general and statistical information - City of Inglewood

general and statistical information - City of Inglewood

general and statistical information - City of Inglewood

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

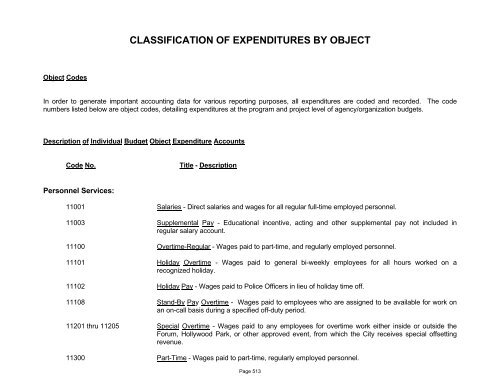

CLASSIFICATION OF EXPENDITURES BY OBJECT<br />

Object Codes<br />

In order to generate important accounting data for various reporting purposes, all expenditures are coded <strong>and</strong> recorded. The code<br />

numbers listed below are object codes, detailing expenditures at the program <strong>and</strong> project level <strong>of</strong> agency/organization budgets.<br />

Description <strong>of</strong> Individual Budget Object Expenditure Accounts<br />

Code No. Title - Description<br />

Personnel Services:<br />

11001 Salaries - Direct salaries <strong>and</strong> wages for all regular full-time employed personnel.<br />

11003 Supplemental Pay - Educational incentive, acting <strong>and</strong> other supplemental pay not included in<br />

regular salary account.<br />

11100 Overtime-Regular - Wages paid to part-time, <strong>and</strong> regularly employed personnel.<br />

11101 Holiday Overtime - Wages paid to <strong>general</strong> bi-weekly employees for all hours worked on a<br />

recognized holiday.<br />

11102 Holiday Pay - Wages paid to Police Officers in lieu <strong>of</strong> holiday time <strong>of</strong>f.<br />

11108 St<strong>and</strong>-By Pay Overtime - Wages paid to employees who are assigned to be available for work on<br />

an on-call basis during a specified <strong>of</strong>f-duty period.<br />

11201 thru 11205 Special Overtime - Wages paid to any employees for overtime work either inside or outside the<br />

Forum, Hollywood Park, or other approved event, from which the <strong>City</strong> receives special <strong>of</strong>fsetting<br />

revenue.<br />

11300 Part-Time - Wages paid to part-time, regularly employed personnel.<br />

Page 513