68. RETAILTexasmarketingpresentationFINAL.pdf - Enerplus

68. RETAILTexasmarketingpresentationFINAL.pdf - Enerplus

68. RETAILTexasmarketingpresentationFINAL.pdf - Enerplus

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

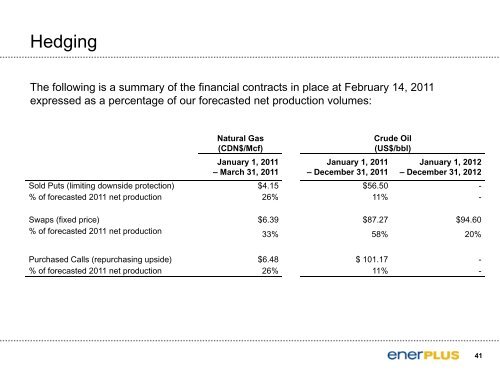

Hedging<br />

The following is a summary of the financial contracts in place at February 14, 2011<br />

expressed as a percentage of our forecasted net production volumes:<br />

Natural Gas<br />

(CDN$/Mcf)<br />

January 1, 2011<br />

– March 31, 2011<br />

January 1, 2011<br />

– December 31, 2011<br />

Crude Oil<br />

(US$/bbl)<br />

January 1, 2012<br />

– December 31, 2012<br />

Sold Puts (limiting downside protection) $4.15 $56.50 -<br />

% of forecasted 2011 net production 26% 11% -<br />

Swaps (fixed price) $6.39 $87.27 $94.60<br />

% of forecasted 2011 net production 33% 58% 20%<br />

Purchased Calls (repurchasing upside) $6.48 $ 101.17 -<br />

% of forecasted 2011 net production 26% 11% -<br />

41