D&O Liability Insurance - C5

D&O Liability Insurance - C5

D&O Liability Insurance - C5

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

“The <strong>C5</strong> D&O conference is “the place to be” ….For sure, one<br />

of the events of the year that cannot be missed ”<br />

Guillaume Deschamps, Senior Vice President, FINPRO Deputy Director,<br />

Continental Europe, D&O Practice Leader, Marsh (Delegate, 2011)<br />

Buy-side insights from a<br />

cross-industry selection of client<br />

speakers. Plus a limited number of<br />

complimentary seats for insurance<br />

buyers and risk managers<br />

Business Information<br />

In A Global Context<br />

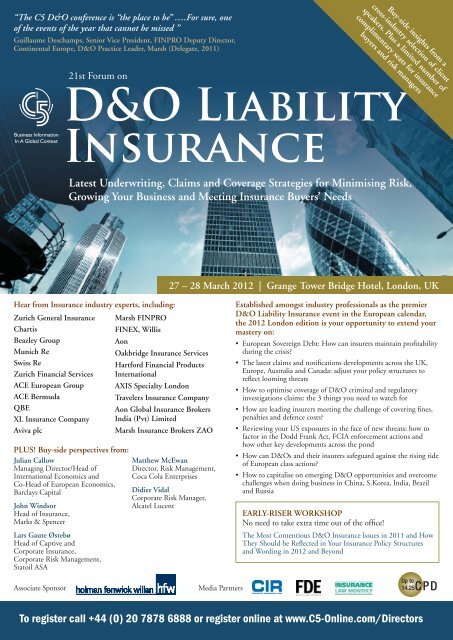

21st Forum on<br />

D&O <strong>Liability</strong><br />

<strong>Insurance</strong><br />

Latest Underwriting, Claims and Coverage Strategies for Minimising Risk,<br />

Growing Your Business and Meeting <strong>Insurance</strong> Buyers’ Needs<br />

27 – 28 March 2012 | Grange Tower Bridge Hotel, London, UK<br />

Hear from <strong>Insurance</strong> industry experts, including:<br />

Zurich General <strong>Insurance</strong><br />

Chartis<br />

Beazley Group<br />

Munich Re<br />

Swiss Re<br />

Zurich Financial Services<br />

ACE European Group<br />

ACE Bermuda<br />

QBE<br />

XL <strong>Insurance</strong> Company<br />

Aviva plc<br />

PLUS! Buy-side perspectives from:<br />

Julian Callow<br />

Managing Director/Head of<br />

International Economics and<br />

Co-Head of European Economics,<br />

Barclays Capital<br />

John Windsor<br />

Head of <strong>Insurance</strong>,<br />

Marks & Spencer<br />

Lars Gaute Østebø<br />

Head of Captive and<br />

Corporate <strong>Insurance</strong>,<br />

Corporate Risk Management,<br />

Statoil ASA<br />

Marsh FINPRO<br />

FINEX, Willis<br />

Aon<br />

Oakbridge <strong>Insurance</strong> Services<br />

Hartford Financial Products<br />

International<br />

AXIS Specialty London<br />

Travelers <strong>Insurance</strong> Company<br />

Aon Global <strong>Insurance</strong> Brokers<br />

India (Pvt) Limited<br />

Marsh <strong>Insurance</strong> Brokers ZAO<br />

Matthew McEwan<br />

Director, Risk Management,<br />

Coca Cola Enterprises<br />

Didier Vidal<br />

Corporate Risk Manager,<br />

Alcatel Lucent<br />

Established amongst industry professionals as the premier<br />

D&O <strong>Liability</strong> <strong>Insurance</strong> event in the European calendar,<br />

the 2012 London edition is your opportunity to extend your<br />

mastery on:<br />

• European Sovereign Debt: How can insurers maintain profitability<br />

during the crisis<br />

• The latest claims and notifications developments across the UK,<br />

Europe, Australia and Canada: adjust your policy structures to<br />

reflect looming threats<br />

• How to optimise coverage of D&O criminal and regulatory<br />

investigations claims: the 3 things you need to watch for<br />

• How are leading insurers meeting the challenge of covering fines,<br />

penalties and defence costs<br />

• Reviewing your US exposures in the face of new threats: how to<br />

factor in the Dodd Frank Act, FCIA enforcement actions and<br />

how other key developments across the pond<br />

• How can D&Os and their insurers safeguard against the rising tide<br />

of European class actions<br />

• How to capitalise on emerging D&O opportunities and overcome<br />

challenges when doing business in China, S.Korea, India, Brazil<br />

and Russia<br />

EARLY-RISER WORKSHOP<br />

No need to take extra time out of the office!<br />

The Most Contentious D&O <strong>Insurance</strong> Issues in 2011 and How<br />

They Should be Reflected in Your <strong>Insurance</strong> Policy Structures<br />

and Wording in 2012 and Beyond<br />

Associate Sponsor<br />

Media Partners<br />

Up to<br />

14.25CPD<br />

To register call +44 (0) 20 7878 6888 or register online at www.<strong>C5</strong>-Online.com/xxxxxxxxxxxxxx<br />

