Annual Report 2008 - ProCredit Bank

Annual Report 2008 - ProCredit Bank

Annual Report 2008 - ProCredit Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong> Bosnia and Herzegovina<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong>

2<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

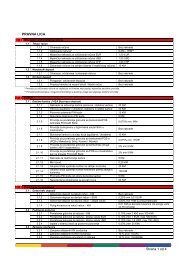

Key Figures<br />

EUR ’000 BAM ’000 Change<br />

<strong>2008</strong> 2007 <strong>2008</strong> 2007 BAM<br />

Balance Sheet Data<br />

Total Assets 237,314 216,717 464,146 423,861 10%<br />

Gross Loan Portfolio 162,880 162,102 318,566 317,045 0%<br />

Business Loan Portfolio 96,479 96,208 188,697 188,168 0%<br />

EUR < 10,000 41,444 46,542 81,058 91,028 -11%<br />

EUR > 10,000 < 50,000 26,873 25,829 52,559 50,518 4%<br />

EUR > 50,000 < 150,000 15,806 14,590 30,914 28,536 8%<br />

EUR > 150,000 12,356 9,247 24,166 18,086 34%<br />

Agricultural Loan Portfolio 42,085 50,082 82,311 97,952 -16%<br />

Housing Improvement Loan Portfolio 4,496 3,663 8,793 7,164 23%<br />

Other 19,820 12,149 38,765 23,761 63%<br />

Allowance for Impairment on Loans 5,529 4,354 10,814 8,517 27%<br />

Net Loan Portfolio 157,351 157,748 307,752 308,528 0%<br />

Liabilities to Customers 171,585 143,093 335,591 279,867 20%<br />

Liabilities to <strong>Bank</strong>s and Financial Institutions<br />

(excluding PCH) 33,561 39,994 65,639 78,221 -16%<br />

Shareholders’ Equity 22,822 19,249 44,635 37,648 19%<br />

Income Statement<br />

Operating Income 19,343 18,619 37,831 36,415 4%<br />

Operating Expenses 19,684 17,136 38,499 33,516 15%<br />

Operating Profit Before Tax -342 1,482 -668 2,899 -123%<br />

Net Profit -384 1,304 -751 2,551 -129%<br />

Key Ratios<br />

Cost/Income Ratio 86.3% 81.9% 86.3% 81.9%<br />

ROE -1.8% 8.1% -1.8% 8.1%<br />

Capital Ratio 18.4% 16.5% 18.4% 16.5%<br />

Operational Statistics<br />

Number of Loans Outstanding 65,277 68,752 -5%<br />

Number of Loans Disbursed within the Year 41,972 61,348 -32%<br />

Number of Business and Agricultural<br />

Loans Outstanding 57,245 62,928 -9%<br />

Number of Deposit Accounts 113,096 84,126 34%<br />

Number of Staff 888 831 7%<br />

Number of Branches and Outlets 44 38 16%<br />

Exchange rate as of December 31:<br />

<strong>2008</strong>: EUR 1 = BAM 1.95583<br />

2007: EUR 1 = BAM 1.95583

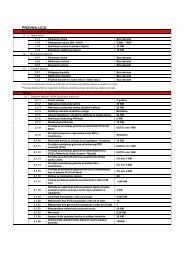

Contents 3<br />

Mission Statement 4<br />

Letter from the Supervisory Board 5<br />

The <strong>Bank</strong> and its Shareholders 6<br />

The <strong>ProCredit</strong> Group: Responsible <strong>Bank</strong>s for Ordinary People 8<br />

<strong>ProCredit</strong> in Eastern Europe 11<br />

Highlights in <strong>2008</strong> 14<br />

Management Business Review 16<br />

Special Feature 24<br />

Risk Management 26<br />

Branch Network 30<br />

Organisation, Staff and Staff Development 32<br />

Business Ethics and Environmental Standards 35<br />

Our Clients 36<br />

Financial Statements 40<br />

Contact Addresses 70

4<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

Mission Statement<br />

<strong>ProCredit</strong> <strong>Bank</strong> Bosnia and Herzegovina is a development-oriented full-service bank.<br />

We offer excellent customer service and a wide range of banking products. In our credit<br />

operations, we focus on lending to very small, small and medium-sized enterprises, as<br />

we are convinced that these businesses create the largest number of jobs and make a<br />

vital contribution to the economies in which they operate.<br />

Unlike other banks, our bank does not promote consumer loans. Instead we focus on<br />

responsible banking, by building a savings culture and long-term partnerships with our<br />

customers.<br />

Our shareholders expect a sustainable return on investment, but are not primarily<br />

interested in short-term profit maximisation. We invest extensively in the training of our<br />

staff in order to create an enjoyable and efficient working atmosphere, and to provide<br />

the friendliest and most competent service possible for our customers.

Letter from the Supervisory Board 5<br />

Letter from the Supervisory Board<br />

The year under review was challenging for the financial sector due to the global economic downturn that<br />

followed a collapse of the subprime mortgage market in the United States. This crisis has illustrated all<br />

too clearly the negative effects that can result from irresponsible consumer lending when the main institutional<br />

objective is short-term profit maximisation. International capital market restrictions and a loss of<br />

trust among savers and investors were soon visible in the USA and parts of Western Europe. An indirect<br />

impact was later felt in transition economies, including Bosnia and Herzegovina (BiH). Faced with reduced<br />

liquidity, many local banks launched a series of non-transparent saving campaigns devised to attract private<br />

deposits; they also increased interest rates on outstanding short-term loans, particularly with regard<br />

to consumer and credit card lending.<br />

Operating in this environment, <strong>ProCredit</strong> <strong>Bank</strong> BiH continued to support private sector development by<br />

providing fixed-rate loans to very small, small and medium-sized entrepreneurs and farmers across the<br />

country. At year-end, the loan portfolio consisted of more than 57,000 loans, representing a total volume<br />

of BAM 271 million (EUR 138.5 million). In line with our business policy to focus on lending to these core<br />

groups, only 3.3% of our portfolio consisted of consumer loans.<br />

The banking sector in BiH is highly competitive, consisting of 31 banks and twenty microcredit organisations.<br />

1 Many of these institutions have disbursed so many loans over recent years without conducting a<br />

sound analysis that their clients have in many cases become over-indebted and are now unable to meet<br />

repayments. Run by the central bank, the Central Credit Registry became fully functional in <strong>2008</strong>. Thanks<br />

to its ability to cross-reference data from all lending institutions, we learnt that, although credit analysis<br />

was performed on an individual basis, many of our own clients were in fact deeply indebted. Given this<br />

information, our most important task remained to adhere to our traditional principles of responsible banking,<br />

assessing each client’s true ability to meet obligations. The Central Credit Registry provides additional<br />

strength to our credit risk management strategy.<br />

A major achievement in <strong>2008</strong> was another step towards funding the loan portfolio entirely through domestic<br />

deposits. Given the general loss of public confidence in the banking sector, this result demonstrates our<br />

solid reputation amongst savers. By offering simple and appealing savings products, we increased our<br />

deposit base by 20% to BAM 335.6 million (EUR 171.6 million).<br />

On the basis of this growth, <strong>ProCredit</strong> <strong>Bank</strong> opened seven units in <strong>2008</strong>, extending the branch network to<br />

44 offices in 33 towns and cities. In line with the approach we have always taken to our business, all of our<br />

new branches offer our clients professional and friendly financial advice from the very first day of operation.<br />

This is achieved through heavy investment in staff development and training.<br />

