Annual Report 2008 - ProCredit Bank

Annual Report 2008 - ProCredit Bank

Annual Report 2008 - ProCredit Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

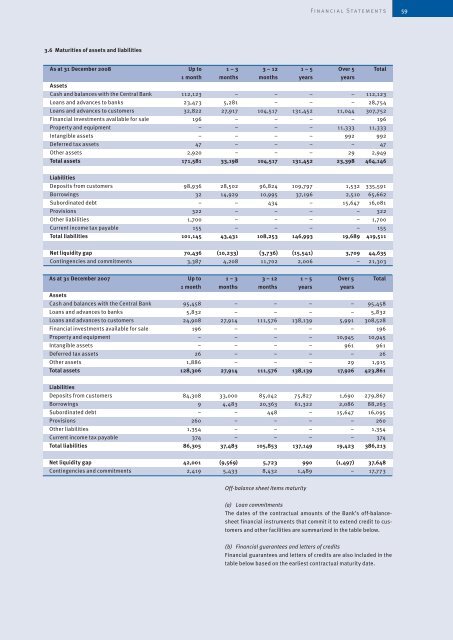

Financial Statements 59<br />

3.6 Maturities of assets and liabilities<br />

As at 31 December <strong>2008</strong> Up to 1 – 3 3 – 12 1 – 5 Over 5 Total<br />

1 month months months years years<br />

Assets<br />

Cash and balances with the Central <strong>Bank</strong> 112,123 – – – – 112,123<br />

Loans and advances to banks 23,473 5,281 – – – 28,754<br />

Loans and advances to customers 32,822 27,917 104,517 131,452 11,044 307,752<br />

Financial investments available for sale 196 – – – – 196<br />

Property and equipment – – – – 11,333 11,333<br />

Intangible assets – – – – 992 992<br />

Deferred tax assets 47 – – – – 47<br />

Other assets 2,920 – – – 29 2,949<br />

Total assets 171,581 33,198 104,517 131,452 23,398 464,146<br />

Liabilities<br />

Deposits from customers 98,936 28,502 96,824 109,797 1,532 335,591<br />

Borrowings 32 14,929 10,995 37,196 2,510 65,662<br />

Subordinated debt – – 434 – 15,647 16,081<br />

Provisions 322 – – – – 322<br />

Other liabilities 1,700 – – – – 1,700<br />

Current income tax payable 155 – – – – 155<br />

Total liabilities 101,145 43,431 108,253 146,993 19,689 419,511<br />

Net liquidity gap 70,436 (10,233) (3,736) (15,541) 3,709 44,635<br />

Contingencies and commitments 3,387 4,208 11,702 2,006 – 21,303<br />

As at 31 December 2007 Up to 1 – 3 3 – 12 1 – 5 Over 5 Total<br />

1 month months months years years<br />

Assets<br />

Cash and balances with the Central <strong>Bank</strong> 95,458 – – – – 95,458<br />

Loans and advances to banks 5,832 – – – – 5,832<br />

Loans and advances to customers 24,908 27,914 111,576 138,139 5,991 308,528<br />

Financial investments available for sale 196 – – – – 196<br />

Property and equipment – – – – 10,945 10,945<br />

Intangible assets – – – – 961 961<br />

Deferred tax assets 26 – – – – 26<br />

Other assets 1,886 – – – 29 1,915<br />

Total assets 128,306 27,914 111,576 138,139 17,926 423,861<br />

Liabilities<br />

Deposits from customers 84,308 33,000 85,042 75,827 1,690 279,867<br />

Borrowings 9 4,483 20,363 61,322 2,086 88,263<br />

Subordinated debt – – 448 – 15,647 16,095<br />

Provisions 260 – – – – 260<br />

Other liabilities 1,354 – – – – 1,354<br />

Current income tax payable 374 – – – – 374<br />

Total liabilities 86,305 37,483 105,853 137,149 19,423 386,213<br />

Net liquidity gap 42,001 (9,569) 5,723 990 (1,497) 37,648<br />

Contingencies and commitments 2,419 5,433 8,432 1,489 – 17,773<br />

Off-balance sheet items maturity<br />

(a) Loan commitments<br />

The dates of the contractual amounts of the <strong>Bank</strong>’s off-balancesheet<br />

financial instruments that commit it to extend credit to customers<br />

and other facilities are summarized in the table below.<br />

(b) Financial guarantees and letters of credits<br />

Financial guarantees and letters of credits are also included in the<br />

table below based on the earliest contractual maturity date.