To register call +44 (0) 20 7878 6888 or register online at www.<strong>C5</strong>-Online.com/Directors

“Previously thought a luxury of large companies, D&O liability insurance in Europe is primed<br />

for robust growth across companies of all sizes, as it is increasingly viewed as essential ”<br />

(Advisen Report, 2011)<br />

The combined effect of the 2008 global recession and current economic pressures have ensured that Directors and Officers<br />

remain a focal point for both regulatory and shareholder scrutiny. With European Courts proving ever more receptive to group<br />

actions and increasingly proactive enforcement authorities stepping up investigations in a number of spheres including securities,<br />

anti-corruption and anti-trust, D&Os are more exposed than ever and may incur considerable costs in defending themselves,<br />

even when they feel the allegations are unfounded.<br />

It is therefore critical that D&O insurers anticipate the challenges looming on the horizon and take immediate mitigatory steps<br />

to avoid potentially extensive losses. At the same time, there are profits to be made - the insurance industry must exploit the<br />

opportunity to meet growing and emerging coverage needs across a number of jurisdictions and carve out an edge for themselves<br />

in today’s highly competitive market.<br />

Every Spring, over 100 underwriters and brokers, together with expert advisors, attend <strong>C5</strong>’s D&O <strong>Liability</strong> <strong>Insurance</strong> event in<br />

London. Now in its 21st edition, this conference is firmly established as THE essential industry gathering for anyone working<br />

in D&O insurance.<br />

Like hundreds of D&O professionals before you, attending this conference will ensure you are:<br />

❯ Up to the minute on D&O insurance industry developments in the UK, US, Europe and beyond, as well<br />

as macro-economic and legal issues affecting D&O insurance<br />

❯ Equipped to exploit the latest trends and statistics and market best practices for maximising profits<br />

❯ Geared to capitalise on growth opportunities in emerging markets<br />

❯ On top of claims trends world over whilst adapting your policies and client procedures to minimise exposures<br />

❯ Ahead of the game by benchmarking your practices and policies against your competitors<br />

Be sure to also attend the practically focused and interactive early-riser workshop.<br />

The Most Contentious D&O <strong>Insurance</strong> Issues in 2011 and How They Should be<br />

Reflected in Your <strong>Insurance</strong> Policy Structures and Wording in 2012 and Beyond<br />

28th March 2012 | 8.00–10.15 a.m<br />

There is no other event in Europe that focuses exclusively on D&O <strong>Liability</strong> <strong>Insurance</strong>. So don’t miss this unparalleled opportunity<br />

to meet, hear from and share ideas with those at the forefront of your industry.<br />

Book your place today, by calling us on +44 (0) 20 7878 6888, faxing your registration form to +44 (0) 20 7878 6885 or<br />

registering online at www.<strong>C5</strong>-Online.com/Directors<br />

WHO SHOULD ATTEND<br />

<strong>C5</strong>’s 21st D&O <strong>Liability</strong> <strong>Insurance</strong> is a must for:<br />

• D&O <strong>Insurance</strong> Underwriters<br />

• Brokers<br />

• Claims Personnel<br />

• Reinsurers<br />

• Product Leaders<br />

• <strong>Insurance</strong> buyers, risk managers, compliance personnel<br />

and in-house lawyers<br />

• <strong>Insurance</strong>/reinsurance lawyers in private practice<br />

GLOBAL SPONSORSHIP OPPORTUNITIES<br />

<strong>C5</strong> Group, works closely with sponsors to create the perfect business<br />

development solution catered exclusively to the needs of any practice<br />

group, business line or corporation. With over 500 conferences held<br />

in Europe, Russia and the CIS, China, India, the US and Canada, <strong>C5</strong>,<br />