<strong>ProCredit</strong> <strong>Bank</strong> now has over 880 employees. Remaining true to our principles, we emphasise the significance<br />

of transparent communication and a socially responsible attitude towards our staff members,<br />

clients, business partners and the broad community. These priorities were reflected in the financial education<br />

activities we carried out during the year. Our campaigns aimed to enable people to understand<br />

standard banking services and use them wisely. The bank also undertook a number of projects to benefit<br />

the communities in which it operates, including the building of playgrounds, improvement of local parks<br />

and renovation of children’s day care centres.<br />

In closing, I would like to acknowledge our staff and to thank our shareholders for their long-term commitment<br />

to supporting our mission. <strong>ProCredit</strong> <strong>Bank</strong> BiH has a responsibility to provide sound financial advice<br />

and transparent services, and I trust that our employees will endeavour to make 2009 a successful year<br />

for the institution.<br />

Claus-Peter Zeitinger<br />

Chairman of the Supervisory Board<br />

Members of the<br />

Supervisory Board as of<br />

December 31, <strong>2008</strong>:<br />

Claus-Peter Zeitinger<br />

Helen Alexander<br />

Frieder Wöhrmann<br />

Klaus Glaubitt<br />

Nicolas Antonio Baron Adamovich<br />

Members of the<br />

Management Board as of<br />

December 31, <strong>2008</strong>:<br />

Peter Moelders<br />

Maja Hrnjić<br />

Sabina Mujanović<br />

Edin Hrnjica<br />

Vedran Hadžiahmetović<br />

Senad Redžić<br />

Radomir Savić<br />

1<br />

<strong>Annual</strong>ised data based on CBBH bulletin No. 3

6<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

The <strong>Bank</strong> and its Shareholders<br />

<strong>ProCredit</strong> <strong>Bank</strong> Bosnia and Herzegovina is a<br />

member of the <strong>ProCredit</strong> group, which is led by<br />

its Frankfurt-based parent company, <strong>ProCredit</strong><br />

Holding. <strong>ProCredit</strong> Holding is the majority owner<br />

of <strong>ProCredit</strong> <strong>Bank</strong> Bosnia and Herzegovina and<br />

now holds 92.4% of the shares.<br />

<strong>ProCredit</strong> <strong>Bank</strong> BiH was founded in October 1997<br />

as Micro Enterprise <strong>Bank</strong> (MEB) by an alliance of<br />

international development-oriented investors.<br />

Their goal was to establish a new kind of financial<br />

institution that would meet the demand of<br />

small and very small businesses in a socially<br />

responsible way. The primary aim was not shortterm<br />

profit maximisation but rather to deepen<br />

the financial sector and contribute to long-term<br />

economic development while also achieving a<br />

sustainable return on investment.<br />

The founding shareholders of <strong>ProCredit</strong> <strong>Bank</strong><br />

BiH were Internationale Projekt Consult (IPC),<br />

International Finance Corporation (IFC), the European<br />

<strong>Bank</strong> for Reconstruction and Development<br />

(EBRD), the Netherlands Development Finance<br />

Company (FMO), and BH <strong>Bank</strong>. Over the years,<br />

<strong>ProCredit</strong> Holding, working closely with IPC, has<br />

consolidated the ownership and management<br />

structure of all the <strong>ProCredit</strong> banks and financial<br />

institutions to create a truly global group with a<br />

clear shareholder structure and to bring to each<br />

<strong>ProCredit</strong> institution all the synergies and benefits<br />

that this implies.<br />

Today’s shareholder structure of <strong>ProCredit</strong> <strong>Bank</strong><br />

BiH is outlined below. Its current share capital is<br />

EUR 18.1 million.<br />

Shareholder<br />

(as of Dec. 31, <strong>2008</strong>)<br />

<strong>ProCredit</strong> Holding<br />

Commerzbank AG<br />

Sector<br />

Headquarters<br />

Share<br />

Paid-in Capital<br />

(in EUR million)<br />

16.75<br />

1.38<br />

Investment<br />

<strong>Bank</strong>ing<br />

Germany<br />

Germany<br />

92.4%<br />

7.6%<br />

Total Capital<br />

100%<br />

18.13<br />

<strong>ProCredit</strong> Holding is the<br />

parent company of a global<br />

group of 22 <strong>ProCredit</strong> banks. <strong>ProCredit</strong> Holding<br />

was founded as Internationale Micro Investitionen<br />

AG (IMI) in 1998 by the pioneering development<br />

finance consultancy company IPC.<br />

<strong>ProCredit</strong> Holding is committed to expanding access<br />

to financial services in developing countries<br />

and transition economies by building a group of<br />

banks that are the leading providers of fair, transparent<br />

financial services for very small, small and<br />

medium-sized businesses as well as the general<br />

population in their countries of operation. In addition<br />

to meeting the equity needs of its subsidiaries,<br />

<strong>ProCredit</strong> Holding guides the development<br />

of the <strong>ProCredit</strong> banks, provides their senior management,<br />

and supports the banks in all key areas<br />

of activity, including banking operations, human<br />

resources and risk management. It ensures that<br />

<strong>ProCredit</strong> corporate values, best-practice banking<br />

operations and Basel II risk management<br />

principles are implemented group-wide.<br />

IPC is the leading shareholder and strategic<br />

investor in <strong>ProCredit</strong> Holding. IPC has been<br />

the driving entrepreneurial force behind the<br />

<strong>ProCredit</strong> group since the foundation of the<br />

banks.<br />

<strong>ProCredit</strong> Holding is a public-private partnership.<br />

In addition to IPC and IPC Invest (the investment<br />

vehicle of the staff of IPC and <strong>ProCredit</strong>), the<br />

other private shareholders of <strong>ProCredit</strong> Holding<br />

include the Dutch DOEN Foundation, the US<br />

pension fund TIAA-CREF, the US Omidyar-Tufts<br />

Microfinance Fund and the Swiss investment<br />

fund responsAbility. The public shareholders of<br />

<strong>ProCredit</strong> Holding include KfW (the German promotional<br />

bank), IFC (the private sector arm of the<br />

World <strong>Bank</strong>), FMO (the Dutch development bank)<br />

and BIO (the Belgian Investment Company for Developing<br />

Countries).<br />

<strong>ProCredit</strong> Holding has an investment grade rating<br />

(BBB-) from Fitch Ratings Agency. As of the<br />

end of <strong>2008</strong>, the equity base of the <strong>ProCredit</strong><br />

group is EUR 387 million. The total assets of the<br />

<strong>ProCredit</strong> group are EUR 4.8 billion.

The <strong>Bank</strong> and its Shareholders 7<br />

Commerzbank AG, established<br />

in 1870, is Germany’s second-largest<br />

bank and one of the leading financial institutions<br />

in Europe. The bank is a competent provider<br />

of financial services, primarily for private<br />

customers and small- and medium-sized enterprises<br />

(SMEs). It also manages major corporate<br />

customers and institutions in Europe as well<br />

as multinational enterprises around the world.<br />

Commerzbank aims to enhance its market share<br />

among these core target groups and, in particular,<br />

to establish itself as the number one bank for<br />

Germany’s SME market.<br />

Commerzbank runs a nationwide banking network<br />

in its domestic market. Following the acquisition<br />

of Dresdner <strong>Bank</strong>, it is the leading bank for private<br />

and corporate banking with some 1,200 branches<br />

in Germany and a strong presence in Central and<br />

Eastern Europe. In Asia and the US, the bank is active<br />

in all major commercial centres.<br />

Commerzbank AG is the parent company of a global<br />

financial services group. The group’s operating<br />

business is organised into five segments providing<br />

each other with mutually beneficial synergies:<br />

Private Customers, Mittelstandsbank (SME bank),<br />

Central & Eastern Europe, Corporates & Markets<br />

and Commercial Real Estate / Shipping.

8<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

The <strong>ProCredit</strong> Group: Responsible <strong>Bank</strong>s for Ordinary People<br />

