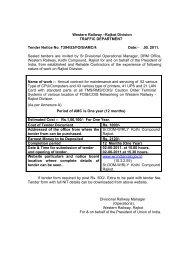

Western Railway - Indian Railway

Western Railway - Indian Railway

Western Railway - Indian Railway

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

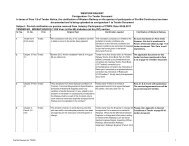

GENERAL CONDITIONS<br />

1. The tender will be governed by <strong>Indian</strong> <strong>Railway</strong> Revised Standard conditions of contract<br />

1986 and amendments issued up to date and instructions to tenderer and special<br />

conditions and special instructions to tenderer contained and by form S137 F giving<br />

special conditions and instructions for the guidance of tenderer.<br />

2 Inspection: Inspection Authority will be nominated by <strong>Railway</strong> administration, Final<br />

inspection after receipt of material by consignee at SSE/ZMC/BL.<br />

3 Despatches: Tenderer should clearly specify F.O.R. terms at destination while<br />

quoting the rate. Tenderer while quoting their rates should take freight element into<br />

account and no extra freight charges will be allowed.<br />

4 Payment terms: Payment will be made as per IRS conditions of contract. The bills are<br />

to be furnished on <strong>Railway</strong>’s standard computerized bill Performa No.858F/R1m<br />

SB2/ICRGS 2817<br />

obtainable from office of Controller of Stores, W. Rly, Churchgate Mumbai- 400 020.<br />

Failure to furnish the bill in the above Performa would result in the payment not being<br />

made.<br />

All payments shall be subject to deduction of any amount for which the contractor is<br />

liable under this contract or any other contract.<br />

5. Taxes and Duties:<br />

5.1 Sales Tax:- CST @ applicable will be admissible on basic manufacturing cost<br />

excluding of freight. In case of offers stipulating CST as extra, State Sales Tax/VAT<br />

will also be admissible. Any variation or any statutory taxes being imposed during the<br />

currency of the contract is admissible against the documentary proof. Variation or new<br />

statutory taxes imposed during the extended contract shall not be admissible on<br />

supplies made during the extended contract.<br />

5.2 Any decrease in CST-VAT during entire currency of the contract shall be passed on to<br />

the purchaser. Any increase during the original Delivery Period will be reimbursed by<br />

the purchaser subject to production of documentary evidence.<br />

5.3 VAT & VAT credits:<br />

5.3.1 In state where VAT has been implemented instead of local sales TAX / CST, VAT<br />

being a statutory levy will be paid as per VAT rules for the states.<br />

5.3.2 The tenderer should quote the exact percentage of VAT that they will be charging<br />

extra.<br />

5.3.3 While quoting the rates, tenderer should pass on(by way of reduction in prices) the set<br />

off/input tax credit that would become available to them by switching over to the<br />

system of vat from existing system of sales tax, duly stating the quantum of such credit<br />

per unit of the item quoted for.<br />

5.3.4 The tenderer while quoting for tenders should give the following declaration:<br />

“ We agree to pass on such additional set off/input tax credit as may become available<br />

in future in respect of all the inputs used in the manufacture of the final product on the<br />

date of supply under the VAT scheme by way of reduction in price and advise the<br />

purchaser accordingly.”.<br />

TENDERER’S SIGNATURE for CE/TMC/CCG 4<br />

WITH RUBBER STAMP<br />

WESTERN RAILWAY<br />

for and on behalf of President of India