Monthly M&A Insider - Mergermarket

Monthly M&A Insider - Mergermarket

Monthly M&A Insider - Mergermarket

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

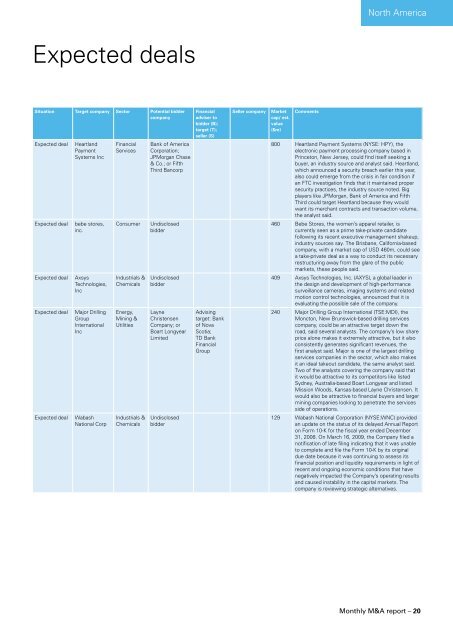

Expected deals<br />

Situation Target company Sector Potential bidder<br />

company<br />

Expected deal Heartland<br />

Payment<br />

Systems Inc<br />

Expected deal bebe stores,<br />

inc.<br />

Expected deal Axsys<br />

Technologies,<br />

Inc<br />

Expected deal Major Drilling<br />

Group<br />

International<br />

Inc<br />

Expected deal Wabash<br />

National Corp<br />

Financial<br />

Services<br />

Bank of America<br />

Corporation;<br />

JPMorgan Chase<br />

& Co.; or Fifth<br />

Third Bancorp<br />

Consumer Undisclosed<br />

bidder<br />

Industrials &<br />

Chemicals<br />

Energy,<br />

Mining &<br />

Utilities<br />

Industrials &<br />

Chemicals<br />

Undisclosed<br />

bidder<br />

Layne<br />

Christensen<br />

Company; or<br />

Boart Longyear<br />

Limited<br />

Undisclosed<br />

bidder<br />

Financial<br />

adviser to<br />

bidder (B);<br />

target (T);<br />

seller (S)<br />

Advising<br />

target: Bank<br />

of Nova<br />

Scotia;<br />

TD Bank<br />

Financial<br />

Group<br />

Seller company Market<br />

cap/ est.<br />

value<br />

($m)<br />

Comments<br />

North America<br />

800 Heartland Payment Systems (NYSE: HPY), the<br />

electronic payment processing company based in<br />

Princeton, New Jersey, could find itself seeking a<br />

buyer, an industry source and analyst said. Heartland,<br />

which announced a security breach earlier this year,<br />

also could emerge from the crisis in fair condition if<br />

an FTC investigation finds that it maintained proper<br />

security practices, the industry source noted. Big<br />

players like JPMorgan, Bank of America and Fifth<br />

Third could target Heartland because they would<br />

want its merchant contracts and transaction volume,<br />

the analyst said.<br />

460 Bebe Stores, the women’s apparel retailer, is<br />

currently seen as a prime take-private candidate<br />

following its recent executive management shakeup,<br />

industry sources say. The Brisbane, California-based<br />

company, with a market cap of USD 460m, could see<br />

a take-private deal as a way to conduct its necessary<br />

restructuring away from the glare of the public<br />

markets, these people said.<br />

409 Axsys Technologies, Inc. (AXYS), a global leader in<br />

the design and development of high-performance<br />

surveillance cameras, imaging systems and related<br />

motion control technologies, announced that it is<br />

evaluating the possible sale of the company.<br />

240 Major Drilling Group International (TSE:MDI), the<br />

Moncton, New Brunswick-based drilling services<br />

company, could be an attractive target down the<br />

road, said several analysts. The company’s low share<br />

price alone makes it extremely attractive, but it also<br />

consistently generates significant revenues, the<br />

first analyst said. Major is one of the largest drilling<br />

services companies in the sector, which also makes<br />

it an ideal takeout candidate, the same analyst said.<br />

Two of the analysts covering the company said that<br />

it would be attractive to its competitors like listed<br />

Sydney, Australia-based Boart Longyear and listed<br />

Mission Woods, Kansas-based Layne Christensen. It<br />

would also be attractive to financial buyers and larger<br />

mining companies looking to penetrate the services<br />

side of operations.<br />

129 Wabash National Corporation (NYSE:WNC) provided<br />

an update on the status of its delayed Annual Report<br />

on Form 10-K for the fiscal year ended December<br />

31, 2008. On March 16, 2009, the Company filed a<br />

notification of late filing indicating that it was unable<br />

to complete and file the Form 10-K by its original<br />

due date because it was continuing to assess its<br />

financial position and liquidity requirements in light of<br />

recent and ongoing economic conditions that have<br />

negatively impacted the Company’s operating results<br />

and caused instability in the capital markets. The<br />

company is reviewing strategic alternatives.<br />

<strong>Monthly</strong> M&A report – 20

![mergermarket [TITLE OF RELEASE TO GO HERE] 3 January 2013 ...](https://img.yumpu.com/11701841/1/190x135/mergermarket-title-of-release-to-go-here-3-january-2013-.jpg?quality=85)