The <strong>ProCredit</strong> group comprises 22 financial institutions<br />

whose business focus is on providing<br />

responsible banking services in transition economies<br />

and developing countries. We aim to provide<br />

accessible, reliable services to small businesses<br />

and the ordinary people who live and work in the<br />

neighbourhoods in which we operate. Today our<br />

21,400 employees, working in 814 branches,<br />

serve 2.9 million customers in Eastern Europe,<br />

Latin America and Africa.<br />

The first <strong>ProCredit</strong> banks were founded more than<br />

a decade ago with the aim of making a significant<br />

development impact by promoting the growth of<br />

small businesses. We sought to achieve this by<br />

providing loans tailored to their requirements and<br />

offering attractive deposit facilities that would enable<br />

and encourage low-income individuals and<br />

families to save. The group has grown strongly<br />

over the years – today we are one of the leading<br />

providers of banking services to small business clients<br />

in most of the countries in which we operate.<br />

Our development mission and socially responsible<br />

approach remain as relevant today as they<br />

have ever been. Indeed, their importance has<br />

been underscored by the global financial crisis<br />

and the challenges this has created for individual<br />

clients as well as for national economies.<br />

The impact of the “credit crunch” will differ from<br />

country to country and from region to region, but<br />

now more than ever our customers need a reliable<br />

banking partner. That is why we have consistently<br />

applied the principles that have defined the<br />

<strong>ProCredit</strong> group since its foundation.<br />

Our mission is to provide credit in a responsible<br />

manner to very small, small and medium-sized<br />

enterprises, as we are convinced that these businesses<br />

create the largest number of jobs and<br />

make a vital contribution to the local economy.<br />

Unlike most other banks operating in our markets,<br />

we avoid aggressive consumer lending and<br />

all speculative lines of business. Instead, the<br />

<strong>ProCredit</strong> banks work in close contact with their<br />

clients to gain a profound understanding of the<br />

problems small businesses face and the opportunities<br />

that are available to them.<br />

Our tailored credit technology reflects the realities<br />

of our clients’ operating environment. Developed<br />

by the German consulting firm IPC, this<br />

technology combines careful individual analysis<br />

of all credit risks with a high degree of standardisation<br />

and efficiency. It enables <strong>ProCredit</strong> institutions<br />

to reach a large number of small businesses<br />

while maintaining high loan portfolio quality. By<br />

making the effort to know our clients well and<br />

build long-term working relationships based on<br />

trust and understanding, we are well positioned<br />

to support them not only when the economy is<br />

buoyant, but also during a downturn.<br />

Furthermore, our targeted efforts to foster a savings<br />

culture in our countries of operation have enabled<br />

us to build a stable deposit base. <strong>ProCredit</strong><br />

deposit facilities are appropriate for a broad<br />

range of customers, and for low-income groups<br />

in particular. We offer simple savings products<br />

with no minimum deposit requirement. <strong>ProCredit</strong><br />

banks place great emphasis on children’s savings<br />

products and on running financial literacy<br />

campaigns in the broader community. In addition<br />

to deposit facilities, we offer our clients a full<br />

range of standard non-credit banking services.<br />

The <strong>ProCredit</strong> group has a simple business model:<br />

lending to a diverse range of enterprises and<br />

mobilising local deposits. As a result, our banks<br />

have a transparent, low-risk profile. We do not<br />

rely heavily on capital market funding and have<br />

no exposure to complex financial products. Furthermore,<br />

our well-trained staff are highly flexible<br />

and able to provide competent advice to<br />

clients, guiding them through difficult times. Despite<br />

the turmoil of the global financial markets,<br />

the performance of the <strong>ProCredit</strong> group has been<br />

remarkably stable: we ended <strong>2008</strong> with approximately<br />

15.4% year-on-year growth in assets over<br />

the year and a comfortable level of profitability.<br />

Our shareholders have always taken a conservative,<br />

long-term view of business development,<br />

aiming to strike the right balance between a<br />

shared developmental goal – reaching as many<br />

small enterprises and small savers as possible –<br />

and achieving commercial success.<br />

Strong shareholders provide a solid foundation<br />

for the <strong>ProCredit</strong> group. It is led by <strong>ProCredit</strong><br />

Holding AG, a German-based company that was<br />

founded by IPC in 1998. <strong>ProCredit</strong> Holding is a<br />

public-private partnership. The private shareholders<br />

include: IPC and IPC Invest, an invest-

The <strong>ProCredit</strong> Group: Responsible <strong>Bank</strong>s for Ordinary People 9<br />

ment vehicle set up by IPC and <strong>ProCredit</strong> staff<br />

members; the Dutch DOEN Foundation; the US<br />

pension fund TIAA-CREF; the US Omidyar-Tufts<br />

Microfinance Fund; and the Swiss investment<br />

fund responsAbility. The public shareholders<br />

include the German KfW <strong>Bank</strong>engruppe (KfW<br />

banking group); IFC, the private sector arm of the<br />

World <strong>Bank</strong>; the Dutch development bank FMO;<br />

and the Belgian Investment Company for Developing<br />

Counties (BIO). The group also receives<br />

strong support from the EBRD and Commerzbank,<br />

our minority shareholders in Eastern Europe, and<br />

from the IDB in Latin America.<br />

<strong>ProCredit</strong> Holding is not only a source of equity<br />

for its subsidiaries, but also a guide for the development<br />

of the <strong>ProCredit</strong> banks, providing the<br />

personnel for their senior management and offering<br />

support in all key areas of activity. The<br />

holding company ensures the implementation of<br />

<strong>ProCredit</strong> corporate values, best practice banking<br />

operations and Basel II risk management<br />

principles across the group. The group’s business<br />

is run in accordance with the rigorous regulatory<br />

standards imposed by the German banking<br />

supervisory authority (BaFin).<br />

<strong>ProCredit</strong> Holding and the <strong>ProCredit</strong> group place<br />

strong emphasis on human resource management.<br />

Our neighbourhood banking concept is<br />

not limited to our target customers and how we<br />

reach them, it is also about our staff: how we<br />

work with one another and how we work with<br />

our customers. The strength of our relationships<br />

with our customers will be central to working with<br />

them effectively in 2009 and achieving steady<br />

The international group<br />

of <strong>ProCredit</strong> institutions;<br />

see also<br />

www.procredit-holding.com<br />

<strong>ProCredit</strong><br />

Mexico<br />

Banco <strong>ProCredit</strong><br />

Honduras<br />

Banco <strong>ProCredit</strong><br />

El Salvador<br />

Banco <strong>ProCredit</strong><br />

Nicaragua<br />

Banco <strong>ProCredit</strong><br />

Colombia<br />

Banco <strong>ProCredit</strong><br />

Ecuador<br />

Banco Los Andes<br />

<strong>ProCredit</strong> Bolivia<br />

<strong>ProCredit</strong> <strong>Bank</strong> Serbia<br />

<strong>ProCredit</strong> <strong>Bank</strong><br />

Bosnia and Herzegovina<br />

<strong>ProCredit</strong> <strong>Bank</strong> Kosovo<br />

<strong>ProCredit</strong> <strong>Bank</strong> Albania<br />

<strong>ProCredit</strong> <strong>Bank</strong> Macedonia<br />

<strong>ProCredit</strong> <strong>Bank</strong><br />

Sierra Leone<br />

<strong>ProCredit</strong><br />

Savings and Loans Ghana<br />

<strong>ProCredit</strong> <strong>Bank</strong><br />

Democratic Republic of Congo<br />

Banco <strong>ProCredit</strong> Mozambique<br />

<strong>ProCredit</strong> <strong>Bank</strong> Ukraine<br />

<strong>ProCredit</strong> <strong>Bank</strong> Moldova<br />

<strong>ProCredit</strong> <strong>Bank</strong> Romania<br />

<strong>ProCredit</strong> <strong>Bank</strong> Georgia<br />

<strong>ProCredit</strong> <strong>Bank</strong> Armenia<br />

<strong>ProCredit</strong> <strong>Bank</strong> Bulgaria

10<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

business results. A responsible neighbourhood<br />

bank approach requires a decentralised decisionmaking<br />

process and a high level of judgment and<br />

creativity from all staff members, especially our<br />

branch managers. Our corporate values embed<br />

principles such as honest communication, transparency<br />

and professionalism into our day-to-day<br />

business. Key to our success is therefore the recruitment<br />

and training of a dedicated staff. We<br />

maintain a corporate culture which strengthens<br />

the professional development of our staff, while<br />

fostering their deep sense of personal and social<br />

responsibility. This entails not only intensive<br />

training in technical and management skills, but<br />

also a continuous exchange of personnel among<br />

our member institutions in order to take full advantage<br />

of the opportunities for staff development<br />

that are created by their participation in a<br />

truly international group.<br />

A central plank in our approach to training is the<br />

group’s <strong>ProCredit</strong> Academy in Germany, which<br />

provides a three-year, part-time “<strong>ProCredit</strong> <strong>Bank</strong>er”<br />

training programme for high-potential personnel<br />

from each of the <strong>ProCredit</strong> institutions. The<br />

programme includes intensive technical training<br />

and also exposes participants to a very multicultural<br />

learning environment and to subjects such as<br />

anthropology, history, philosophy and ethics. The<br />

programme provides an opportunity for our future<br />

leaders to develop their views of the world, as well<br />

as their communication and staff management<br />

skills. The first year of <strong>ProCredit</strong> Academy participants<br />

graduated in September <strong>2008</strong>. The professional<br />

development of local middle managers is<br />

further supported by three regional academies in<br />

Latin America, Africa and Eastern Europe, which<br />

provide similar off-site training for a larger number<br />

of people.<br />

The group’s strategy for 2009 will reflect the<br />

prevailing conditions of the countries in which<br />

we work. We plan to intensify our focus on loan<br />

portfolio quality and to offer personal support<br />

to our existing clients. We will continue to invest<br />

in our staff since it is their skills which enable us<br />

to work effectively with our clients under changing<br />

macroeconomic conditions. As responsible<br />

banks for ordinary people, with prudent policies<br />

and an excellent staff to ensure our steady performance,<br />

we look forward to consolidating our<br />

position in all our countries of operation.

