Privileged Investors - BNP Paribas Investment Partners

Privileged Investors - BNP Paribas Investment Partners

Privileged Investors - BNP Paribas Investment Partners

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

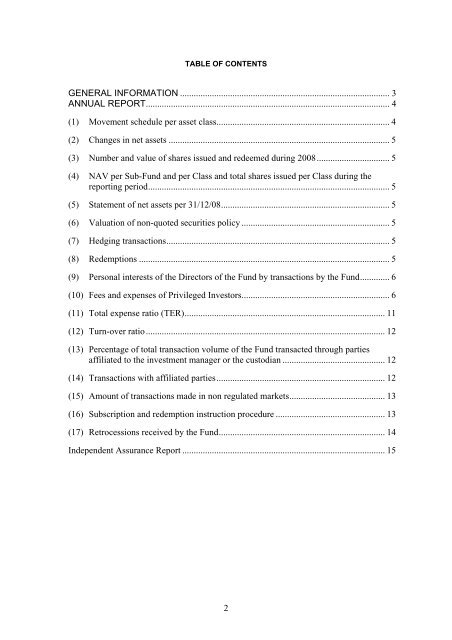

TABLE OF CONTENTS<br />

GENERAL INFORMATION ............................................................................................ 3<br />

ANNUAL REPORT........................................................................................................... 4<br />

(1) Movement schedule per asset class............................................................................ 4<br />

(2) Changes in net assets ................................................................................................. 5<br />

(3) Number and value of shares issued and redeemed during 2008................................ 5<br />

(4)<br />

NAV per Sub-Fund and per Class and total shares issued per Class during the<br />

reporting period.......................................................................................................... 5<br />

(5) Statement of net assets per 31/12/08.......................................................................... 5<br />

(6) Valuation of non-quoted securities policy ................................................................. 5<br />

(7) Hedging transactions.................................................................................................. 5<br />

(8) Redemptions .............................................................................................................. 5<br />

(9) Personal interests of the Directors of the Fund by transactions by the Fund............. 6<br />

(10) Fees and expenses of <strong>Privileged</strong> <strong>Investors</strong>................................................................. 6<br />

(11) Total expense ratio (TER)........................................................................................ 11<br />

(12) Turn-over ratio......................................................................................................... 12<br />

(13)<br />

Percentage of total transaction volume of the Fund transacted through parties<br />

affiliated to the investment manager or the custodian ............................................. 12<br />

(14) Transactions with affiliated parties.......................................................................... 12<br />

(15) Amount of transactions made in non regulated markets.......................................... 13<br />

(16) Subscription and redemption instruction procedure ................................................ 13<br />

(17) Retrocessions received by the Fund......................................................................... 14<br />

Independent Assurance Report ......................................................................................... 15<br />

2