Annual Report 2008 - ProCredit Bank

Annual Report 2008 - ProCredit Bank

Annual Report 2008 - ProCredit Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

56<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2008</strong><br />

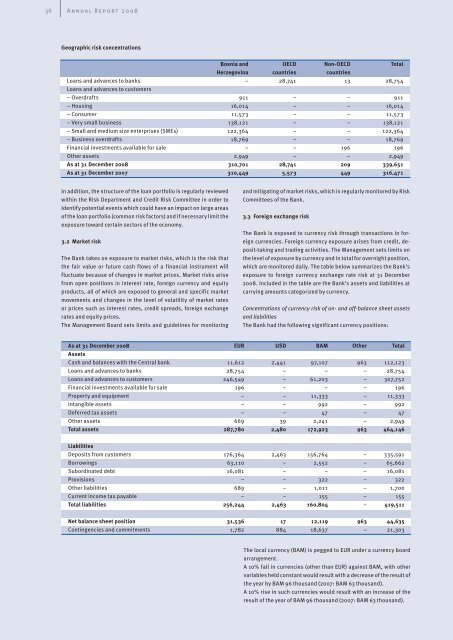

Geographic risk concentrations<br />

Bosnia and OECD Non-OECD Total<br />

Herzegovina countries countries<br />

Loans and advances to banks – 28,741 13 28,754<br />

Loans and advances to customers<br />

– Overdrafts 911 – – 911<br />

– Housing 16,014 – – 16,014<br />

– Consumer 11,573 – – 11,573<br />

– Very small business 138,121 – – 138,121<br />

– Small and medium size enterprises (SMEs) 122,364 – – 122,364<br />

– Business overdrafts 18,769 – – 18,769<br />

Financial investments available for sale – – 196 196<br />

Other assets 2,949 – – 2,949<br />

As at 31 December <strong>2008</strong> 310,701 28,741 209 339,651<br />

As at 31 December 2007 310,449 5,573 449 316,471<br />

In addition, the structure of the loan portfolio is regularly reviewed<br />

within the Risk Department and Credit Risk Committee in order to<br />

identify potential events which could have an impact on large areas<br />

of the loan portfolio (common risk factors) and if necessary limit the<br />

exposure toward certain sectors of the economy.<br />

3.2 Market risk<br />

The <strong>Bank</strong> takes on exposure to market risks, which is the risk that<br />

the fair value or future cash flows of a financial instrument will<br />

fluctuate because of changes in market prices. Market risks arise<br />

from open positions in interest rate, foreign currency and equity<br />

products, all of which are exposed to general and specific market<br />

movements and changes in the level of volatility of market rates<br />

or prices such as interest rates, credit spreads, foreign exchange<br />

rates and equity prices.<br />

The Management Board sets limits and guidelines for monitoring<br />

and mitigating of market risks, which is regularly monitored by Risk<br />

Committees of the <strong>Bank</strong>.<br />

3.3 Foreign exchange risk<br />

The <strong>Bank</strong> is exposed to currency risk through transactions in foreign<br />

currencies. Foreign currency exposure arises from credit, deposit-taking<br />

and trading activities. The Management sets limits on<br />

the level of exposure by currency and in total for overnight position,<br />

which are monitored daily. The table below summarizes the <strong>Bank</strong>’s<br />

exposure to foreign currency exchange rate risk at 31 December<br />

<strong>2008</strong>. Included in the table are the <strong>Bank</strong>’s assets and liabilities at<br />

carrying amounts categorized by currency.<br />

Concentrations of currency risk of on- and off-balance sheet assets<br />

and liabilities<br />

The <strong>Bank</strong> had the following significant currency positions:<br />

As at 31 December <strong>2008</strong> EUR USD BAM Other Total<br />

Assets<br />

Cash and balances with the Central bank 11,612 2,441 97,107 963 112,123<br />

Loans and advances to banks 28,754 – – – 28,754<br />

Loans and advances to customers 246,549 – 61,203 – 307,752<br />

Financial investments available for sale 196 – – – 196<br />

Property and equipment – – 11,333 – 11,333<br />

Intangible assets – – 992 – 992<br />

Deferred tax assets – – 47 – 47<br />

Other assets 669 39 2,241 – 2,949<br />

Total assets 287,780 2,480 172,923 963 464,146<br />

Liabilities<br />

Deposits from customers 176,364 2,463 156,764 – 335,591<br />

Borrowings 63,110 – 2,552 – 65,662<br />

Subordinated debt 16,081 – – – 16,081<br />

Provisions – – 322 – 322<br />

Other liabilities 689 – 1,011 – 1,700<br />

Current income tax payable – – 155 – 155<br />

Total liabilities 256,244 2,463 160,804 – 419,511<br />

Net balance sheet position 31,536 17 12,119 963 44,635<br />

Contingencies and commitments 1,782 884 18,637 – 21,303<br />

The local currency (BAM) is pegged to EUR under a currency board<br />

arrangement.<br />

A 10% fall in currencies (other than EUR) against BAM, with other<br />

variables held constant would result with a decrease of the result of<br />

the year by BAM 96 thousand (2007: BAM 63 thousand).<br />

A 10% rise in such currencies would result with an increase of the<br />

result of the year of BAM 96 thousand (2007: BAM 63 thousand).