Monthly M&A Insider - Mergermarket

Monthly M&A Insider - Mergermarket

Monthly M&A Insider - Mergermarket

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

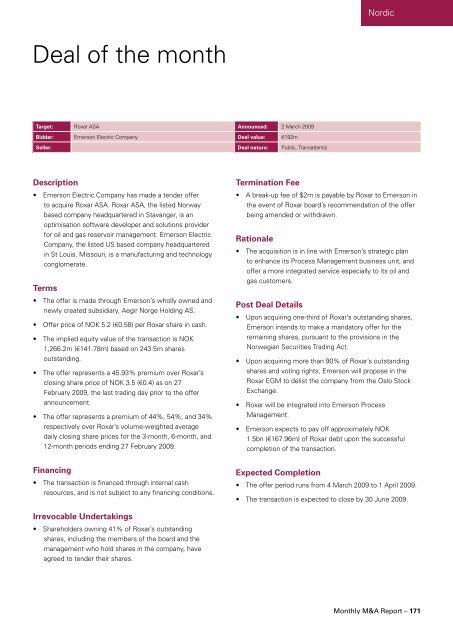

Deal of the month<br />

Target: Roxar ASA Announced: 2 March 2009<br />

Bidder: Emerson Electric Company Deal value: €192m<br />

Seller: Deal nature: Public, Transatlantic<br />

Description<br />

• Emerson Electric Company has made a tender offer<br />

to acquire Roxar ASA. Roxar ASA, the listed Norway<br />

based company headquartered in Stavanger, is an<br />

optimisation software developer and solutions provider<br />

for oil and gas reservoir management. Emerson Electric<br />

Company, the listed US based company headquartered<br />

in St Louis, Missouri, is a manufacturing and technology<br />

conglomerate.<br />

Terms<br />

• The offer is made through Emerson’s wholly owned and<br />

newly created subsidiary, Aegir Norge Holding AS.<br />

• Offer price of NOK 5.2 (€0.58) per Roxar share in cash.<br />

• The implied equity value of the transaction is NOK<br />

1,266.2m (€141.78m) based on 243.5m shares<br />

outstanding.<br />

• The offer represents a 45.93% premium over Roxar’s<br />

closing share price of NOK 3.5 (€0.4) as on 27<br />

February 2009, the last trading day prior to the offer<br />

announcement.<br />

• The offer represents a premium of 44%, 54%, and 34%<br />

respectively over Roxar’s volume-weighted average<br />

daily closing share prices for the 3-month, 6-month, and<br />

12-month periods ending 27 February 2009.<br />

Financing<br />

• The transaction is financed through internal cash<br />

resources, and is not subject to any financing conditions.<br />

Irrevocable Undertakings<br />

• Shareholders owning 41% of Roxar’s outstanding<br />

shares, including the members of the board and the<br />

management who hold shares in the company, have<br />

agreed to tender their shares.<br />

Termination Fee<br />

• A break-up fee of $2m is payable by Roxar to Emerson in<br />

the event of Roxar board’s recommendation of the offer<br />

being amended or withdrawn.<br />

Rationale<br />

• The acquisition is in line with Emerson’s strategic plan<br />

to enhance its Process Management business unit, and<br />

offer a more integrated service especially to its oil and<br />

gas customers.<br />

Post Deal Details<br />

• Upon acquiring one-third of Roxar’s outstanding shares,<br />

Emerson intends to make a mandatory offer for the<br />

remaining shares, pursuant to the provisions in the<br />

Norwegian Securities Trading Act.<br />

• Upon acquiring more than 90% of Roxar’s outstanding<br />

shares and voting rights, Emerson will propose in the<br />

Roxar EGM to delist the company from the Oslo Stock<br />

Exchange.<br />

• Roxar will be integrated into Emerson Process<br />

Management.<br />

• Emerson expects to pay off approximately NOK<br />

1.5bn (€167.96m) of Roxar debt upon the successful<br />

completion of the transaction.<br />

Expected Completion<br />

Nordic<br />

• The offer period runs from 4 March 2009 to 1 April 2009.<br />

• The transaction is expected to close by 30 June 2009.<br />

<strong>Monthly</strong> M&A Report – 171

![mergermarket [TITLE OF RELEASE TO GO HERE] 3 January 2013 ...](https://img.yumpu.com/11701841/1/190x135/mergermarket-title-of-release-to-go-here-3-january-2013-.jpg?quality=85)