TOP AUDITING ISSUES FOR 2013 - CCH

TOP AUDITING ISSUES FOR 2013 - CCH

TOP AUDITING ISSUES FOR 2013 - CCH

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

36<br />

<strong>TOP</strong> <strong>AUDITING</strong> <strong>ISSUES</strong> <strong>FOR</strong> <strong>2013</strong> CPE COURSE<br />

Auditors should report their findings using these elements. They should<br />

place their findings in perspective by describing the nature and extent of the<br />

issues reported, and the extent of audit work performed. When appropriate,<br />

auditors should relate the instances identified to the population or number<br />

of cases examined, and quantify the results in monetary or other form.<br />

OBSERVATION<br />

In 2007 the President’s Council on Integrity and Efficiency released its Report on National<br />

Single Audit Sampling Project. This report noted that missing audit finding information<br />

was a common deficiency among the audits that it selected for sampling. It stated that<br />

one or more of the required elements were not included in many of the findings. Although<br />

this report applies specifically to audits conducted under the Single Audit Act, it signals to<br />

the profession that federal regulators expect to see each of the above elements written<br />

explicitly into each audit finding.<br />

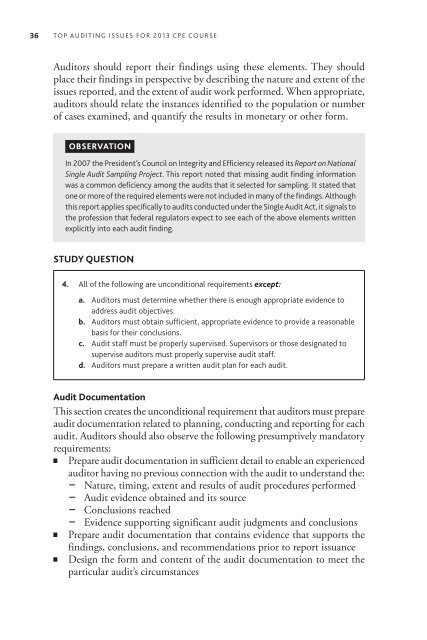

STUDY QUESTION<br />

4. All of the following are unconditional requirements except:<br />

a. Auditors must determine whether there is enough appropriate evidence to<br />

address audit objectives.<br />

b. Auditors must obtain sufficient, appropriate evidence to provide a reasonable<br />

basis for their conclusions.<br />

c. Audit staff must be properly supervised. Supervisors or those designated to<br />

supervise auditors must properly supervise audit staff.<br />

d. Auditors must prepare a written audit plan for each audit.<br />

Audit Documentation<br />

This section creates the unconditional requirement that auditors must prepare<br />

audit documentation related to planning, conducting and reporting for each<br />

audit. Auditors should also observe the following presumptively mandatory<br />

requirements:<br />

Prepare audit documentation in sufficient detail to enable an experienced<br />

auditor having no previous connection with the audit to understand the:<br />

Nature, timing, extent and results of audit procedures performed<br />

Audit evidence obtained and its source<br />

Conclusions reached<br />

Evidence supporting significant audit judgments and conclusions<br />

Prepare audit documentation that contains evidence that supports the<br />

findings, conclusions, and recommendations prior to report issuance<br />

Design the form and content of the audit documentation to meet the<br />

particular audit’s circumstances