Monthly M&A Insider - Mergermarket

Monthly M&A Insider - Mergermarket

Monthly M&A Insider - Mergermarket

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

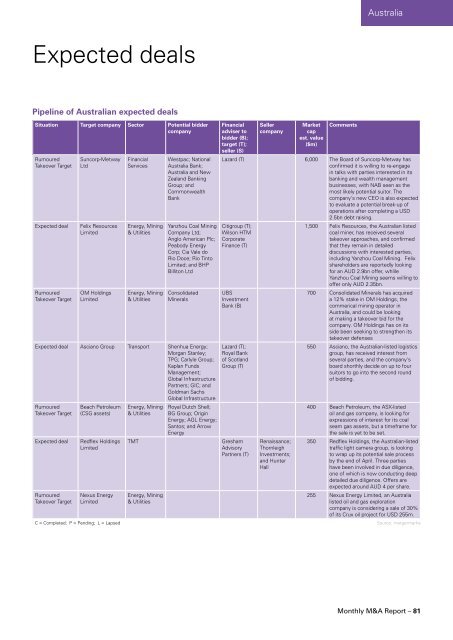

Expected deals<br />

Pipeline of Australian expected deals<br />

Situation Target company Sector Potential bidder<br />

company<br />

Rumoured<br />

Takeover Target<br />

Suncorp-Metway<br />

Ltd<br />

Expected deal Felix Resources<br />

Limited<br />

Rumoured<br />

Takeover Target<br />

OM Holdings<br />

Limited<br />

Financial<br />

Services<br />

Energy, Mining<br />

& Utilities<br />

Energy, Mining<br />

& Utilities<br />

Westpac; National<br />

Australia Bank;<br />

Australia and New<br />

Zealand Banking<br />

Group; and<br />

Commonwealth<br />

Bank<br />

Yanzhou Coal Mining<br />

Company Ltd;<br />

Anglo American Plc;<br />

Peabody Energy<br />

Corp; Cia Vale do<br />

Rio Doce; Rio Tinto<br />

Limited; and BHP<br />

Billiton Ltd<br />

Consolidated<br />

Minerals<br />

Expected deal Asciano Group Transport Shenhua Energy;<br />

Morgan Stanley;<br />

TPG; Carlyle Group;<br />

Kaplan Funds<br />

Management;<br />

Global Infrastructure<br />

Partners; GIC; and<br />

Goldman Sachs<br />

Global Infrastructure<br />

Rumoured<br />

Takeover Target<br />

Beach Petroleum<br />

(CSG assets)<br />

Expected deal Redflex Holdings<br />

Limited<br />

Rumoured<br />

Takeover Target<br />

Nexus Energy<br />

Limited<br />

C = Completed; P = Pending; L = Lapsed<br />

Energy, Mining<br />

& Utilities<br />

Royal Dutch Shell;<br />

BG Group; Origin<br />

Energy; AGL Energy;<br />

Santos; and Arrow<br />

Energy<br />

Financial<br />

adviser to<br />

bidder (B);<br />

target (T);<br />

seller (S)<br />

Seller<br />

company<br />

Market<br />

cap<br />

est. value<br />

($m)<br />

Comments<br />

Australia<br />

Lazard (T) 6,000 The Board of Suncorp-Metway has<br />

confirmed it is willing to re-engage<br />

in talks with parties interested in its<br />

banking and wealth management<br />

businesses, with NAB seen as the<br />

most likely potential suitor. The<br />

company's new CEO is also expected<br />

to evaluate a potential break-up of<br />

operations after completing a USD<br />

2.5bn debt raising.<br />

Citigroup (T);<br />

Wilson HTM<br />

Corporate<br />

Finance (T)<br />

UBS<br />

Investment<br />

Bank (B)<br />

Lazard (T);<br />

Royal Bank<br />

of Scotland<br />

Group (T)<br />

TMT Gresham<br />

Advisory<br />

Partners (T)<br />

Energy, Mining<br />

& Utilities<br />

Renaissance;<br />

Thornleigh<br />

Investments;<br />

and Hunter<br />

Hall<br />

1,500 Felix Resources, the Australian listed<br />

coal miner, has received several<br />

takeover approaches, and confirmed<br />

that they remain in detailed<br />

discussions with interested parties,<br />

including Yanzhou Coal Mining. Felix<br />

shareholders are reportedly looking<br />

for an AUD 2.9bn offer, whlile<br />

Yanzhou Coal Mining seems willing to<br />

offer only AUD 2.35bn.<br />

700 Consolidated Minerals has acquired<br />

a 12% stake in OM Holdings, the<br />

commerical mining operator in<br />

Australia, and could be looking<br />

at making a takeover bid for the<br />

company. OM Holdings has on its<br />

side been seeking to strengthen its<br />

takeover defenses<br />

550 Asciano, the Australian-listed logistics<br />

group, has received interest from<br />

several parties, and the company's<br />

board shorthly decide on up to four<br />

suitors to go into the second round<br />

of bidding.<br />

400 Beach Petroleum, the ASX-listed<br />

oil and gas company, is looking for<br />

expressions of interest for its coal<br />

seam gas assets, but a timeframe for<br />

the sale is yet to be set.<br />

350 Redflex Holdings, the Australian-listed<br />

traffic light camera group, is looking<br />

to wrap up its potential sale process<br />

by the end of April. Three parties<br />

have been involved in due diligence,<br />

one of which is now conducting deep<br />

detailed due diligence. Offers are<br />

expected around AUD 4 per share.<br />

255 Nexus Energy Limited, an Australia<br />

listed oil and gas exploration<br />

company is considering a sale of 30%<br />

of its Crux oil project for USD 255m.<br />

Source: mergermarke<br />

<strong>Monthly</strong> M&A Report – 81

![mergermarket [TITLE OF RELEASE TO GO HERE] 3 January 2013 ...](https://img.yumpu.com/11701841/1/190x135/mergermarket-title-of-release-to-go-here-3-january-2013-.jpg?quality=85)