ACI and CI provide a diverse portfolio of first-class events tailored to<br />

the senior level executive.<br />

For more information about this program or our global portfolio,<br />

please contact: Dan Capel on +44 (0)20 7878 6870<br />

or email d.capel@<strong>C5</strong>-Online.com

Distinguished Speakers<br />

Conference Co-Chairs<br />

Chris Magee<br />

Managing Director, Hartford Financial Products<br />

International Limited<br />

Glaucia Asvolinsque D. de Faria Smithson<br />

Chief Underwriting Officer,<br />

Commercial Executive Risks Europe<br />

Zurich General <strong>Insurance</strong><br />

Julian Callow<br />

Managing Director/Head of International<br />

Economics and Co-Head of<br />

European Economics,<br />

Barclays Capital<br />

John Windsor<br />

Head of <strong>Insurance</strong>,<br />

Marks & Spencer<br />

Lars Gaute Østebø<br />

Head of Captive and Corporate <strong>Insurance</strong>,<br />

Corporate Risk Management,<br />

Statoil ASA<br />

Matthew McEwan<br />

Director, Risk Management,<br />

Coca Cola Enterprises<br />

Didier Vidal<br />

Corporate Risk Manager,<br />

Alcatel Lucent<br />

Kevin LaCroix<br />

Partner,<br />

Oakbridge <strong>Insurance</strong> Services<br />

Stephanie P Manson<br />

Claims Advocate,<br />

UK FSG Legal & Claims Practice<br />

Agenda at a glance<br />

Francis Keane<br />

Executive Director FINEX,<br />

Willis<br />

Christoph Leuzinger<br />

Global Deputy Chief Underwriter,<br />

Management <strong>Liability</strong>,<br />

Zurich General <strong>Insurance</strong><br />

Mark Baily<br />

Head of Financial Lines Claims,<br />

Ace European Group<br />

Michael Rieger-Goroncy<br />

International Large Risks,<br />

Underwriter, Specialty Lines,<br />

Beazley Group<br />

Elisabeth Spann<br />

Head of Financial Lines, Global Clients/<br />

North America,<br />

Casualty Facultative, Munich Re<br />

Marcel Fischer<br />

Senior Underwriter, Facultative Casualty/<br />

Vice President - Europe, Middle East & Africa,<br />

Swiss Reinsurance Company Ltd<br />

Geraud Verhille<br />

European Commercial D&O and<br />

Crime Manager, Chartis<br />

Nepomuk Loesti<br />

European Financial Institutions,<br />

Underwriting Manager, Chartis<br />

Suresh Ellawala<br />

Professional & Financial Lines, QBE<br />

Cristiana Báez-Safa<br />

Chief Underwriting Officer<br />

Commercial Risks, International Professional<br />

XL <strong>Insurance</strong> Company Limited<br />

Guillaume Deschamps<br />

FINPRO CEMEA D&O Practice Leader,<br />

Marsh S.A., Continental Europe,<br />

D&O Practice Leader, Marsh<br />

Dax Gulmohamed<br />

Executive Vice President,<br />

AXIS Specialty London<br />

Nick Allen<br />

Management <strong>Liability</strong> Product Manager,<br />

Travelers <strong>Insurance</strong> Company Limited<br />

Carsten Keune<br />

Chief Underwriting Officer Professional<br />

Emerging Markets<br />

XL <strong>Insurance</strong> Company Ltd<br />

Uttara Viad<br />

COO & Executive Director,<br />

Aon Global <strong>Insurance</strong> Brokers (Pvt) Limited<br />

Vladimir Kryuchkov<br />

Senior Vice President, Finpro Practice Leader,<br />

Marsh <strong>Insurance</strong> Brokers ZAO<br />

David Gutteridge<br />

Vice President,<br />

ACE Bermuda<br />

Matthew Doherty<br />

Underwriting Manager,<br />

Arch <strong>Insurance</strong> Europe<br />

John Batch<br />

