />

BNL/BNP loan - Altair Group<br />

C.C.F.S. loan - MFM<br />

S.Gimignano e S.Prospero loan - SO<br />

Euribor<br />

3m +1.75%(*)<br />

Euribor<br />

3m +1.75%(*)<br />

Euribor<br />

3m +1%<br />

Euribor<br />

3m+0.50%<br />

23/12/2014 73,780<br />

23/12/2014 (30) 62,796 11,950<br />

29/07/2013 30,000<br />

30/06/2013 3,439 26,561<br />

Unicredit loan - Teckal<br />

Euribor<br />

3m+0.75%<br />

31/12/2013 4,460 20,531 24,973<br />

Investire Partecipazioni mortgage - SO 4% 31/12/2010 134 140 191 283<br />

B.Pop. VR mortgage - Gruppo Sicura<br />

Bank loans - Gruppo Sicura<br />

Euribor<br />

3m+1.15%<br />

Euribor<br />

3m+0.85-1.5%<br />

22/10/2012 26 91<br />

15/04/2013 300 714<br />

Banca Bo - solar panels - DUC Gestione 5.50% 16/12/2028 81 429<br />

Finance lease obligations<br />

Overdrafts, advances and hot money<br />

Euribor<br />

3m+0.90%<br />

Euribor<br />

3m+0.50/0.90%<br />

2009-2015 1,588 2,221 221 1,292 2,741<br />

On demand 64,746 112,498<br />

Other non-current liabilities 4.50% 2<br />

Loans from consortium members Euribor 3m+0.5% 1,029 191 370<br />

Consortium treasury accounts On demand 189 43<br />

<strong>Manutencoop</strong> intercompany account Euribor 3m+0.5% On demand 1,193 66,025<br />

Commercial paper 4.05-5.60% Mar-09 10,250 2,000<br />

Loan from Calyon 31/03/2009 4,047 5,441<br />

Total loans obtained 91,371 143,328 86,380 187,960 27,997<br />

(*) The spread applied on the BNL/BNP loan to MFM S.p.A. and the Altair Group depends on the level of financial parameters that are checked every 6 months.