<strong>ProCredit</strong> in Eastern Europe 11<br />

<strong>ProCredit</strong> in Eastern Europe<br />

<strong>ProCredit</strong> operates in 11 countries across Eastern<br />

Europe. With more than 611,000 loans outstanding,<br />

it is the region’s leading provider of banking<br />

services to very small, small and medium-sized<br />

businesses.<br />

<strong>2008</strong> proved to be a challenging year for the<br />

region. After several years of strong economic<br />

growth and rapid expansion of banking sector<br />

assets, the effects of the global financial crisis<br />

were felt in the latter half of the year as credit<br />

growth slowed and public trust wavered. Although<br />

the medium-term implications are not<br />

yet clear, the region will certainly be affected<br />

by both the worldwide economic downturn and,<br />

with the banking sector dominated by western<br />

European banks, the turmoil in the global financial<br />

sector. We anticipate lower economic<br />

growth and higher levels of market volatility in<br />

our countries of operation – conditions to which<br />

<strong>ProCredit</strong> and its clients must adapt.<br />

Given our consistent, reliable approach, <strong>ProCredit</strong><br />

institutions are well placed to succeed in the current<br />

economic environment. We have a stable,<br />

straightforward balance sheet and a highly diversified<br />

client base. Our expansion in the first<br />

half of the year continued to be strong. Growth<br />

levelled off during the final two quarters as we introduced<br />

more conservative lending policies in response<br />

to greater credit risk. Our staff focused on<br />

working closely with our debtors and retail clients<br />

to help them understand and respond to changing<br />

conditions.<br />

Across the region, the focus of most other banks in<br />

recent years has been on corporate financing and<br />

consumer lending. In comparative terms, these<br />

institutions have neglected the provision of credit<br />

to small entrepreneurs and family businesses.<br />

At <strong>ProCredit</strong>, we consider such clients to be our<br />

core target group. We are their banking partner<br />

of choice, able to understand their needs and offer<br />

sound, professional advice. These businesses<br />

will remain the driving force behind economic<br />

growth and job creation across Eastern Europe,<br />

just as they have been since the collapse of Soviet<br />

influence and large, state-owned enterprises. As<br />

other banks provide fewer loans in the region, due<br />

to either domestic or international constraints, it<br />

will be more important than ever that we provide<br />

our clients with access to sufficient finance to<br />

support their operations.<br />

<strong>ProCredit</strong> has always emphasised the fact that<br />

consumer lending, which has been so aggressively<br />

pursued by other banks in Eastern Europe, has<br />

never been a line of business in which we wish to<br />

engage. Such loans can easily lead to over-indebtedness<br />

when banks advertise and disburse them<br />

irresponsibly in a competition to gain market<br />

share. We fear that the widespread practice of approving<br />

loans with an inadequate analysis of customers’<br />

repayment capacity may now exacerbate<br />

the problems that individuals and families face in<br />

less prosperous times. This poses further potential<br />

difficulties for the banking sector as a whole.<br />

Our approach is to provide primarily business<br />

loans following a careful, individual analysis of<br />

each client’s ability to meet his or her obligations.<br />

We have decentralised decision-making systems<br />

in place and a body of highly qualified staff who<br />

are able to conduct an efficient and reliable risk<br />

assessment even in more volatile economic conditions.<br />

<strong>ProCredit</strong> is guided by a responsible, longterm<br />

attitude towards business development. We<br />

aim to build lasting relationships with our clients<br />

and do not forget that a loan is also a debt. These<br />

values will be particularly pertinent when managing<br />

potential arrears in cases where clients have<br />

to adapt to lower than anticipated sales.<br />

Our lending activities include the provision of<br />

agricultural loans; we are keen to support a sector<br />

that has been particularly neglected by other<br />

banks and that is vital for employment and social<br />

cohesion outside the main urban areas. We also<br />

provide housing improvement loans to help lowincome<br />

families renovate their homes and improve<br />

energy efficiency.<br />

Alongside its credit operations, <strong>ProCredit</strong> has<br />

invested strongly over the years in creating a<br />

savings culture amongst clients and the broader<br />

public. We believe that setting money aside can<br />

help protect savers against the uncertainties of<br />

life. This is perhaps truer now than ever before.<br />

The ratio of deposits to GDP in Eastern European<br />

countries is well below Western European levels,<br />

typically at around 50%. Through promotional<br />

events and direct, personal communication, we<br />

encourage people – particularly those who do not<br />

yet have a bank account – to make use of banking<br />

services and to regularly save a portion of their<br />

earnings.

12<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

Belarus<br />

Russia<br />

Poland<br />

Germany<br />

Czech Republic<br />

Ukraine<br />

Slovakia<br />

Switzerland<br />

Austria<br />

Slovenia<br />

Hungary<br />

Romania<br />

Moldova<br />

Italy<br />

Croatia<br />

Bosnia<br />

and<br />

Herzegovina<br />

Serbia<br />

Montenegro Kosovo<br />

Macedonia<br />

Albania<br />

Bulgaria<br />

Georgia<br />

Armenia<br />

Azerbaijan<br />

Turkey<br />

Greece<br />

Syria<br />

We offer simple and reliable retail banking services,<br />

including flexible savings and deposit accounts<br />

to accommodate depositors’ long- and short-term<br />

needs. Our belief in transparent, direct communication<br />

is particularly important in fostering clients’<br />

trust in these difficult times. We understand<br />

that our clients want to know in simple language<br />

how to save safely; they also want to access their<br />

money when they need it without unexpected<br />

complications. Thanks to the trust that the public<br />

has placed in <strong>ProCredit</strong>, local deposits are the<br />

principal source of funding for our lending activities<br />

to local businesses. We have therefore not had<br />

to rely on unpredictable capital markets. All the<br />

<strong>ProCredit</strong> institutions in Eastern Europe ended the<br />

year with a comfortable liquidity position and a stable,<br />

indeed increasing, net interest margin.<br />

In line with our mission to reach clients in their<br />

neighbourhoods wherever they are, the <strong>ProCredit</strong><br />

group continued to expand in <strong>2008</strong>: we opened<br />

116 branches and recruited more than 2,500 people<br />

in Eastern Europe alone, bringing the regional<br />

total to over 13,500 employees in 557 branches.<br />

In the coming year we will focus on strengthening<br />

our business operations from this base. We<br />

place a strong emphasis on transparency and will<br />

continue to run information campaigns in 2009 to<br />

ensure that people understand the pricing of our<br />

products as well as those of our competitors.<br />

Our staff is the key element in our approach to being<br />

a stable, down-to-earth and personal banking<br />

partner. The <strong>ProCredit</strong> group has a strong commitment<br />

to staff training, professional development<br />

and the cultivation of an open, honest communication<br />

culture. Staff exchanges, cross-border training<br />

programmes and regional workshops are an important<br />

part of our approach. In September <strong>2008</strong>, construction<br />

was completed on the new Eastern European<br />

Academy, located near Skopje in Macedonia.<br />

Dedicated to the training of <strong>ProCredit</strong> middle managers,<br />

the Academy is an important channel for<br />

rapid and consistent communication region-wide<br />

and one that helps us adapt quickly to face new<br />

challenges: 210 managers have already graduated<br />

from the six-week intensive course since the facility<br />

was founded. A language centre at the Academy<br />

also provides residential English courses, maximising<br />

the potential for international exchange within<br />

the group. Like all prudent banks, we will continue<br />

to focus on efficient cost management in 2009 and<br />

beyond. Investment in our staff is however an ongoing<br />

commitment and will remain a central plank<br />

in the <strong>ProCredit</strong> <strong>Bank</strong> approach. A qualified, motivated<br />

and professional team lies at the root of our<br />

lasting success across Eastern Europe.