Senior Vice President, D&O Product Leader,<br />

FINPRO CEMEA<br />

Douglas Robare<br />

Head of Financial and Professional Lines, Aviva plc<br />

Conference Day One: 27 March 2012<br />

8.30 Registration and Coffee<br />

9.00 Chairman’s Opening Remarks<br />

9.15 How to Find Profits in a Challenging D&O <strong>Insurance</strong><br />

Market: Your Guide to the Next 12 Months<br />

10.30 Morning Refreshments<br />

10.45 European Sovereign Debt: How Can D&O Insurers<br />

Maintain Profitability During the Crisis<br />

Part 1 – Macroeconomic analysis<br />

Part 2 – D&O insurance analysis<br />

12.15 What is the Potential for Claims Arising From Action<br />

Against D&Os Under Anti-Corruption Legislation in<br />

the UK, US and Beyond<br />

1.00 Networking Lunch<br />

2.00 Claims Flowing from Criminal and Regulatory Investigations<br />

and Coverage of Fines, Penalties and Defence Costs:<br />

Experience to Date, What to Cover and What to Exclude<br />

3.00 Afternoon Refreshments<br />

3.15 Ensuring Your Policies Can Withstand the Latest US D&O<br />

Legislative, Case Law and Enforcement Developments<br />

4.00 UK and European D&O Claims, Settlements, Class Actions<br />

and Other Litigation: How to Factor the Latest Developments<br />

into Your D&O <strong>Insurance</strong> Strategy<br />

Part 1 – Claims update<br />

Part 2 – European class actions and other litigation<br />

Part 3 – Australia, Canada and other D&O Claims hotspots<br />

5.30 Conference Adjourns<br />

Conference Day Two: 28 March 2012<br />

8.00 Early Riser Workshop: The Most Contentious D&O<br />

<strong>Insurance</strong> Issues in 2011 and How They Should be Reflected<br />

in Your <strong>Insurance</strong> Policy Structures and Wording in 2012<br />

and Beyond<br />

10.00 Morning Refreshments<br />

10.15 Workshop Ends<br />

10.20 Chairman’s Opening Remarks<br />

10.30 What Current Exposures Are Keeping D&Os and Risk<br />

Managers Awake at Night and What Solutions Are Being<br />

Sought by Their <strong>Insurance</strong> Buyers<br />

11.30 The Key Policy Amendments and Coverage Issues You<br />

Need to Be Aware of to Provide Profitable Coverage in a<br />

Turbulent Market<br />

12.30 Networking Lunch<br />

1.30 How to Take Advantage of D&O Opportunities in Emerging<br />

Markets: China, India, Brazil and Russia<br />

3.30 Afternoon Refreshments<br />

3.45 How to prepare for a Potential Rise in Corporate Insolvency<br />

– and What That Means for Your Business<br />

4.45 Reinsurance Market Leaders’ Perspective on Current Market<br />

Conditions and Strategies for Risk Minimisation<br />

5.30 Chairman’s Closing Remarks and End of Conference<br />

Very practical and up to date information, as usual<br />

Remi Passemard, Partner,<br />

Bouckaert Ormen Passemard Sportes (Delegate, 2011)<br />

To register call +44 (0) 20 7878 6888 OR fax +44 (0) 20 7878 6885

DAY 1, TUESDAY, 27 MARCH 2012<br />

8.30 Registration and Coffee<br />

9.00 Conference Co-Chair’s Opening Remarks<br />

Chris Magee, Managing Director,<br />

Hartford Financial Products International Limited<br />

9.15 How to Find Profits in a Challenging D&O<br />

<strong>Insurance</strong> Market: Your Guide to the Next<br />

12 Months<br />

Christoph Leuzinger, Global Deputy Chief Underwriter,<br />

Management <strong>Liability</strong>, Zurich General <strong>Insurance</strong><br />

