Annual Report 2008 - ProCredit Bank

Annual Report 2008 - ProCredit Bank

Annual Report 2008 - ProCredit Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

26<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

Risk Management<br />

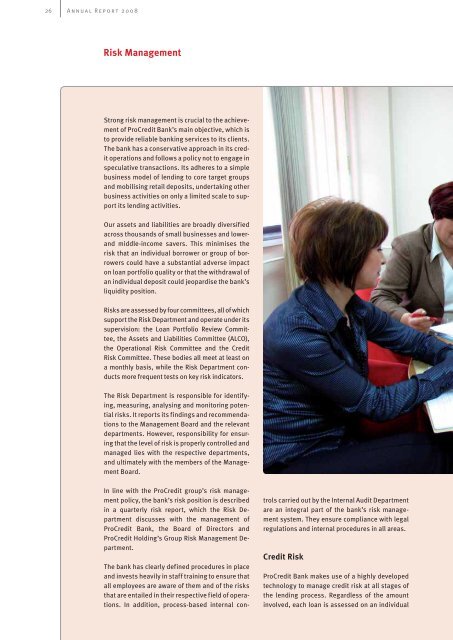

Strong risk management is crucial to the achievement<br />

of <strong>ProCredit</strong> <strong>Bank</strong>’s main objective, which is<br />

to provide reliable banking services to its clients.<br />

The bank has a conservative approach in its credit<br />

operations and follows a policy not to engage in<br />

speculative transactions. Its adheres to a simple<br />

business model of lending to core target groups<br />

and mobilising retail deposits, undertaking other<br />

business activities on only a limited scale to support<br />

its lending activities.<br />

Our assets and liabilities are broadly diversified<br />

across thousands of small businesses and lowerand<br />

middle-income savers. This minimises the<br />

risk that an individual borrower or group of borrowers<br />

could have a substantial adverse impact<br />

on loan portfolio quality or that the withdrawal of<br />

an individual deposit could jeopardise the bank’s<br />

liquidity position.<br />

Risks are assessed by four committees, all of which<br />

support the Risk Department and operate under its<br />

supervision: the Loan Portfolio Review Committee,<br />

the Assets and Liabilities Committee (ALCO),<br />

the Operational Risk Committee and the Credit<br />

Risk Committee. These bodies all meet at least on<br />

a monthly basis, while the Risk Department conducts<br />

more frequent tests on key risk indicators.<br />

The Risk Department is responsible for identifying,<br />

measuring, analysing and monitoring potential<br />

risks. It reports its findings and recommendations<br />

to the Management Board and the relevant<br />

departments. However, responsibility for ensuring<br />

that the level of risk is properly controlled and<br />

managed lies with the respective departments,<br />

and ultimately with the members of the Management<br />

Board.<br />

In line with the <strong>ProCredit</strong> group’s risk management<br />

policy, the bank’s risk position is described<br />

in a quarterly risk report, which the Risk Department<br />

discusses with the management of<br />

<strong>ProCredit</strong> <strong>Bank</strong>, the Board of Directors and<br />

<strong>ProCredit</strong> Holding’s Group Risk Management Department.<br />

The bank has clearly defined procedures in place<br />

and invests heavily in staff training to ensure that<br />

all employees are aware of them and of the risks<br />

that are entailed in their respective field of operations.<br />

In addition, process-based internal controls<br />

carried out by the Internal Audit Department<br />

are an integral part of the bank’s risk management<br />

system. They ensure compliance with legal<br />

regulations and internal procedures in all areas.<br />

Credit Risk<br />

<strong>ProCredit</strong> <strong>Bank</strong> makes use of a highly developed<br />

technology to manage credit risk at all stages of<br />

the lending process. Regardless of the amount<br />

involved, each loan is assessed on an individual