<strong>ProCredit</strong> in Eastern Europe 13<br />

Name<br />

<strong>ProCredit</strong> <strong>Bank</strong><br />

Albania<br />

<strong>ProCredit</strong> <strong>Bank</strong><br />

Armenia<br />

<strong>ProCredit</strong> <strong>Bank</strong><br />

Bosnia and Herzegovina<br />

<strong>ProCredit</strong> <strong>Bank</strong><br />

Bulgaria<br />

<strong>ProCredit</strong> <strong>Bank</strong><br />

Georgia<br />

<strong>ProCredit</strong> <strong>Bank</strong><br />

Kosovo<br />

<strong>ProCredit</strong> <strong>Bank</strong><br />

Macedonia<br />

<strong>ProCredit</strong><br />

Moldova<br />

<strong>ProCredit</strong> <strong>Bank</strong><br />

Moldova<br />

<strong>ProCredit</strong> <strong>Bank</strong><br />

Romania<br />

<strong>ProCredit</strong> <strong>Bank</strong><br />

Serbia<br />

<strong>ProCredit</strong> <strong>Bank</strong><br />

Ukraine<br />

Highlights*<br />

Founded in October 1998<br />

34 branches<br />

40,619 loans / EUR 134.1 million in loans<br />

177,630 deposit accounts / EUR 203.9 million<br />

1,003 employees<br />

Founded in December 2007<br />

4 branches<br />

2,340 loans / EUR 16.7 million in loans<br />

6,592 deposit accounts / EUR 6.7 million<br />

203 employees<br />

Founded in October 1997<br />

44 branches<br />

65,277 loans / EUR 162.9 million in loans<br />

113,096 deposit accounts / EUR 171.5 million<br />

888 employees<br />

Founded in October 2001<br />

87 branches<br />

66,612 loans / EUR 578.9 million in loans<br />

220,023 deposit accounts / EUR 341.9 million<br />

1,955 employees<br />

Founded in May 1999<br />

58 branches<br />

66,083 loans / EUR 221.8 million in loans<br />

364,742 deposit accounts / EUR 126.1 million<br />

1,815 employees<br />

Founded in January 2000<br />

60 branches<br />

98,366 loans / EUR 439.6 million in loans<br />

402,214 deposit accounts / EUR 570.0 million<br />

1,158 employees<br />

Founded in July 2003<br />

40 branches<br />

35,493 loans / EUR 129.1 million in loans<br />

129,687 deposit accounts / EUR 127.6 million<br />

791 employees<br />

Founded in December 1999<br />

13 branches<br />

13,221 loans / EUR 23.5 million in loans<br />

175 employees<br />

Founded in December 2007<br />

17 branches<br />

2,973 loans / EUR 8.7 million in loans<br />

9,226 deposit accounts / EUR 5.1 million<br />

350 employees<br />

Founded in May 2002<br />

40 branches<br />

41,948 loans / EUR 214.0 million in loans<br />

142,379 deposit accounts / EUR 148.1 million<br />

1,121 employees<br />

Founded in April 2001<br />

86 branches<br />

133,043 loans / EUR 453.3 million in loans<br />

478,745 deposit accounts / EUR 332.3 million<br />

2,058 employees<br />

Founded in January 2001<br />

74 branches<br />

45,858 loans / EUR 262.6 million in loans<br />

105,656 deposit accounts / EUR 122.8 million<br />

2,035 employees<br />

Contact<br />

Rruga Sami Frasheri<br />

Tirana<br />

Tel./Fax: +355 4 2 271 272 / 276<br />

info@procreditbank.com.al<br />

www.procreditbank.com.al<br />

31, Moskovyan Str.<br />

Building 99<br />

Yerevan 0002<br />

Tel./Fax: + 374 10 514 860 / 853<br />

info@procreditbank.am<br />

www.procreditbank.am<br />

Emerika Bluma 8<br />

71000 Sarajevo<br />

Tel./Fax: +387 33 250 950 / 250 971<br />

info@procreditbank.ba<br />

www.procreditbank.ba<br />

131, Hristo Botev Blvd.<br />

Sofia 1233<br />

Tel./Fax: +359 2 813 51 00 / 51 10<br />

contact@procreditbank.bg<br />

www.procreditbank.bg<br />

154 D. Agmashenebeli Ave.<br />

0112 Tbilisi<br />

Tel./Fax: +995 32 20 2222 / 24 3753<br />

info@procreditbank.ge<br />

www.procreditbank.ge<br />

“Mother Tereze” Boulevard No. 16<br />

10 000 Prishtina<br />

Tel./Fax: +381 38 555 777 / 248 777<br />

info@procreditbank-kos.com<br />

www.procreditbank-kos.com<br />

Bul. Jane Sandanski 109a<br />

1000 Skopje<br />

Tel./Fax: +389 2 321 99 00 / 01<br />

info@procreditbank.com.mk<br />

www.procreditbank.com.mk<br />

65, Stefan cel Mare Ave.<br />

office 900, Chisinau<br />

Tel./Fax: +373 22 836555 / 273488<br />

office@procredit.md<br />

www.procredit.md<br />

65, Stefan cel Mare Ave.<br />

office 901, Chisinau<br />

Tel./Fax: +373 22 836555 / 273488<br />

office@procreditbank.md<br />

www.procreditbank.md<br />

62-64 Buzesti Str., Sector 1<br />

011017 Bucharest<br />

Tel./Fax: +40 21 2016000 / 305 5663<br />

headoffice@procreditbank.ro<br />

www.procreditbank.ro<br />

Milutina Milankovica 17<br />

Belgrade<br />

Tel./Fax: +381 11 20 77 906/ 905<br />

info@procreditbank.rs<br />

www.procreditbank.rs<br />

107a Peremogy Ave.<br />

Kyiv 03115<br />

Tel./Fax: +380 44 590 10 17 / 01<br />

info@procreditbank.com.ua<br />

www.procreditbank.com.ua<br />

* The figures in this section have been compiled on the basis of the financial and operational reporting performed in accordance with groupwide<br />

standards; they may differ from the figures reported in the bank’s local GAAP statements.

14<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

Highlights in <strong>2008</strong><br />

• The bank’s loan portfolio grew to over BAM<br />

318.6 million (EUR 162.9 million) at yearend.<br />

At the same time, by offering simple<br />

and transparent saving products, we were<br />

able to increase the deposit base by 20% to<br />

BAM 335.6 million (EUR 171.6 million). This<br />

achievement brought the bank closer to its<br />

goal of being able to fund the entire loan portfolio<br />

through customer deposits.<br />

• <strong>ProCredit</strong> <strong>Bank</strong> opened seven offices across<br />

the country, bringing the total number of units<br />

to 44. We focused on opening offices in smaller<br />

cities to reach clients who had previously<br />

not had access to our entire range of services.<br />

• <strong>ProCredit</strong> <strong>Bank</strong> recruited 166 staff, bringing<br />

the total number of employees to 888. We assigned<br />

a high priority to training and professional<br />

development measures for employees at<br />

all levels, conducting seven induction courses<br />

and providing a total of 30 internal and external<br />

training measures for existing staff.<br />

• <strong>ProCredit</strong> <strong>Bank</strong> was chosen as one of the most<br />

desirable employers in <strong>2008</strong> by visitors to one<br />

of the country’s biggest Internet job search<br />

engines, Posao.ba.<br />

• The bank initiated a high-profile savings campaign<br />

in June to promote our range of easily<br />

accessible savings products to potential depositors.<br />

<strong>ProCredit</strong> <strong>Bank</strong> provides transparent,<br />

easy-to-understand interest rates and<br />

five deposit options designed to meet the<br />

needs of its broad customer base.<br />

• We continued implementing neighbourhood<br />

projects to help improve the quality of life in<br />

our local communities. <strong>ProCredit</strong> <strong>Bank</strong> built<br />

two children’s playgrounds, renovated classrooms<br />

in elementary schools, and planted<br />

trees in public areas, such as outside a children’s<br />

day care centre in Banja Luka.