Geraud Verhille, European Commercial D&O and<br />

Crime Manager, Chartis<br />

Mark Baily, Head of Financial Lines Claims,<br />

Ace European Group<br />

Michael Rieger-Goroncy, International Large Risks<br />

Underwriter, Specialty Lines, Beazley Group<br />

Enrico Nanni, Managing Director, Aon<br />

• What are the macro trends affecting the D&O market<br />

• Where are the main global exposures<br />

• How much D&O capacity is there in the market currently<br />

What changes are expected in the coming 12 months<br />

• What are the main areas of growth Where are insurers<br />

seeing opportunities to get an edge over competitors<br />

- to what extent is there a market for transactional liability<br />

products, given mergers are expected to increase<br />

- where has D&O cover been deemed mandatory<br />

or prescribed as best practice<br />

• What emerging risks must the market factor in<br />

- to what extent are D&Os likely to be targets for losses<br />

stemming from the sovereign debt crisis<br />

- losses caused by rogue traders at banks: what are<br />

shareholders doing by way of taking against officers<br />

responsible<br />

- how has the market reacted to such emerging risks<br />

and what migratory steps are being taken right now<br />

• Pricing trends: are rates reflective of risks<br />

• Overview of recent D&O purchasing: what products are<br />

clients buying and where does Excess cover come in<br />

• How much broader will or should coverage become What<br />

are the implications of ever-broadening of primary coverage<br />

• New products and extensions<br />

• Availability of reinsurance and terms<br />

• Opportunities for profit, loss drivers and D&O insurance<br />

developments in SMEs, large accounts and financial<br />

institutions<br />

- claim trends<br />

- claims from privately held vs listed companies<br />

- pricing developments<br />

- P&L dynamics<br />

- acquisition and transactions costs<br />

- innovation<br />

• What factors are most important to brokers when deciding<br />

which insures to work with<br />

- pricing<br />

- coverage<br />

- ratings<br />

- financial security<br />

- new products capacity<br />

- internal resources, including for claims handling<br />

10.30 Morning Refreshments<br />

10.45 European Sovereign Debt: How Can D&O<br />

Insurers Maintain Profitability During the Crisis<br />

Part 1 – Macroeconomic analysis<br />

Julian Callow, Managing Director/Head of International<br />

Economics and Co-Head of European Economics,<br />

Barclays Capital<br />

• How is the 2008 economic crisis different from the<br />

current situation<br />

• How is economic growth being impaired How are<br />

on-going economic conditions impacting on business<br />

• Who is most significantly impacted by sovereign debt<br />

exposure and what is the wider impact<br />

• To what extent do entities exposed to sovereign debt<br />

also have US exposure<br />

• Outlook for the coming 12-18 months<br />

Part 2 – Impact on D&O insurance<br />

Geraud Verhille, European Commercial D&O<br />

and Crime Manager, Chartis<br />

Nepomuk Loesti, European Financial Institutions<br />

Underwriting, Manager, Chartis<br />

• Impact on the financial institutions D&O<br />

- what were the main insurance implications of the 2008<br />

vs current crisis What is different today<br />

- how does the performance of insurance products in<br />

2008 compare with their current response to economic<br />

conditions<br />

- varying impact for banks, assets managers, insurance<br />

companies and other players<br />

- claims experience so far and potential claims scenarios<br />

• Impact on the commercial companies D&O<br />

- most impacted industry sectors from an insurance<br />

perspective<br />

- recession related claims scenarios and experience<br />

• US exposure for both financial institutions and<br />

commercial products/lines in 2008 vs projected exposures<br />

in the coming months<br />

• Assessing likely impact on insurers’ profitability<br />

12.15 What is the Potential for Claims Arising From<br />

Actions Against D&Os Under Anti-Corruption<br />

Legislation in the UK, US and Beyond<br />

Vivian Robinson QC, Partner, McGuireWoods London<br />

LLP/Formerly General Counsel, the Serious Fraud<br />

Office (SFO),<br />

Suresh Ellawala, Professional & Financial Lines, QBE<br />

• Recent prosecutions and enforcement priorities under<br />

the FCPA<br />

• The UK Bribery Act in practice: early complaints,<br />

investigations and prosecutions<br />

• Understanding the full scope of the law: what offences<br />

by D&Os will qualify for scrutiny under key bribery/anticorruption<br />

legislation and as interpreted by the relevant<br />

authorities<br />

• Ascertaining the full territorial reach of the acts beyond<br />

the US and UK: when will your clients in other<br />

jurisdictions be impacted and how<br />

• 8 out of 10 largest recent FCPA fines are related to UK<br />

or European companies: how is this reflected in D&O<br />

claims<br />

• What provisions should insurers insist on to limit their<br />

own exposures viz. the individual D&Os/the business<br />

entity What questions must insurers ask their insureds<br />

1.00 Networking Lunch<br />

To register call +44 (0) 20 7878 6888 OR fax +44 (0) 20 7878 6885

2.00 Claims Flowing from Criminal and Regulatory<br />

Investigations and Coverage of Fines, Penalties<br />

and Defence Costs: Experience to Date, What to<br />

Cover and What to Exclude<br />

Cristiana Báez-Safa, Chief Underwriting Officer<br />

Commercial Risks, International Professional<br />

XL <strong>Insurance</strong> Company Limited<br />

Guillaume Deschamps, FINPRO CEMEA D&O<br />

Practice Leader, Marsh S.A., Continental Europe<br />

D&O Practice Leader, Marsh<br />

Dr Alexander Mahnke, CEO <strong>Insurance</strong>,<br />

Siemens Financial Services, GmbH<br />

• In which areas are investigations against D&Os especially<br />

prevalent and which authorities are the most proactive<br />

- securities exposures<br />

- competition authorities<br />

- anti-corruption<br />

- money laundering<br />

• How are investigation costs normally covered<br />

