annual report 2010 - 2011 - Intsika Yethu Municipality

annual report 2010 - 2011 - Intsika Yethu Municipality

annual report 2010 - 2011 - Intsika Yethu Municipality

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

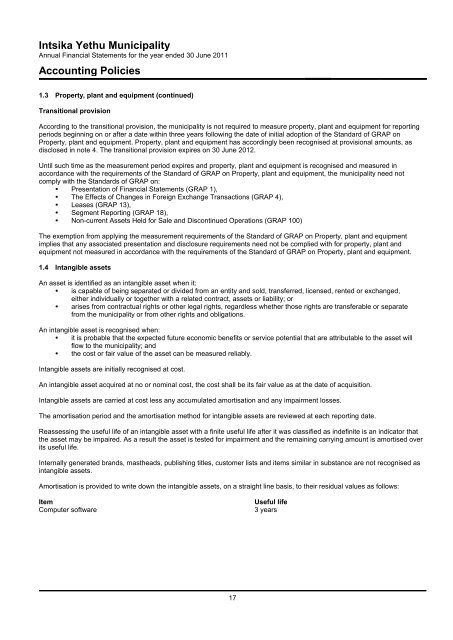

<strong>Intsika</strong> <strong>Yethu</strong> <strong>Municipality</strong><br />

Annual Financial Statements for the year ended 30 June <strong>2011</strong><br />

Accounting Policies<br />

1.3 Property, plant and equipment (continued)<br />

Transitional provision<br />

According to the transitional provision, the municipality is not required to measure property, plant and equipment for <strong>report</strong>ing<br />

periods beginning on or after a date within three years following the date of initial adoption of the Standard of GRAP on<br />

Property, plant and equipment. Property, plant and equipment has accordingly been recognised at provisional amounts, as<br />

disclosed in note 4. The transitional provision expires on 30 June 2012.<br />

Until such time as the measurement period expires and property, plant and equipment is recognised and measured in<br />

accordance with the requirements of the Standard of GRAP on Property, plant and equipment, the municipality need not<br />

comply with the Standards of GRAP on:<br />

Presentation of Financial Statements (GRAP 1),<br />

The Effects of Changes in Foreign Exchange Transactions (GRAP 4),<br />

Leases (GRAP 13),<br />

Segment Reporting (GRAP 18),<br />

Non-current Assets Held for Sale and Discontinued Operations (GRAP 100)<br />

The exemption from applying the measurement requirements of the Standard of GRAP on Property, plant and equipment<br />

implies that any associated presentation and disclosure requirements need not be complied with for property, plant and<br />

equipment not measured in accordance with the requirements of the Standard of GRAP on Property, plant and equipment.<br />

1.4 Intangible assets<br />

An asset is identified as an intangible asset when it:<br />

is capable of being separated or divided from an entity and sold, transferred, licensed, rented or exchanged,<br />

either individually or together with a related contract, assets or liability; or<br />

arises from contractual rights or other legal rights, regardless whether those rights are transferable or separate<br />

from the municipality or from other rights and obligations.<br />

An intangible asset is recognised when:<br />

it is probable that the expected future economic benefits or service potential that are attributable to the asset will<br />

flow to the municipality; and<br />

the cost or fair value of the asset can be measured reliably.<br />

Intangible assets are initially recognised at cost.<br />

An intangible asset acquired at no or nominal cost, the cost shall be its fair value as at the date of acquisition.<br />

Intangible assets are carried at cost less any accumulated amortisation and any impairment losses.<br />

The amortisation period and the amortisation method for intangible assets are reviewed at each <strong>report</strong>ing date.<br />

Reassessing the useful life of an intangible asset with a finite useful life after it was classified as indefinite is an indicator that<br />

the asset may be impaired. As a result the asset is tested for impairment and the remaining carrying amount is amortised over<br />

its useful life.<br />

Internally generated brands, mastheads, publishing titles, customer lists and items similar in substance are not recognised as<br />

intangible assets.<br />

Amortisation is provided to write down the intangible assets, on a straight line basis, to their residual values as follows:<br />

Item<br />

Computer software<br />

Useful life<br />

3 years<br />

17