Privileged Investors - BNP Paribas Investment Partners

Privileged Investors - BNP Paribas Investment Partners

Privileged Investors - BNP Paribas Investment Partners

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

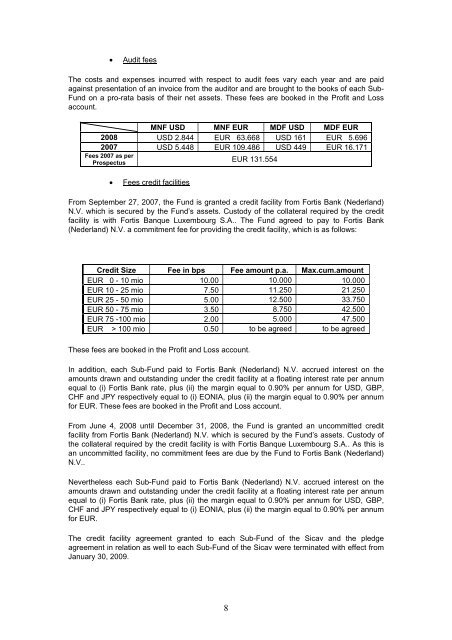

Audit fees<br />

The costs and expenses incurred with respect to audit fees vary each year and are paid<br />

against presentation of an invoice from the auditor and are brought to the books of each Sub-<br />

Fund on a pro-rata basis of their net assets. These fees are booked in the Profit and Loss<br />

account.<br />

MNF USD MNF EUR MDF USD MDF EUR<br />

2008 USD 2.844 EUR 63.668 USD 161 EUR 5.696<br />

2007 USD 5.448 EUR 109.486 USD 449 EUR 16.171<br />

Fees 2007 as per<br />

Prospectus<br />

EUR 131.554<br />

<br />

Fees credit facilities<br />

From September 27, 2007, the Fund is granted a credit facility from Fortis Bank (Nederland)<br />

N.V. which is secured by the Fund’s assets. Custody of the collateral required by the credit<br />

facility is with Fortis Banque Luxembourg S.A.. The Fund agreed to pay to Fortis Bank<br />

(Nederland) N.V. a commitment fee for providing the credit facility, which is as follows:<br />

Credit Size Fee in bps Fee amount p.a. Max.cum.amount<br />

EUR 0 - 10 mio 10.00 10.000 10.000<br />

EUR 10 - 25 mio 7.50 11.250 21.250<br />

EUR 25 - 50 mio 5.00 12.500 33.750<br />

EUR 50 - 75 mio 3.50 8.750 42.500<br />

EUR 75 -100 mio 2.00 5.000 47.500<br />

EUR > 100 mio 0.50 to be agreed to be agreed<br />

These fees are booked in the Profit and Loss account.<br />

In addition, each Sub-Fund paid to Fortis Bank (Nederland) N.V. accrued interest on the<br />

amounts drawn and outstanding under the credit facility at a floating interest rate per annum<br />

equal to (i) Fortis Bank rate, plus (ii) the margin equal to 0.90% per annum for USD, GBP,<br />

CHF and JPY respectively equal to (i) EONIA, plus (ii) the margin equal to 0.90% per annum<br />

for EUR. These fees are booked in the Profit and Loss account.<br />

From June 4, 2008 until December 31, 2008, the Fund is granted an uncommitted credit<br />

facility from Fortis Bank (Nederland) N.V. which is secured by the Fund’s assets. Custody of<br />

the collateral required by the credit facility is with Fortis Banque Luxembourg S.A.. As this is<br />

an uncommitted facility, no commitment fees are due by the Fund to Fortis Bank (Nederland)<br />

N.V..<br />

Nevertheless each Sub-Fund paid to Fortis Bank (Nederland) N.V. accrued interest on the<br />

amounts drawn and outstanding under the credit facility at a floating interest rate per annum<br />

equal to (i) Fortis Bank rate, plus (ii) the margin equal to 0.90% per annum for USD, GBP,<br />

CHF and JPY respectively equal to (i) EONIA, plus (ii) the margin equal to 0.90% per annum<br />

for EUR.<br />

The credit facility agreement granted to each Sub-Fund of the Sicav and the pledge<br />

agreement in relation as well to each Sub-Fund of the Sicav were terminated with effect from<br />

January 30, 2009.<br />

8