- formal regulatory investigations vs internal investigations<br />

- cover for civil fines and penalties<br />

- sub-limited cover<br />

• Current views on coverage for fines and penalties–Legally<br />

permissible/not permissible<br />

- UK and US approach<br />

- varying approaches in different European countries<br />

• Defence costs: what costs are considered ”reasonable”<br />

Which standard prevails: “necessary”/“required”<br />

• Challenges in providing effective cover and insurance<br />

industry responses<br />

- expanding current D&O policy to include it<br />

vs developing dedicated policies<br />

- implications for shared limits/sub-limits<br />

- practical experience so far<br />

• Recent examples of claims and policy responses<br />

3.00 Afternoon Refreshments<br />

3.15 Ensuring Your Policies Can Withstand the<br />

Latest US D&O Legislative, Case Law and<br />

Enforcement Developments<br />

Kevin LaCroix, Partner, Oakbridge <strong>Insurance</strong> Services<br />

• Impact of the Morrison decision on securities litigation<br />

Involving non-U.S. companies<br />

• What was the rationale for even broader coverage seen<br />

in the past 12 months<br />

• D&O implications flowing from the implementation<br />

of the Dodd Frank Act<br />

• The impact of the new whistle-blower provisions: to what<br />

extent is this expected to result in a rise in shareholder<br />

litigation<br />

• Rise in SEC and other investigation claims and insurance<br />

coverage by the US market<br />

• What implications flow for D&Os from the rising tide<br />

of FCIA enforcement actions against banks<br />

• Increase in M&A related litigation: frequency, severity<br />

and coverage Implications<br />

• Emerging and future exposures<br />

4.00 UK and European D&O Claims, Settlements,<br />

Class Actions and Other Litigation: How to<br />

Factor the Latest Developments into Your D&O<br />

<strong>Insurance</strong> Strategy<br />

Part 1 - Claims update<br />

Stephanie P Manson, Claims Advocate,<br />

UK FSG Legal & Claims Practice<br />

• Round up of key claims and notifications in the past<br />

12-18 months<br />

- nature and basis<br />

- how did the claims arise<br />

- amounts involved<br />

- how did the policy respond/what aspects didn’t and why<br />

- what were the insurance buyer’s expectations<br />

• What types of D&O behaviours have commonly led<br />

to common claims<br />

• Threatened claims from the previous recession<br />

- how many threatened financial crisis claims have come<br />

to fruition<br />

- what is the rationale behind the relatively low proportion<br />

of recession claims to date in the UK and Europe<br />

- why did cases such as the Northern Rock scenario<br />

not result in the expected claims<br />

- can insurers feasibly expect this trend to be replicated<br />

in a further recession<br />

• What is the true potential for lenders’ claims as a second<br />

recession looms and what are the early claims indications<br />

Part 2- Litigation update<br />

Hans Londonck Sluijk, Partner, Houthoff Buruma<br />

• In which areas are D&Os most vulnerable going forward<br />

• Cases of note in Europe and potential implications<br />

for D&O insurers<br />

• European class actions: one-off or trend<br />

- Dutch group action system – cases so far and impact<br />

on D&Os<br />

- Italian Intersa Sao Paulo case: on what basis was this<br />

class action approved and what is the likely impact on<br />

D&Os of the bank<br />

- what are the wider implications of these decisions for<br />

European class actions<br />

- how can developments in the Netherlands and Italy be<br />

expected to drive demand for insurance cover amongst<br />

D&Os<br />

- to what have recent French decisions thwarted the<br />

potential for class actions against D&Os in France<br />

Part 3 - Australia, Canada and other D&O claims hotspots<br />

Suresh Ellawala, Professional & Financial Lines, QBE<br />

• Class actions/securities class actions<br />

• Litigation funding trends and correlation with class action<br />

trends<br />

• Canadian dual traded companies: why are they so<br />

vulnerable to litigation<br />

• Other types of litigation against D&Os<br />

• The regulatory environment<br />

• The oppression remedy; what is it, and what does it mean<br />

for boards of directors<br />

5.30 Conference Adjourns<br />

Associate Sponsor<br />

Holman Fenwick Willan is a leading insurance<br />

and reinsurance law firm. HFW advises on<br />

all the types of protection available under<br />

management liability policies including Directors and Officers liability<br />

(“D&O”), Employment Practices <strong>Liability</strong> (“EPL”) Corporate Legal<br />

liability insurances and Pension Trustees liability insurance (“PTL”).<br />

HFW advise on coverage issues and defend insureds against third party<br />

liabilities. HFW also advise on wordings and new products including the<br />

definition and scope of terms and exclusions. We can also draw on our<br />

Regulatory and Employment teams on related issues, where necessary.<br />

Fax order form to +44 (0) 20 7878 6885 or register online at www.<strong>C5</strong>-Online.com/Directors

Day 2, WEDNESDAY, 28 March 2012<br />

Early Riser Workshop | 8.00 – 10.15 am<br />

The Most Contentious D&O <strong>Insurance</strong> Issues in<br />

2011 and How They Should be Reflected in Your<br />

<strong>Insurance</strong> Policy Structures and Wording in 2012<br />

and Beyond<br />

Douglas Robare<br />

Head of Financial and Professional Lines, Aviva Plc<br />

Costas Frangeskides<br />

Partner, Holman Fenwick Willan<br />

Led by a seasoned industry insider and an experienced legal expert,<br />

this workshop will draw on some of the most contentious and complex<br />

D&O issues encountered by the workshop presenters. With reference<br />

to case studies and examples which regularly arise in the D&O arena<br />

and common wording scenarios, the workshop leaders will analyse the<br />

significant coverage considerations each of those issues raise and guide<br />

participants on how these considerations should be refl ected in policy<br />

structures and wordings in the coming months. Topics for dicussion include:<br />

