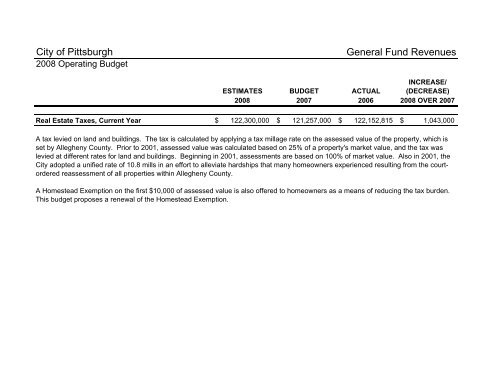

<strong>City</strong> <strong>of</strong> <strong>Pittsburgh</strong> <strong>2008</strong> <strong>Operating</strong> <strong>Budget</strong> General Fund Revenues INCREASE/ ESTIMATES BUDGET ACTUAL (DECREASE) <strong>2008</strong> 2007 2006 <strong>2008</strong> OVER 2007 Real Estate Taxes, Current Year $ 122,300,000 $ 121,257,000 $ 122,152,815 $ 1,043,000 Real Estate Taxes, Prior Years $ 3,245,000 $ 2,741,000 $ 5,010,041 $ 504,000 Mercantile Tax $ - $ - $ 121,827 $ - Amusement Tax $ 8,840,000 $ 9,140,000 $ 9,236,854 $ (300,000) Earned Income Tax $ 60,535,000 $ 50,950,000 $ 50,211,312 $ 9,585,000 Deed Transfer Tax $ 14,900,000 $ 16,828,000 $ 17,284,579 $ (1,928,000) Parking Tax $ 44,107,000 $ 47,043,000 $ 50,506,240 $ (2,936,000) Occupation Privilege Tax $ - $ - $ (2,062) $ - Business Privilege Tax $ 8,150,000 $ 8,043,000 $ 14,677,563 $ 107,000 Institution and Service Privilege Tax $ 460,000 $ 449,000 $ 430,114 $ 11,000 Penalties and Interest $ 2,717,000 $ 2,078,000 $ 2,551,295 $ 639,000 Interest on Bank Balances $ 6,000,000 $ 3,100,000 $ 4,454,809 $ 2,900,000 Fines and Forfeits $ 6,210,000 $ 5,061,000 $ 6,722,854 $ 1,149,000 Liquor and Malt Beverage Licenses $ 428,000 $ 425,063 $ 410,950 $ 2,937 Business Licenses $ 250 $ 250 $ 667 $ - General Government Licenses $ 820,000 $ 1,019,789 $ 622,502 $ (199,789) Rentals and Charges - Depts. $ 4,386,789 $ 4,154,360 $ 4,101,874 $ 232,429 Public Service Privileges $ 950,000 $ 870,000 $ 575,470 $ 80,000 Provision <strong>of</strong> Services $ 8,962,500 $ 8,730,221 $ 7,392,024 $ 232,279 Breakeven Centers $ 21,366,000 $ 21,018,114 $ 21,217,304 $ 347,886 Joint Operations $ 150,000 $ 100,000 $ 137,000 $ 50,000 Federal and State Grants $ 29,149,500 $ 31,044,625 $ 31,227,143 $ (1,895,125) Non-Pr<strong>of</strong>it Payment for Services $ 4,316,000 $ 5,699,979 $ 9,038,869 $ (1,383,979) Reimbursement, CDBG $ 750,000 $ 735,000 $ 8,159 $ 15,000 Authority Payments $ 13,130,000 $ 9,130,000 $ 6,585,321 $ 4,000,000 State Utility Tax Distribution $ 500,000 $ 470,000 $ 522,571 $ 30,000 Act 77 - Tax Relief $ 13,100,000 $ 12,696,000 $ 12,762,349 $ 404,000 Miscellaneous Not Otherwise Classified $ 331,144 $ 324,644 $ 201,460 $ 6,500 Economic Development Slots Revenue $ 5,100,000 $ 7,657,881 $ - $ (2,557,881) 2% Local Share <strong>of</strong> Slots Revenue $ - $ - $ - $ - Local Services Tax $ 8,700,000 $ 9,819,681 $ 16,063,213 $ (1,119,681) Non-resident Sports Facility Usage Fee $ 2,500,000 $ 2,250,000 $ 2,366,439 $ 250,000 Payroll Preparation Tax $ 44,000,000 $ 42,100,000 $ 41,083,152 $ 1,900,000 Intergovernmental Services Fee $ 722,000 $ 722,000 $ - $ - TOTAL $ 436,826,183 $ 425,657,607 $ 437,674,708 $ 11,168,576

