Annual Report 2008 - ProCredit Bank

Annual Report 2008 - ProCredit Bank

Annual Report 2008 - ProCredit Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Risk Management 27<br />

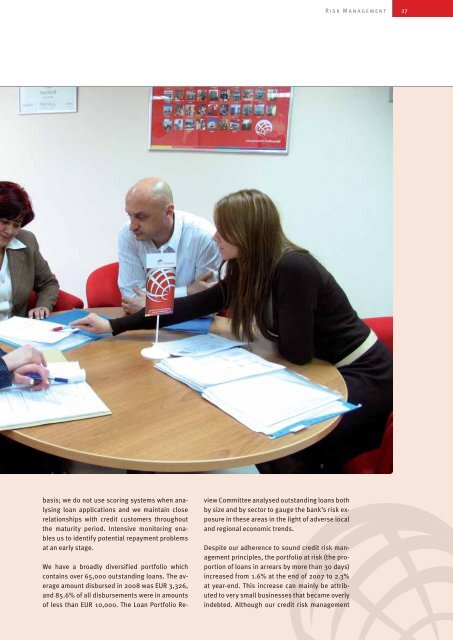

basis; we do not use scoring systems when analysing<br />

loan applications and we maintain close<br />

relationships with credit customers throughout<br />

the maturity period. Intensive monitoring enables<br />

us to identify potential repayment problems<br />

at an early stage.<br />

We have a broadly diversified portfolio which<br />

contains over 65,000 outstanding loans. The average<br />

amount disbursed in <strong>2008</strong> was EUR 3,326,<br />

and 85.6% of all disbursements were in amounts<br />

of less than EUR 10,000. The Loan Portfolio Review<br />

Committee analysed outstanding loans both<br />

by size and by sector to gauge the bank’s risk exposure<br />

in these areas in the light of adverse local<br />

and regional economic trends.<br />

Despite our adherence to sound credit risk management<br />

principles, the portfolio at risk (the proportion<br />

of loans in arrears by more than 30 days)<br />

increased from 1.6% at the end of 2007 to 2.3%<br />

at year-end. This increase can mainly be attributed<br />

to very small businesses that became overly<br />

indebted. Although our credit risk management