• Does your D&O insurance provide global cover What<br />

programme structures allow for optimal coverage<br />

• Do directors want their own ring-fenced insurance cover that<br />

will not be eroded by the companies’ claims Why would they<br />

need that and how do you achieve that<br />

• Insuring clauses: what is the scope of the insurance offered<br />

Does it cover all those risks you want it to cover<br />

• Current and emerging exclusion: how do these limit the cover<br />

Is it too limited What issues have recently arisen<br />

• Presumption of Indemnity: what are the consequences if a<br />

company wrongly refuses to indemnify a director How can<br />

they be prevented<br />

• What issues can develop from outside directorship extensions<br />

to the policies<br />

There will be plenty of Q&A opportunities and participants may also<br />

raise any specific questions they have for the workshop leaders ahead<br />

of the conference, via the conference organisers<br />

Main Conference<br />

10.00 Morning Refreshments<br />

10.20 Conference Co-Chair’s Opening Remarks<br />

Glaucia Asvolinsque D. de Faria Smithson<br />

Chief Underwriting Officer,<br />

Commercial Executive Risks Europe<br />

Zurich General <strong>Insurance</strong><br />

10.30 What Current Exposures Are Keeping D&Os<br />

and Risk Managers Awake at Night and What<br />

Solutions are Being Sought by Their <strong>Insurance</strong><br />

Buyers<br />

John Windsor, Head of <strong>Insurance</strong>, Marks & Spencer<br />

Lars Gaute Østebø<br />

Head of Captive and Corporate <strong>Insurance</strong>, Corporate<br />

Risk Management, Statoil ASA<br />

Didier Vidal, Corporate Risk Manager, Alcatel Lucent<br />

Matthew McEwan, Risk Management Director,<br />

Coca Cola Enterprises<br />

Douglas Robare, Head of Financial and Professional<br />

Lines, Aviva plc - moderator<br />

• What risks and exposures are currently on company<br />

secretaries’/risk managers’ radar<br />

- what legislative changes are being monitored<br />

- what directors’ duties are being highlighted by<br />

shareholders currently<br />

• How have exposures changed in the past 6-12 months<br />

• How do risk managers assess their exposure to sovereign<br />

debt, what is the projected impact and what is being done<br />

to address adverse implications<br />

• What primary risk management measures are in place to<br />

address such risks<br />

• What are the cutting edge strategies corporate boards<br />

and risk managers have in place to protect their D&Os<br />

from liability<br />

• Who decides on insurance coverage needs<br />

• What are the drivers for purchasing cover<br />

• International programmes<br />

- is there a rise in demand for international programmes<br />

amongst risk managers<br />

- what adjustments would buyers suggest to improve the<br />

process of implementing a multi-national programme<br />

- are there any challenges in this area that the insurance<br />

industry has not addressed<br />

• Risk exposures anticipated for the future and emerging<br />

gaps in coverage<br />

11.30 The Key Policy Amendments and Coverage<br />

Issues You Need to Be Aware of to Provide<br />

Profitable Coverage in a Turbulent Market<br />

Graham Denny, Solicitor, Holman Fenwick Willan<br />

Francis Keane, Executive Director FINEX, Willis<br />

Dax Gulmohamed, Executive Vice President,<br />

AXIS Specialty London<br />

Nick Allen, Management <strong>Liability</strong> Product Manager,<br />

Travelers <strong>Insurance</strong> Company Limited<br />

• Overview and analysis of key coverage issues arising in 2011<br />

• How are D&O underwriters addressing potential losses<br />

arising from current economic conditions<br />

- what adjustments are being make to policy wordings<br />

- what exclusionary language is being used Will<br />

underwriters introduce exclusions akin to the<br />

“deliberate corporate acts” and Ponzi scheme exclusions<br />

added during the previous crisis<br />

- will these changes result in changes to the actual<br />

coverage offered<br />

- are price buffers being built in<br />

• How will existing standard wordings respond to new<br />

pressures in the current climate Which provisions are<br />

particularly vulnerable or inadequate<br />

• To what extent are risks stemming from broadening cover<br />

being redressed through wordings<br />

• Broker specific products: how do new wordings used in<br />

products by Willis, Marsh, JLT etc. differ from traditional<br />

products<br />

12.15 Networking Lunch<br />

1.30 How to Take Advantage of D&O Opportunities<br />

in Emerging Markets: China, India, Brazil and<br />

Russia<br />

Carsten Keune<br />

Chief Underwriting Officer Professional Emerging Markets<br />

XL <strong>Insurance</strong> Company Ltd<br />

Glaucia Asvolinsque D. de Faria Smithson<br />

Chief Underwriting Officer,<br />

Commercial Executive Risks Europe<br />

Zurich General <strong>Insurance</strong><br />

To register call +44 (0) 20 7878 6888 OR fax +44 (0) 20 7878 6885

E m e r g i n g M a r k e t s F o c u s<br />

Uttara Viad, COO & Executive Director,<br />