<strong>City</strong> <strong>of</strong> <strong>Pittsburgh</strong> <strong>2008</strong> <strong>Operating</strong> <strong>Budget</strong> General Fund Revenues INCREASE/ ESTIMATES BUDGET ACTUAL (DECREASE) <strong>2008</strong> 2007 2006 <strong>2008</strong> OVER 2007 Real Estate Taxes, Current Year $ 122,300,000 $ 121,257,000 $ 122,152,815 $ 1,043,000 A tax levied on land and buildings. The tax is calculated by applying a tax millage rate on the assessed value <strong>of</strong> the property, which is set by Allegheny County. Prior to 2001, assessed value was calculated based on 25% <strong>of</strong> a property's market value, and the tax was levied at different rates for land and buildings. Beginning in 2001, assessments are based on 100% <strong>of</strong> market value. Also in 2001, the <strong>City</strong> adopted a unified rate <strong>of</strong> 10.8 mills in an effort to alleviate hardships that many homeowners experienced resulting from the courtordered reassessment <strong>of</strong> all properties within Allegheny County. A Homestead Exemption on the first $10,000 <strong>of</strong> assessed value is also <strong>of</strong>fered to homeowners as a means <strong>of</strong> reducing the tax burden. This budget proposes a renewal <strong>of</strong> the Homestead Exemption.

- Page 1 and 2: City of Pittsburgh 1758-2008 250 th

- Page 3 and 4: • Animal control operations are r

- Page 5 and 6: City of Pittsburgh 2008 Budget Depa

- Page 7 and 8: City of Pittsburgh City Council Mem

- Page 9 and 10: Section 3. The maximum levels are e

- Page 11 and 12: City of Pittsburgh General Fund Rev

- Page 13: City of Pittsburgh Summary of Opera

- Page 17 and 18: City of Pittsburgh 2008 Operating B

- Page 19 and 20: City of Pittsburgh 2008 Operating B

- Page 21 and 22: City of Pittsburgh 2008 Operating B

- Page 23 and 24: City of Pittsburgh 2008 Operating B

- Page 25 and 26: City of Pittsburgh 2008 Operating B

- Page 27 and 28: City of Pittsburgh 2008 Operating B

- Page 29 and 30: City of Pittsburgh 2008 Operating B

- Page 31 and 32: City of Pittsburgh 2008 Operating B

- Page 33 and 34: City of Pittsburgh 2008 Operating B

- Page 35 and 36: City of Pittsburgh 2008 Operating B

- Page 37 and 38: City of Pittsburgh 2008 Operating B

- Page 39 and 40: City of Pittsburgh 2008 Operating B

- Page 41 and 42: City of Pittsburgh 2008 Operating B

- Page 43 and 44: City of Pittsburgh 2008 Operating B

- Page 45 and 46: City of Pittsburgh 2008 Operating B

- Page 47 and 48: City of Pittsburgh 2008 Operating B

- Page 49 and 50: City of Pittsburgh 2008 Operating B

- Page 51 and 52: City of Pittsburgh 2008 Operating B

- Page 53 and 54: City of Pittsburgh 2008 Operating B

- Page 55 and 56: City of Pittsburgh 2008 Operating B

- Page 57 and 58: City of Pittsburgh 2008 Operating B

- Page 59 and 60: City of Pittsburgh 2008 Operating B

- Page 61 and 62: City of Pittsburgh 2008 Operating B

- Page 63 and 64: City of Pittsburgh 2008 Operating B

- Page 65 and 66:

City of Pittsburgh 2008 Operating B

- Page 67 and 68:

City of Pittsburgh 2008 Operating B

- Page 69 and 70:

City of Pittsburgh 2008 Operating B

- Page 71 and 72:

City of Pittsburgh 2008 Operating B

- Page 73 and 74:

City of Pittsburgh 2008 Operating B

- Page 75 and 76:

City of Pittsburgh 2008 Operating B

- Page 77 and 78:

City of Pittsburgh Commission on Hu

- Page 79 and 80:

City of Pittsburgh Commission on Hu

- Page 81 and 82:

City of Pittsburgh Commission on Hu

- Page 83 and 84:

City of Pittsburgh 2008 Operating B

- Page 85 and 86:

City of Pittsburgh 2008 Operating B

- Page 87 and 88:

City of Pittsburgh 2008 Operating B

- Page 89 and 90:

City of Pittsburgh 2008 Operating B

- Page 91 and 92:

City of Pittsburgh 2008 Operating B

- Page 93 and 94:

City of Pittsburgh 2008 Operating B

- Page 95 and 96:

City of Pittsburgh 2008 Operating B

- Page 97 and 98:

City of Pittsburgh Department of Fi

- Page 99 and 100:

City of Pittsburgh Department of Fi

- Page 101 and 102:

City of Pittsburgh Department of Fi

- Page 103 and 104:

City of Pittsburgh Department of Fi

- Page 105 and 106:

City of Pittsburgh 2008 Operating B

- Page 107 and 108:

City of Pittsburgh 2008 Operating B

- Page 109 and 110:

City of Pittsburgh 2008 Operating B

- Page 111 and 112:

City of Pittsburgh 2008 Operating B

- Page 113 and 114:

City of Pittsburgh 2008 Operating B

- Page 115 and 116:

