Annual Report 2008 - ProCredit Bank

Annual Report 2008 - ProCredit Bank

Annual Report 2008 - ProCredit Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

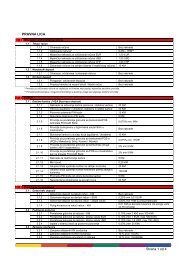

Financial Statements 55<br />

(e) Loans and advances to customers<br />

The <strong>Bank</strong> holds collateral against loans and advances to customers<br />

in the form of mortgage interest over property, other securities<br />

over assets and guarantees. Estimates of fair value of collateral are<br />

based on the value of collateral assessed at the time of borrowing,<br />

and generally are not updated except when a loan is individually assessed<br />

as impaired. Collateral is not held over loans and advances<br />

to banks and financial assets available for sale.<br />

The breakdown of the gross amount of individually impaired loans<br />

and advances by class, along with the fair value of related collateral<br />

held by the <strong>Bank</strong> as security, are as follows:<br />

Overdraft Housing Others Very SMEs Others<br />

small<br />

business<br />

31 December <strong>2008</strong><br />

Individually impaired loans – – – 26 2,571 –<br />

Collectively impaired loans 937 16,291 11,806 145,522 122,210 19,203<br />

Collateral 952 28,395 17,879 156,956 365,316 51,527<br />

31 December 2007<br />

Individually impaired loans – – – 27 2,060 –<br />

Collectively impaired loans 804 12,702 6,149 172,931 109,929 12,443<br />

Collateral 1,099 24,399 7,764 180,000 299,220 37,186<br />

The disclosed value of collateral is determined by local chartered<br />

surveyors and represents value estimated as realisable by the legal<br />

owners of the assets. Management considers the loans covered by<br />

collateral as impaired because experience shows that a significant<br />

proportion of the collateral cannot be enforced due to administrative<br />

and legal difficulties. The impairment provisions reflect the<br />

probability that management will not be able to enforce its rights<br />

and repossess collateral on defaulted loans.<br />

As at 31 December <strong>2008</strong> the <strong>Bank</strong> did not have any repossessed<br />

property or some other type of collateral.<br />

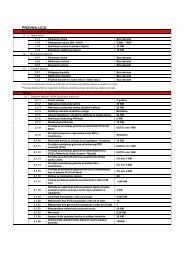

3.1.6 Concentration of risks of financial assets with credit risk<br />

exposure<br />

The <strong>Bank</strong> monitors concentrations of credit risk by economic sector<br />

and by geographic location. Credit portfolio risk is limited by<br />

the <strong>Bank</strong>’s credit strategy; in particular the focus on small and very<br />

small loans and the broad geographical and economic sector diversification<br />

of the loan portfolio. An analysis of such concentrations<br />

at the reporting date is shown below:<br />

Economic sector risk concentrations<br />

Wholesale Agriculture, Production Individuals Tourism, Other Total<br />

and retail forestry catering<br />

and fishing<br />

Loans and advances to banks – – – – – 28,754 28,754<br />

Loans and advances to customers<br />

– Overdrafts – – – 911 – – 911<br />

– Housing – – 422 15,592 – – 16,014<br />

– Consumer – – – 11,573 – – 11,573<br />

Loans to corporate entities:<br />

– Very small business 20,665 77,374 5,675 3,413 2,745 28,249 138,121<br />

– Small and medium size enterprises (SMEs) 60,256 2,427 24,318 5,982 7,819 21,562 122,364<br />

– Business overdrafts 12,209 185 3,129 922 235 2,089 18,769<br />

Financial investments available for sale – – – – – 196 196<br />

Other assets – – – – – 2,949 2,949<br />

As at 31 December <strong>2008</strong> 93,130 79,986 33,544 38,393 10,799 83,799 339,651<br />

As at 31 December 2007 88,091 92,721 32,952 25,324 10,976 66,407 316,471