annual report 2010 - 2011 - Intsika Yethu Municipality

annual report 2010 - 2011 - Intsika Yethu Municipality

annual report 2010 - 2011 - Intsika Yethu Municipality

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

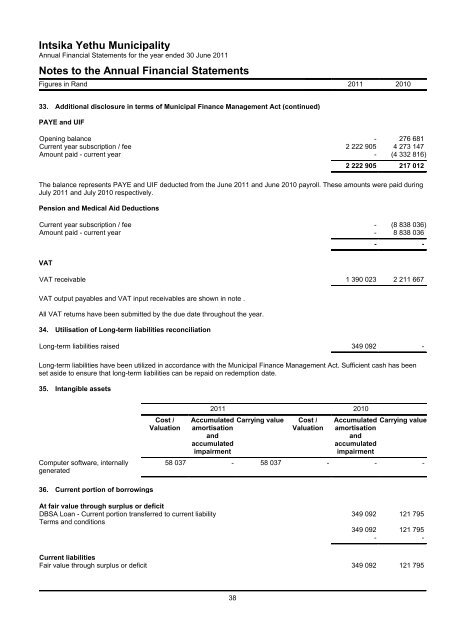

<strong>Intsika</strong> <strong>Yethu</strong> <strong>Municipality</strong><br />

Annual Financial Statements for the year ended 30 June <strong>2011</strong><br />

Notes to the Annual Financial Statements<br />

Figures in Rand <strong>2011</strong> <strong>2010</strong><br />

33. Additional disclosure in terms of Municipal Finance Management Act (continued)<br />

PAYE and UIF<br />

Opening balance - 276 681<br />

Current year subscription / fee 2 222 905 4 273 147<br />

Amount paid - current year - (4 332 816)<br />

2 222 905 217 012<br />

The balance represents PAYE and UIF deducted from the June <strong>2011</strong> and June <strong>2010</strong> payroll. These amounts were paid during<br />

July <strong>2011</strong> and July <strong>2010</strong> respectively.<br />

Pension and Medical Aid Deductions<br />

Current year subscription / fee - (8 838 036)<br />

Amount paid - current year - 8 838 036<br />

VAT<br />

- -<br />

VAT receivable 1 390 023 2 211 667<br />

VAT output payables and VAT input receivables are shown in note .<br />

All VAT returns have been submitted by the due date throughout the year.<br />

34. Utilisation of Long-term liabilities reconciliation<br />

Long-term liabilities raised 349 092 -<br />

Long-term liabilities have been utilized in accordance with the Municipal Finance Management Act. Sufficient cash has been<br />

set aside to ensure that long-term liabilities can be repaid on redemption date.<br />

35. Intangible assets<br />

Computer software, internally<br />

generated<br />

Cost /<br />

Valuation<br />

<strong>2011</strong> <strong>2010</strong><br />

Accumulated Carrying value Cost /<br />

amortisation<br />

Valuation<br />

and<br />

accumulated<br />

impairment<br />

Accumulated Carrying value<br />

amortisation<br />

and<br />

accumulated<br />

impairment<br />

58 037 - 58 037 - - -<br />

36. Current portion of borrowings<br />

At fair value through surplus or deficit<br />

DBSA Loan - Current portion transferred to current liability<br />

Terms and conditions<br />

349 092 121 795<br />

349 092 121 795<br />

- -<br />

Current liabilities<br />

Fair value through surplus or deficit 349 092 121 795<br />

38