Highlights in <strong>2008</strong> 15<br />

• Financial education activities were an important<br />

focus in <strong>2008</strong>, and we held a total of<br />

59 educational events at locations throughout<br />

the country. As part of these activities,<br />

<strong>ProCredit</strong> <strong>Bank</strong> launched its “Kids’ Corner”<br />

website, which provides information on money<br />

and banking in a form which children can<br />

easily understand.<br />

• <strong>ProCredit</strong> <strong>Bank</strong> launched a promotional campaign<br />

under the name “ProBiznis” which<br />

highlighted the ways in which small and medium<br />

enterprises can improve their performance<br />

using our services. The focus was on<br />

the advantages of having a reliable banking<br />

partner that offers loans on straightforward<br />

terms and conditions, including interest rates<br />

that are fixed for the entire maturity period.

16<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

Management Business Review<br />

Management<br />

standing,<br />

from left to right:<br />

Senad Redžić<br />

Executive Director, Corporate Business Sector<br />

Vedran Hadžiahmetović<br />

Executive Director, General Services Sector<br />

Edin Hrnjica<br />

Executive Director, Treasury, Retail and Payments Sector<br />

Radomir Savić<br />

Executive Director, Risk and Compliance Sector<br />

seated,<br />

from left to right:<br />

Sabina Mujanović<br />

Executive Director, Accounting and Controlling Sector<br />

Peter Moelders<br />

Director<br />

Maja Hrnjić<br />

Senior Management Advisor

Management Business Review 17<br />

Political and Economic Environment<br />

The Stabilisation and Association Agreement<br />

(SAA) with BiH was signed in June <strong>2008</strong>, signalling<br />

the European Union’s readiness to support<br />

the country’s bid for EU accession. Reform of the<br />

national constitution, however, remains at the top<br />

of the international political agenda. Progress on<br />

this front has been impeded by the apparent irreconcilability<br />

of the major political parties’ positions<br />

and deteriorating relations between them.<br />

An agreement on constitutional reform therefore<br />

seems unlikely in the near future. A high level of<br />

public spending and inefficient public administration,<br />

as well as the general lack of fiscal responsibility<br />

shown by the country’s governing entities,<br />

will continue to be high on the agenda of pressing<br />

political issues in 2009 and beyond.<br />

<strong>Annual</strong> GDP growth came to 6.8% in <strong>2008</strong>, up from<br />

5.8% in 2007. The expansion was driven by a favourable<br />

external environment and a strong rise in<br />

private consumption due to increased real wages<br />

and consumer borrowing. However, due to a tighter<br />

monetary policy and slower export growth, real<br />

GDP growth is projected to slow to 5.5% in 2009,<br />

stabilising thereafter at a level of around 5%. 1<br />

There was greater industrial output during the<br />

year, which is projected to continue rising with<br />

large-scale developments in road networks and<br />

energy grids. The SAA will probably have a positive<br />

impact on some local producers due to the reduction<br />

or abolition of customs duties on a wide<br />

range of imports from the EU. At the same time,<br />

reduced collection of duties might lead to further<br />

declines in the revenues of the country’s governing<br />

entities.<br />

The currency board arrangement remained in place<br />

with the local currency – the convertible mark<br />

(BAM) – pegged to the euro at a fixed rate. This<br />

contributed greatly to macroeconomic stability.<br />

Consumer price inflation stood at 9.9% at yearend.<br />

2 Inflation during <strong>2008</strong> was driven primarily<br />

by increases in food prices and housing and heating<br />

costs, which together accounted for 55% of<br />

household expenditures in BiH.<br />

Both exports and imports rose during <strong>2008</strong>. Although<br />

electricity exports doubled, a greater<br />

level of imports drove the current account deficit<br />

to 16%. This is projected to remain high in the<br />

coming year.<br />

The International Monetary Fund and other international<br />

institutions have urged the authorities in<br />

BiH to make a greater effort to reduce the regulatory<br />

burden on businesses. In <strong>2008</strong> the World <strong>Bank</strong>’s<br />

“Doing Business” report ranked BiH 119th among<br />

181 countries in terms of the constraints faced by<br />

businesses. This poor ranking was attributable to<br />

the difficulties involved in starting a business and<br />

registering property, as well as other bureaucratic<br />

requirements to be met by businesses.<br />

Financial Sector Developments<br />

The banking industry comprises 31 institutions<br />

and is dominated by foreign capital. <strong>Bank</strong>s with foreign<br />

capital held 81.9% of the sector’s total capital<br />

at year-end. Concentration was moderate, with the<br />

three largest banks holding 67.4% of total assets. 3<br />

Growth in the banking sector slowed down in<br />

<strong>2008</strong> compared to the previous two years. Total<br />

assets increased by 11% to BAM 22.2 billion (EUR<br />

11.1 billion) at year-end.<br />

The banking sector’s total loan portfolio grew<br />

to BAM 14.6 billion (EUR 7.4 billion), 4 which was<br />

63% of GDP. Loans with a maturity of more than<br />

one year accounted for 74% of total loans, or BAM<br />

10.9 billion (EUR 5.6 billion).<br />

The overall rate of credit growth in <strong>2008</strong> was<br />

22% on an annual basis, somewhat below the reported<br />

increase of 28% in 2007. While the sector<br />

was growing at the same year-on-year pace over<br />

1<br />

Unless otherwise indicated, figures are based on:<br />

www.imf.org, Bosnia and Herzegovina: On the Road to<br />

EU Accession, November <strong>2008</strong><br />

2<br />

Data in this and the following sections are based on EIU,<br />

Country <strong>Report</strong> Bosnia and Herzegovina, November<br />

<strong>2008</strong>. Inflation is calculated according to the EU-harmonised<br />

measure, which differs from the IMF source<br />

3<br />

Federation of Bosnia and Herzegovina only, Federal<br />

<strong>Bank</strong>ing Agency <strong>Report</strong>: September 30, <strong>2008</strong>.<br />