City of Pittsburgh 2008 Operating B

- Page 117 and 118:

City of Pittsburgh 2008 Operating B

- Page 119 and 120:

City of Pittsburgh 2008 Operating B

- Page 121 and 122:

City of Pittsburgh 2008 Operating B

- Page 123 and 124:

City of Pittsburgh 2008 Operating B

- Page 125 and 126:

City of Pittsburgh Personnel & Civi

- Page 127 and 128:

City of Pittsburgh Personnel & Civi

- Page 129 and 130:

City of Pittsburgh 2008 Operating B

- Page 131 and 132:

City of Pittsburgh 2008 Operating B

- Page 133 and 134:

City of Pittsburgh 2008 Operating B

- Page 135 and 136:

City of Pittsburgh Department of Ci

- Page 137 and 138:

City of Pittsburgh Department of Pu

- Page 139 and 140:

City of Pittsburgh Department of Pu

- Page 141 and 142:

City of Pittsburgh Department of Pu

- Page 143 and 144:

City of Pittsburgh Department of Pu

- Page 145 and 146:

City of Pittsburgh Department of Pu

- Page 147 and 148:

City of Pittsburgh Department of Pu

- Page 149 and 150:

City of Pittsburgh Department of Pu

- Page 151 and 152:

City of Pittsburgh Department of Pu

- Page 153 and 154:

City of Pittsburgh Department of Pu

- Page 155 and 156:

City of Pittsburgh Department of Pu

- Page 157 and 158:

City of Pittsburgh Department of Pu

- Page 159 and 160:

City of Pittsburgh Department of Pu

- Page 161 and 162:

City of Pittsburgh Department of Pu

- Page 163 and 164:

City of Pittsburgh Department of Pu

- Page 165 and 166:

City of Pittsburgh Department of Pu

- Page 167 and 168:

City of Pittsburgh Department of Pu

- Page 169 and 170:

City of Pittsburgh Department of Pu

- Page 171 and 172:

City of Pittsburgh Department of Pu

- Page 173 and 174:

City of Pittsburgh 2008 Operating B

- Page 175 and 176:

City of Pittsburgh Department of Pu

- Page 177 and 178:

City of Pittsburgh Department of Pu

- Page 179 and 180:

City of Pittsburgh Department of Pu

- Page 181 and 182:

City of Pittsburgh Department of Pu

- Page 183 and 184:

City of Pittsburgh Department of Pu

- Page 185 and 186:

City of Pittsburgh Department of Pu

- Page 187 and 188:

City of Pittsburgh Department of Pu

- Page 189 and 190:

City of Pittsburgh Department of Pu

- Page 191 and 192:

City of Pittsburgh Department of Pu

- Page 193 and 194:

City of Pittsburgh Department of Pu

- Page 195 and 196:

City of Pittsburgh Department of Pu

- Page 197 and 198:

City of Pittsburgh Department of Pu

- Page 199 and 200:

City of Pittsburgh Department of Pu

- Page 201 and 202:

City of Pittsburgh Department of Pu

- Page 203 and 204:

City of Pittsburgh Department of Pu

- Page 205 and 206:

City of Pittsburgh Department of Pu

- Page 207 and 208:

City of Pittsburgh Department of Pu

- Page 209 and 210:

City of Pittsburgh Department of Pu

- Page 211 and 212:

City of Pittsburgh Department of Pu

- Page 213 and 214:

City of Pittsburgh 2008 Operating B

- Page 215 and 216:

City of Pittsburgh 2008 Operating B

- Page 217 and 218:

City of Pittsburgh 2008 Operating B

- Page 219 and 220:

City of Pittsburgh 2008 Operating B

- Page 221 and 222:

City of Pittsburgh Department of Pa

- Page 223 and 224:

City of Pittsburgh Department of Pa

- Page 225 and 226:

City of Pittsburgh Department of Pa

- Page 227 and 228:

City of Pittsburgh Department of Pa

- Page 229 and 230:

City of Pittsburgh Department of Pa

- Page 231 and 232:

City of Pittsburgh Non-Departmental

- Page 233 and 234:

City of Pittsburgh Non-Departmental

- Page 235 and 236:

City of Pittsburgh 2008 Operating B

- Page 237 and 238:

City of Pittsburgh Non-Departmental

- Page 239 and 240:

City of Pittsburgh Non-Departmental

- Page 241 and 242:

Grade and Step Plan - 2008 White Co

- Page 243 and 244:

No. ___ of 2007 Resolution “Adopt

- Page 245 and 246:

Council's 2008 Unspecified Local Op

- Page 247 and 248:

District 4 Allocation Amount Brookl

- Page 249 and 250:

District 7 Allocation Amount Bloomf

- Page 251 and 252:

City of Pittsburgh 2008 Capital Bud

- Page 253 and 254:

City of Pittsburgh 2008 Capital Bud

- Page 255 and 256:

City of Pittsburgh 2008 Capital Bud

- Page 257:

City of Pittsburgh 2008 Capital Bud