Annual Report and Accounts 2011 - Bermuda Stock Exchange

Annual Report and Accounts 2011 - Bermuda Stock Exchange

Annual Report and Accounts 2011 - Bermuda Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

HSBC HOLDINGS PLC<br />

<strong>Report</strong> of the Directors: Operating <strong>and</strong> Financial Review (continued)<br />

Financial summary > Group performance<br />

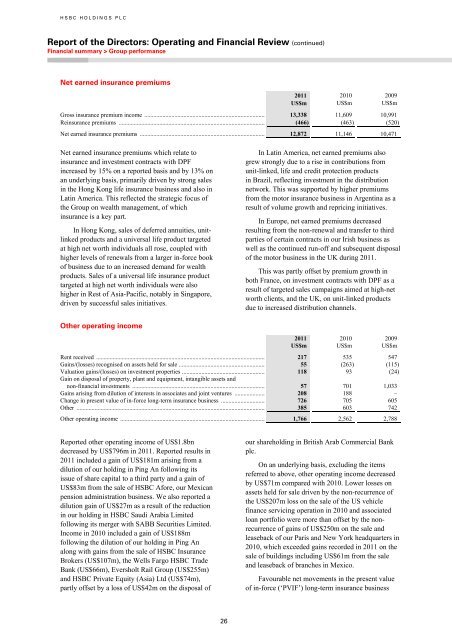

Net earned insurance premiums<br />

<strong>2011</strong><br />

US$m<br />

2010<br />

US$m<br />

2009<br />

US$m<br />

Gross insurance premium income ................................................................................ 13,338 11,609 10,991<br />

Reinsurance premiums ................................................................................................. (466) (463) (520)<br />

Net earned insurance premiums ................................................................................... 12,872 11,146 10,471<br />

Net earned insurance premiums which relate to<br />

insurance <strong>and</strong> investment contracts with DPF<br />

increased by 15% on a reported basis <strong>and</strong> by 13% on<br />

an underlying basis, primarily driven by strong sales<br />

in the Hong Kong life insurance business <strong>and</strong> also in<br />

Latin America. This reflected the strategic focus of<br />

the Group on wealth management, of which<br />

insurance is a key part.<br />

In Hong Kong, sales of deferred annuities, unitlinked<br />

products <strong>and</strong> a universal life product targeted<br />

at high net worth individuals all rose, coupled with<br />

higher levels of renewals from a larger in-force book<br />

of business due to an increased dem<strong>and</strong> for wealth<br />

products. Sales of a universal life insurance product<br />

targeted at high net worth individuals were also<br />

higher in Rest of Asia-Pacific, notably in Singapore,<br />

driven by successful sales initiatives.<br />

In Latin America, net earned premiums also<br />

grew strongly due to a rise in contributions from<br />

unit-linked, life <strong>and</strong> credit protection products<br />

in Brazil, reflecting investment in the distribution<br />

network. This was supported by higher premiums<br />

from the motor insurance business in Argentina as a<br />

result of volume growth <strong>and</strong> repricing initiatives.<br />

In Europe, net earned premiums decreased<br />

resulting from the non-renewal <strong>and</strong> transfer to third<br />

parties of certain contracts in our Irish business as<br />

well as the continued run-off <strong>and</strong> subsequent disposal<br />

of the motor business in the UK during <strong>2011</strong>.<br />

This was partly offset by premium growth in<br />

both France, on investment contracts with DPF as a<br />

result of targeted sales campaigns aimed at high-net<br />

worth clients, <strong>and</strong> the UK, on unit-linked products<br />

due to increased distribution channels.<br />

Other operating income<br />

<strong>2011</strong><br />

US$m<br />

2010<br />

US$m<br />

2009<br />

US$m<br />

Rent received ................................................................................................................ 217 535 547<br />

Gains/(losses) recognised on assets held for sale ......................................................... 55 (263) (115)<br />

Valuation gains/(losses) on investment properties ....................................................... 118 93 (24)<br />

Gain on disposal of property, plant <strong>and</strong> equipment, intangible assets <strong>and</strong><br />

non-financial investments ........................................................................................ 57 701 1,033<br />

Gains arising from dilution of interests in associates <strong>and</strong> joint ventures .................... 208 188 –<br />

Change in present value of in-force long-term insurance business ............................. 726 705 605<br />

Other ............................................................................................................................. 385 603 742<br />

Other operating income ................................................................................................ 1,766 2,562 2,788<br />

<strong>Report</strong>ed other operating income of US$1.8bn<br />

decreased by US$796m in <strong>2011</strong>. <strong>Report</strong>ed results in<br />

<strong>2011</strong> included a gain of US$181m arising from a<br />

dilution of our holding in Ping An following its<br />

issue of share capital to a third party <strong>and</strong> a gain of<br />

US$83m from the sale of HSBC Afore, our Mexican<br />

pension administration business. We also reported a<br />

dilution gain of US$27m as a result of the reduction<br />

in our holding in HSBC Saudi Arabia Limited<br />

following its merger with SABB Securities Limited.<br />

Income in 2010 included a gain of US$188m<br />

following the dilution of our holding in Ping An<br />

along with gains from the sale of HSBC Insurance<br />

Brokers (US$107m), the Wells Fargo HSBC Trade<br />

Bank (US$66m), Eversholt Rail Group (US$255m)<br />

<strong>and</strong> HSBC Private Equity (Asia) Ltd (US$74m),<br />

partly offset by a loss of US$42m on the disposal of<br />

our shareholding in British Arab Commercial Bank<br />

plc.<br />

On an underlying basis, excluding the items<br />

referred to above, other operating income decreased<br />

by US$71m compared with 2010. Lower losses on<br />

assets held for sale driven by the non-recurrence of<br />

the US$207m loss on the sale of the US vehicle<br />

finance servicing operation in 2010 <strong>and</strong> associated<br />

loan portfolio were more than offset by the nonrecurrence<br />

of gains of US$250m on the sale <strong>and</strong><br />

leaseback of our Paris <strong>and</strong> New York headquarters in<br />

2010, which exceeded gains recorded in <strong>2011</strong> on the<br />

sale of buildings including US$61m from the sale<br />

<strong>and</strong> leaseback of branches in Mexico.<br />

Favourable net movements in the present value<br />

of in-force (‘PVIF’) long-term insurance business<br />

26