4<br />

Data based on Central <strong>Bank</strong> BiH monthly statistics as of<br />

December <strong>2008</strong>

18<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

the first two quarters, the second half of the year<br />

was characterised by restricted lending growth,<br />

especially in the final quarter. The majority of<br />

loans outstanding on December 31 had maturities<br />

exceeding one year. Short-term loans increased<br />

at a rate of 35% over the course of the year, with<br />

most growth occurring between January and June.<br />

Loans with a maturity over 12 months grew at a<br />

slower pace of 18% with a slight negative growth<br />

rate in November and December. 5<br />

Stricter lending conditions were largely an effect<br />

of the international financial crisis. Liquidity levels<br />

declined when depositors’ confidence was briefly<br />

shaken in October, leading them to withdraw<br />

some EUR 400 million from commercial banks,<br />

or 6.3% of total sector deposits. To reassure savers,<br />

deposit insurance coverage was significantly<br />

increased and banks demonstrated an ability to<br />

meet withdrawal requests. This action steadied<br />

the volume of household deposits in particular,<br />

which accounted for 46% of total deposits. Due<br />

to additional withdrawals by state bodies and<br />

state-owned companies in the last quarter, total<br />

deposits decreased by 1% to EUR 6.1 billion 6 over<br />

the year.<br />

been required for new foreign loans since October.<br />

The banking sector showed reduced profitability<br />

in <strong>2008</strong> compared to the previous year. This was<br />

due in part to losses from securities trading, but it<br />

also reflected increased funding costs.<br />

In <strong>2008</strong>, the Central Credit Registry for both companies<br />

and private individuals became fully functional.<br />

Managed by the Central <strong>Bank</strong> of Bosnia and<br />

Herzegovina (CBBH), it now includes information<br />

on all loans disbursed by banks and microcredit<br />

organisations in BiH. By enabling lenders to determine<br />

precisely how much debt loan applicants<br />

have already incurred from other institutions, the<br />

registry has greatly increased transparency in the<br />

lending market.<br />

The 10 largest of the 20 microcredit organisations<br />

operating in BiH increased their combined<br />

loan portfolio by 17% to BAM 1 billion (EUR 511<br />

million). 7 While this segment continued to show<br />

strong growth, it was at a lower pace due to more<br />

formal banking regulation, which will also lead to<br />

stricter lending requirements in the coming period.<br />

The central bank increased the mandatory reserve<br />

requirement from 15% to 18% at the beginning of<br />

<strong>2008</strong> in order to stabilise lending growth, but then<br />

reduced the requirement to 14% in October. To encourage<br />

additional inflows of long-term financing<br />

from foreign sources, no mandatory reserve has<br />

5<br />

Data based on monthly statistics provided by the CBBH<br />

6<br />

<strong>Annual</strong>ised data based on CBBH monthly statistics<br />

7<br />

Figures on number of registered micro credit organisations<br />

are based on Central <strong>Bank</strong> annual report 2007.<br />

Gross loan portfolio growth is based on data provided by<br />

the respective institutions.<br />

Loan Portfolio Development<br />

Number of Loans Outstanding – Breakdown by Loan Size*<br />

Volume (in EUR million)<br />

Number (in ’000)<br />

180<br />

90<br />

2.74% 0.35%<br />

160<br />

140<br />

80<br />

70<br />

o.08%<br />

120<br />

60<br />

100<br />

50<br />

80<br />

40<br />

46.8%<br />

60<br />

40<br />

30<br />

20<br />

50.0%<br />

20<br />

10<br />

0<br />

Jun<br />

04<br />

Dec<br />

Jun<br />

05<br />

Dec<br />

Jun<br />

06<br />

Dec<br />

Jun<br />

07<br />

Dec<br />

Jun<br />

08<br />

Dec<br />

0<br />

< EUR 1,000 EUR 50,001 – EUR 150,000<br />

EUR 1,001 – EUR 10,000 > EUR 150,000<br />

EUR 10,001 – EUR 50,000 * 31 Dec <strong>2008</strong>

Management Business Review 19<br />

Business Loan Portfolio – Breakdown by Maturity<br />

Loan Portfolio Quality (arrears >30 days)<br />

in %<br />

in % of loan portfolio<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Jun<br />

04<br />

Dec<br />

Jun<br />

05<br />

Dec<br />

Jun<br />

06<br />

Dec<br />

Jun<br />

07<br />

Dec<br />

Jun<br />

08<br />

Dec<br />

3.0<br />

2.7<br />

2.4<br />

2.1<br />

1.8<br />

1.5<br />

1.2<br />

0.9<br />

0.6<br />

0.3<br />

0<br />

Jun<br />

04<br />

Dec<br />

Jun<br />

05<br />

Dec<br />

Jun<br />

06<br />

Dec<br />

Jun<br />

07<br />

Dec<br />

Jun<br />

08<br />

Dec<br />

< 12 months 12 – 24 months > 24 months<br />

Net write-offs:<br />

in 2004: EUR 59,124<br />

in 2005: EUR 270,002<br />

in 2006: EUR 254,409<br />

in 2007: EUR 703,616<br />

in <strong>2008</strong>: EUR 2,538,340

20<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

Lending Performance<br />

<strong>ProCredit</strong> <strong>Bank</strong> continued to provide loans on an individually<br />

assessed basis to very small, small and<br />

medium-sized businesses and agricultural producers<br />

throughout BiH. By targeting such enterprises,<br />

we contributed to economic growth and job creation<br />

and helped to improve income distribution.<br />

We made no major increases in our lending interest<br />

rates in <strong>2008</strong> despite the changes taking place<br />

both in the local market and around the world. In<br />

view of the role of our target clients in the overall<br />

development of the economy, we considered it extremely<br />

important to be able to provide them with<br />

as much certainty and predictability as possible<br />

in their credit relationships with us. To this end,<br />

we did not change our policy of charging fixed interest<br />

rates on all loans. Only a few other banks in<br />

the country have fixed loan rates.<br />

As the Central Credit Registry was taken over<br />

by the CBBH in <strong>2008</strong>, banks and micro credit<br />

organisations were finally able to assess both<br />

companies’ and private individuals’ total levels<br />

of indebtedness with a high degree of accuracy.<br />

Given the greater transparency that this created,<br />

it became clear to us that many of our clients were<br />

indeed over-indebted – above all because they<br />

had been taking out consumer loans from other<br />

Customer Deposits<br />

Number of Customer Deposits – Breakdown by Size*<br />

Volume (in EUR million)<br />

Number (in ’000)<br />

180<br />

135<br />

1.6%<br />

0.1%<br />

160<br />

140<br />

120<br />

120<br />

105<br />

90<br />

8.8%<br />

o.04%<br />

100<br />

80<br />

75<br />

60<br />

15.3%<br />

60<br />

40<br />

45<br />

30<br />

74.0%<br />

20<br />

15<br />

0<br />

Jun<br />

04<br />

Dec<br />

Jun<br />

05<br />

Dec<br />

Jun<br />

06<br />

Dec<br />

Jun<br />

07<br />

Dec<br />

Jun<br />

08<br />

Dec<br />

0<br />

Term Savings Sight Total number<br />

< EUR 100 EUR 10,001 – EUR 50,000<br />

EUR 101 – EUR 1,000 EUR 50,001 – EUR 100,000<br />

EUR 1,001 – EUR 10,000 > EUR 100,000<br />

* 31 Dec <strong>2008</strong>

Management Business Review 21<br />

banks and microcredit organisations that had<br />

lent liberally over the years. Although <strong>ProCredit</strong><br />

<strong>Bank</strong> has always maintained a conservative and<br />

prudent approach when approving loans, the fact<br />

that many of our borrowers also had loans outstanding<br />

at other institutions adversely affected<br />

their repayment capacity, and thus impacted our<br />

portfolio at risk (the proportion of total loans in arrears<br />

by over 30 days). The PAR rose from 1.6% at<br />

the end of 2007 to 2.3% at year-end. Additional<br />

causes for this increase could be seen in external<br />

shocks, such as accelerating inflation, which created<br />

liquidity constraints for small businesses.<br />

As of December 31, the portfolio comprised<br />

65,277 outstanding loans totalling BAM 318.6<br />

million (EUR 162.9 million). The bank disbursed<br />

42,000 loans during the year with a combined<br />

volume of BAM 273.0 million (EUR 139.6 million).<br />

An average loan disbursement of BAM 6,505 (EUR<br />

3,326) reflects our continuing focus on our designated<br />

target groups.<br />

Loans outstanding to agricultural producers and<br />

sole proprietors amounted to BAM 163.4 million<br />

(EUR 83.5 million) at year-end, representing 51.3%<br />

of the bank’s total portfolio. Loans to small and medium<br />

enterprises stood at BAM 107.7 million (EUR<br />

55.0 million), representing an increase of 10.8%<br />

over 2007. In the coming year, the bank will focus<br />

on boosting its market share in this segment, introducing<br />

new products and services that are tailored<br />

to the requirements of the SME target group.<br />

Our portfolio of bank guarantees and letters of<br />

credit increased by 22.5% to BAM 9.3 million<br />

(EUR 4.8 million). In line with our mission to support<br />

the development of as many small businesses<br />

as possible, we will seek to further increase<br />

our market share of these non-lending products<br />

in the coming year.<br />

Deposits and Other <strong>Bank</strong>ing Services<br />

Despite turbulence in the BiH economy, <strong>ProCredit</strong><br />

<strong>Bank</strong> significantly expanded its deposit base during<br />

<strong>2008</strong>. At year-end, the bank had over 145,000<br />

account holders with 113,096 active accounts.<br />

Total deposits were up by 20%, compared to a<br />

total decrease of 1% for the banking sector as a<br />

whole. At BAM 335.6 million (EUR 171.6 million),<br />

this amount was equivalent to 72.3% of total assets<br />

and 105.0% of the bank’s loan portfolio.<br />

The average individual deposit amount was BAM<br />

2,406 (EUR 1,230), while the average balance per<br />

customer stood at BAM 2,347 (EUR 1,200).<br />

Given the general loss of public confidence in<br />

the banking sector, we consider the growth we<br />

achieved in our deposit business to be a positive<br />

reflection of our solid reputation amongst savers.<br />

It also demonstrates the success of our efforts<br />

to promote a savings culture in BiH and the effectiveness<br />

of our commitment to providing simple,<br />

transparent savings products and high-quality<br />

service.<br />

Domestic Money Transfers<br />

International Money Transfers<br />

Volume (in EUR million)<br />

750<br />

675<br />

600<br />

525<br />

450<br />

375<br />

300<br />

225<br />

150<br />

75<br />

0<br />

Jan–<br />

Jun<br />

04<br />

Jul–<br />

Dec<br />

Jan–<br />

Jun<br />

05<br />

Jul–<br />

Dec<br />

Jan–<br />

Jun<br />

06<br />

Jul–<br />

Dec<br />

Jan–<br />

Jun<br />

07<br />

Incoming Outgoing Number<br />

Jul–<br />

Dec<br />

Number (in ’000)<br />

Jan–<br />

Jun<br />

08<br />

Jul–<br />

Dec<br />

1,000<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Volume (in EUR million)<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Jan–<br />

