annual report 2010 - 2011 - Intsika Yethu Municipality

annual report 2010 - 2011 - Intsika Yethu Municipality

annual report 2010 - 2011 - Intsika Yethu Municipality

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

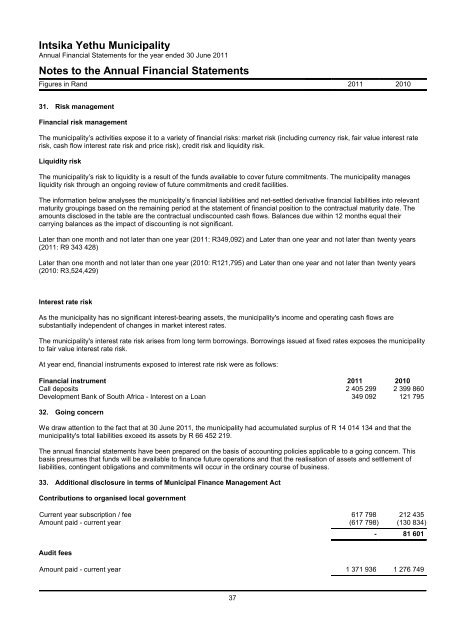

<strong>Intsika</strong> <strong>Yethu</strong> <strong>Municipality</strong><br />

Annual Financial Statements for the year ended 30 June <strong>2011</strong><br />

Notes to the Annual Financial Statements<br />

Figures in Rand <strong>2011</strong> <strong>2010</strong><br />

31. Risk management<br />

Financial risk management<br />

The municipality’s activities expose it to a variety of financial risks: market risk (including currency risk, fair value interest rate<br />

risk, cash flow interest rate risk and price risk), credit risk and liquidity risk.<br />

Liquidity risk<br />

The municipality’s risk to liquidity is a result of the funds available to cover future commitments. The municipality manages<br />

liquidity risk through an ongoing review of future commitments and credit facilities.<br />

The information below analyses the municipality’s financial liabilities and net-settled derivative financial liabilities into relevant<br />

maturity groupings based on the remaining period at the statement of financial position to the contractual maturity date. The<br />

amounts disclosed in the table are the contractual undiscounted cash flows. Balances due within 12 months equal their<br />

carrying balances as the impact of discounting is not significant.<br />

Later than one month and not later than one year (<strong>2011</strong>: R349,092) and Later than one year and not later than twenty years<br />

(<strong>2011</strong>: R9 343 428)<br />

Later than one month and not later than one year (<strong>2010</strong>: R121,795) and Later than one year and not later than twenty years<br />

(<strong>2010</strong>: R3,524,429)<br />

Interest rate risk<br />

As the municipality has no significant interest-bearing assets, the municipality's income and operating cash flows are<br />

substantially independent of changes in market interest rates.<br />

The municipality's interest rate risk arises from long term borrowings. Borrowings issued at fixed rates exposes the municipality<br />

to fair value interest rate risk.<br />

At year end, financial instruments exposed to interest rate risk were as follows:<br />

`<br />

Financial instrument <strong>2011</strong> <strong>2010</strong><br />

Call deposits 2 405 299 2 399 860<br />

Development Bank of South Africa - Interest on a Loan 349 092 121 795<br />

32. Going concern<br />

We draw attention to the fact that at 30 June <strong>2011</strong>, the municipality had accumulated surplus of R 14 014 134 and that the<br />

municipality's total liabilities exceed its assets by R 66 452 219.<br />

The <strong>annual</strong> financial statements have been prepared on the basis of accounting policies applicable to a going concern. This<br />

basis presumes that funds will be available to finance future operations and that the realisation of assets and settlement of<br />

liabilities, contingent obligations and commitments will occur in the ordinary course of business.<br />

33. Additional disclosure in terms of Municipal Finance Management Act<br />

Contributions to organised local government<br />

Current year subscription / fee 617 798 212 435<br />

Amount paid - current year (617 798) (130 834)<br />

Audit fees<br />

- 81 601<br />

Amount paid - current year 1 371 936 1 276 749<br />

37