Annual Report and Accounts 2011 - Bermuda Stock Exchange

Annual Report and Accounts 2011 - Bermuda Stock Exchange

Annual Report and Accounts 2011 - Bermuda Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

HSBC HOLDINGS PLC<br />

<strong>Report</strong> of the Directors: Operating <strong>and</strong> Financial Review (continued)<br />

Global businesses > RBWM / CMB<br />

• In Hong Kong, we retained our position of<br />

having the largest market share in residential<br />

mortgages in <strong>2011</strong>. We were also market leaders<br />

in life insurance.<br />

• For <strong>2011</strong> we set an aggressive goal to achieve<br />

our target customer recommendation in 75% by<br />

revenue weighting of the 16 markets surveyed,<br />

against which we met the target in five markets,<br />

or 35% by revenue weighting. The shortfall<br />

resulted mainly from a challenging environment<br />

in many of our large markets, with strong local<br />

competitors improving their service<br />

performance, <strong>and</strong> a negative reaction to some<br />

portfolio management activity, particularly in<br />

the US <strong>and</strong> Canada. We had a very strong fourth<br />

quarter, with 77% of the markets by revenue<br />

weighting meeting target, driven in part by<br />

traction from service quality programmes<br />

implemented in Mexico, the UK <strong>and</strong> the UAE,<br />

<strong>and</strong> we finished the year ranked first in 5 of the<br />

6 markets surveyed in Asia.<br />

Portfolio management to drive superior returns<br />

• During <strong>2011</strong>, we embarked on a process to<br />

improve our return on capital using the five<br />

filters analysis to determine portfolio<br />

rationalisation initiatives. As a result, we<br />

completed the sale of our Mexican pension<br />

administration business (HSBC Afore), our UK<br />

motor insurance business <strong>and</strong> our Canadian<br />

brokerage business. We announced the closure<br />

of our retail banking businesses in Pol<strong>and</strong>,<br />

Russia, Georgia, <strong>and</strong> Kuwait, the sale of our<br />

operations in Chile, Central America (Costa<br />

Rica, El Salvador <strong>and</strong> Honduras) <strong>and</strong>, most<br />

recently, the disposal of our retail operations in<br />

Thail<strong>and</strong>. We also announced the cessation of<br />

life insurance manufacturing in the US, the sale<br />

of the Card <strong>and</strong> Retail Services business <strong>and</strong><br />

upstate New York branches in the US.<br />

• The North American business has continued to<br />

focus on managing down the residual balances<br />

in our US run-off portfolios.<br />

Commercial Banking<br />

CMB offers a full range of commercial<br />

financial services <strong>and</strong> tailored<br />

propositions to over 3.6m customers<br />

ranging from sole proprietors to<br />

publicly quoted companies in<br />

65 countries.<br />

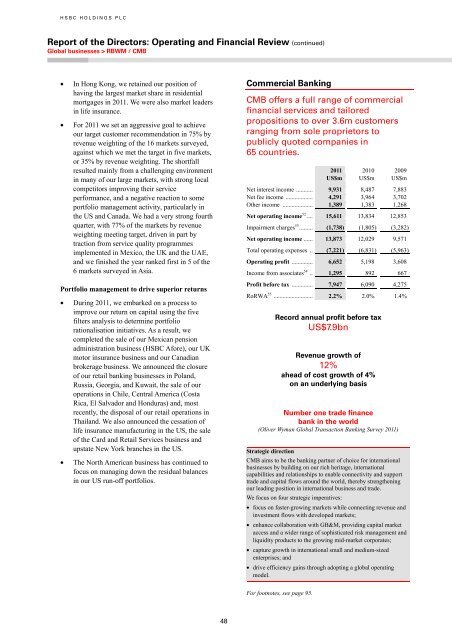

<strong>2011</strong> 2010 2009<br />

US$m US$m US$m<br />

Net interest income ........... 9,931 8,487 7,883<br />

Net fee income .................. 4,291 3,964 3,702<br />

Other income .................... 1,389 1,383 1,268<br />

Net operating income 52 .... 15,611 13,834 12,853<br />

Impairment charges 53 ......... (1,738) (1,805) (3,282)<br />

Net operating income ...... 13,873 12,029 9,571<br />

Total operating expenses .. (7,221) (6,831) (5,963)<br />

Operating profit .............. 6,652 5,198 3,608<br />

Income from associates 54 .. 1,295 892 667<br />

Profit before tax .............. 7,947 6,090 4,275<br />

RoRWA 55 .......................... 2.2% 2.0% 1.4%<br />

Record annual profit before tax<br />

US$7.9bn<br />

Revenue growth of<br />

12%<br />

ahead of cost growth of 4%<br />

on an underlying basis<br />

Number one trade finance<br />

bank in the world<br />

(Oliver Wyman Global Transaction Banking Survey <strong>2011</strong>)<br />

Strategic direction<br />

CMB aims to be the banking partner of choice for international<br />

businesses by building on our rich heritage, international<br />

capabilities <strong>and</strong> relationships to enable connectivity <strong>and</strong> support<br />

trade <strong>and</strong> capital flows around the world, thereby strengthening<br />

our leading position in international business <strong>and</strong> trade.<br />

We focus on four strategic imperatives:<br />

• focus on faster-growing markets while connecting revenue <strong>and</strong><br />

investment flows with developed markets;<br />

• enhance collaboration with GB&M, providing capital market<br />

access <strong>and</strong> a wider range of sophisticated risk management <strong>and</strong><br />

liquidity products to the growing mid-market corporates;<br />

• capture growth in international small <strong>and</strong> medium-sized<br />

enterprises; <strong>and</strong><br />

• drive efficiency gains through adopting a global operating<br />

model.<br />

For footnotes, see page 95.<br />

48