Jun<br />

04<br />

Jul–<br />

Dec<br />

Jan–<br />

Jun<br />

05<br />

Jul–<br />

Dec<br />

Jan–<br />

Jun<br />

06<br />

Jul–<br />

Dec<br />

Jan–<br />

Jun<br />

07<br />

Incoming Outgoing Number<br />

Jul–<br />

Dec<br />

Number (in ’000)<br />

Jan–<br />

Jun<br />

08<br />

Jul–<br />

Dec<br />

30<br />

27<br />

24<br />

21<br />

18<br />

15<br />

12<br />

9<br />

6<br />

3<br />

0

22<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

As the result of intensive direct promotions, we<br />

mobilised a significant volume of new corporate<br />

deposits, demonstrating that our savings products<br />

continued to hold their appeal to business<br />

clients. At year-end, corporate deposits accounted<br />

for 53.8% of total deposits.<br />

The structure of the deposit portfolio was well<br />

balanced in terms of maturity structure: 19.2%<br />

of the total volume was in current accounts, with<br />

savings accounts contributing 7.7% and term<br />

deposits 73.1%. The average retail term deposit<br />

came to BAM 14,200 (EUR 7,270), compared with<br />

BAM 13,900 (EUR 7,100) in 2007, while the average<br />

corporate term deposit amounted to BAM<br />

1,177,350 (EUR 601,970).<br />

In <strong>2008</strong> we sought to encourage people who receive<br />

their salaries through current accounts at<br />

<strong>ProCredit</strong> <strong>Bank</strong> to begin using our full range of<br />

services. To this end, we organised numerous<br />

promotional events for the managers and employees<br />

of our corporate salary account clients.<br />

We expanded our ATM network to 33 units, installing<br />

seven new ATMs mainly in smaller cities.<br />

We also actively promoted our electronic banking<br />

services: the number of clients using our e-banking<br />

system increased by 68.4% to 1,623 users by<br />

the end of <strong>2008</strong>. The number of e-banking transactions<br />

also increased, rising to over 40,260,<br />

while the volume of such transactions was up by<br />

506.6%.<br />

<strong>ProCredit</strong> <strong>Bank</strong> continued to promote the use of<br />

cards as a safe and convenient way for both legal<br />

entities and private individuals to conduct payment<br />

and cash withdrawal transactions. We had<br />

a total of 32,423 active cards in circulation at the<br />

close of <strong>2008</strong>, of which 5.2% had been issued to<br />

legal entities. Most of our cards are debit cards,<br />

while 4.3% are charge cards that require the balance<br />

to be paid within one month. In line with its<br />

commitment to responsible consumer lending,<br />

the bank took great care to appropriately analyse<br />

the debt capacity of each client to whom a charge<br />

card was issued.<br />

Domestic as well as international payments grew<br />

significantly in <strong>2008</strong> in terms of both number<br />

and volume. <strong>ProCredit</strong> <strong>Bank</strong> executed 1,678,709<br />

domestic payments with a total volume of<br />

BAM 2.7 billion (EUR 1.4 billion), an increase of<br />

30.5% in number terms and a rise 43.7% in volume<br />

terms over 2007. The number of international<br />

payments rose by 37.2%, while the volume of<br />

such transactions was up by 18.4%.<br />

Financial Results<br />

<strong>ProCredit</strong> <strong>Bank</strong>’s total assets increased by 10%<br />

to BAM 464 million (EUR 237 million) in <strong>2008</strong>.<br />

Due to the slowdown in economic growth in the<br />

third quarter and the level of over-indebtedness<br />

in BiH, we focused on loan monitoring and recovery<br />

more than on portfolio expansion. As a<br />

result, the total loan portfolio grew by only 0.5%<br />

in <strong>2008</strong>, reaching BAM 318.6 million (EUR 162.9<br />

million) and accounting for 68.6% of total assets<br />

at year-end. The bank maintained a sound liquidity<br />

position with the share of liquid assets in total<br />

assets rising to 30.4%.<br />

To provide a solid foundation for our continuing<br />

asset growth, we further diversified our funding<br />

sources, drawing upon retail deposits and<br />

deposits from other banks as well as loans from<br />

international financial institutions and <strong>ProCredit</strong><br />

Holding. We also focused on attracting customer<br />

deposits, which grew by 20% to BAM 335.6 million<br />

(EUR 171.6 million). Balances in savings and<br />

term deposit accounts increased steadily, accounting<br />

for 80.8% of the total deposit volume<br />

by year-end. The resulting shift in the maturity<br />

structure of our deposits brought the structure of<br />

our liabilities more into line with that of our assets,<br />

thus greatly facilitating liquidity management.<br />

The increase in customer deposits reduced<br />

the share of total liabilities accounted for by borrowings<br />

from international financial institutions<br />

from 23% to 16%.<br />

Interest income for the year amounted to BAM<br />

57.9 million (EUR 29.6 million). This remained<br />

the main source of income, accounting for 89% of<br />

total income. Lending activities generated 87%<br />

of interest income. Even though the market was<br />

very competitive, <strong>ProCredit</strong> <strong>Bank</strong> did not have to<br />

alter its interest rates thanks to the continuing<br />

high demand for its loans. Deposit interest expenses<br />

were up, rising to BAM 19.2 million (EUR<br />

9.8 million) due to increasing competition in the<br />

local market and a rise in global interest rates.

Management Business Review 23<br />

The growth in interest income largely offset this<br />

increase in interest expenses.<br />

Net fee and commission income totalled EUR<br />

2.3 million. The growth here was greater than<br />

expected, reflecting a strong increase in the<br />

number and volume of payment transactions and<br />

the excellent development of the documentary<br />

and card businesses. Provisioning for loan impairment<br />

losses rose from BAM 4.5 million (EUR<br />

2.3 million) to BAM 6.8 million (EUR 3.5 million),<br />

a modest increase, given the higher credit risk<br />

which the bank faced in the market.<br />

To ensure the continuing growth of our institution,<br />

<strong>ProCredit</strong> <strong>Bank</strong> made substantial investments<br />

in personnel and fixed assets. We hired<br />

166 employees, increasing the number of staff to<br />

888. The bank established seven new branches,<br />

and many existing offices were extended and<br />

renovated. Thanks to rigorous cost controls, we<br />

were able to keep administrative expenses at the<br />

same level as in 2007.<br />

With a total operating income amounting to EUR<br />

19.3 million, the cost-income ratio (the ratio of<br />

operating expenses to operating income before<br />

provisioning) increased to 86.3% (2007: 81.9%).<br />

The bank posted a net loss of EUR 383,865, resulting<br />

in a return on equity of -1.8%, compared<br />

to 8.1% in 2007.<br />

Dividends amounting to BAM 2 million (EUR 1 million)<br />

were paid to the shareholders in December<br />

<strong>2008</strong>.<br />

In <strong>2008</strong> we carried out a capital increase in the<br />

amount of EUR 5 million, boosting total shareholders’<br />

funds to EUR 18.1 million. The bank’s<br />

capital adequacy ratio (total Tier 1 plus Tier 2 capital/risk-weighted<br />

assets) was 18.4% at year-end.<br />

Outlook<br />

During the first half of the year, some progress<br />

was made in terms of implementing much-needed<br />

reforms, which created a more favourable environment<br />

for potential economic growth. As the effects<br />

of the financial crisis begin to be felt on an increasing<br />

scale in the real economy, however, banks are<br />

applying more stringent credit standards and loans<br />

are more expensive. The overall economic outlook<br />

could therefore worsen significantly.<br />

Even in a significantly more challenging economic<br />

environment, <strong>ProCredit</strong> <strong>Bank</strong> will continue to provide<br />

loans to small and medium enterprises in order<br />

to support economic growth. In line with our<br />