Aon Global <strong>Insurance</strong> Brokers (Pvt) Limited (India)<br />

Vladimir Kryuchkov, Senior Vice President,<br />

Finpro Practice Leader,<br />

Marsh <strong>Insurance</strong> Brokers ZAO (Russia)<br />

Ed Smerdon, Partner, Sedgwick LLP – moderator<br />

Expert speakers with country specific experience in the markets<br />

covered will guide you through the main opportunities, risks and<br />

challenges in each jurisdiction. They will also cover questions every<br />

insurer looking to enter or consolidate their presence in these<br />

jurisdictions should ask their insurds, red fl ags to watch out for,<br />

common mistakes made by underwriters, mitigatory action you can<br />

take and share their lessons learned.<br />

• Overview of market conditions<br />

• What are the theoretical exposures for directors<br />

- are there any recent developments or trends in actual<br />

cases brought<br />

- how long do cases take to reach court<br />

• Update on recent claims and emerging trends<br />

• What are the drivers for future civil claims against directors<br />

- claims culture<br />

- procedural issues<br />

- commercial imperatives<br />

- funding/loser pays rules<br />

• What is the criminal investigations/regulatory environment<br />

affecting directors<br />

- what are the most common offences<br />

- is fraud/insider dealing/bribery a significant issue<br />

• Beyond the territorial limits, how are local companies<br />

being targeted in other jurisdictions<br />

- where are they being targeted<br />

- what for<br />

- by whom<br />

• What is the position on indemnification by companies<br />

- is it permitted<br />

- if so, how<br />

- are there specific rules governing it<br />

• What is the regulatory environment for insuring local<br />

based risks<br />

- do insurers need to be admitted<br />

- what methods do foreign insurers use to enable them<br />

to write local risks<br />

• What does the locally issued D&O product look like<br />

What are the developments, trends and issues in the product<br />

• Reinsurance market conditions<br />

• What are the recent laws or developments affecting<br />

the local insurance industry<br />

• What are the particular underwriting issues facing insurers<br />

of local based companies<br />

• Are there any other cultural or legal factors insurers from<br />

outside should take into account when doing business there<br />

3.30 Afternoon Refreshments<br />

3.45 How to prepare for a Potential Rise in<br />

Corporate Insolvency – and What That<br />

Means for Your Business<br />

David Gutteridge, Vice President, ACE Bermuda<br />

Matthew Doherty, Underwriting Manager,<br />

Arch <strong>Insurance</strong> Europe<br />

John Batch, Senior Vice President,<br />

D&O Product Leader, FINPRO CEMEA<br />

• Trends in insolvency across UK, the US and Continental<br />

Europe – when can we expect the predicated tide to hit and<br />

how What types of litigation can we expect in its wake<br />

• <strong>Liability</strong> of directors in bankruptcy situations and when<br />

the company is entering the zone of insolvency<br />

• Differences in liability in different European states<br />

and insurance implications that follow<br />

• How do policy exclusions such as “insured vs insured”<br />

work in insolvency<br />

• What are the current gaps in coverage<br />

• Link up between the principal policy, Side A and Run off<br />

policies in insolvency situations: overlaps and potential gaps<br />

• Impact on Side A market<br />

- to what extent has there been an increase in the purchase<br />

of Side A cover in response to rising bankruptcies<br />

- how can Side A products be differentiated in terms of<br />

how they are likely to respond to emerging demands<br />

- how would the cost of Side A products be impacted<br />

and how will deductibles be treated<br />

4.45 Reinsurance Market Leaders’ Perspective on<br />

Current Market Conditions and Strategies<br />

for Risk Minimisation<br />

Elisabeth Spann, Head of Financial Lines,<br />

Global Clients/North America, Casualty Facultative,<br />

Munich Re<br />

Marcel Fischer, Senior Underwriter Facultative<br />

Casualty/Vice President -Europe, Middle East<br />

& Africa, Swiss Reinsurance Company Ltd<br />

• How do reinsurers view their participation in this market<br />

to date and what changes do they anticipate in the<br />

coming months<br />

• How do reinsurers view their exposure in this arena and how<br />

do they calculate their risks in current market conditions<br />

• Reinsurance industry response to decreasing prices/increase<br />

in capacity<br />

• Reinsurance claims: what coverage issues have arisen and<br />

how are reinsurers approaching claims handling Are claims<br />

increasing<br />

• What are reinsurers doing to prepare for the next wave<br />

of claims<br />

• Reinsurance in emerging markets: how do reinsurers<br />

ensure there is no mismatch when local wordings are used<br />

- using local insurer/s<br />

- working through a global programmes<br />

5.30 Chairman’s Closing Remarks<br />

and End of Conference<br />

“<br />

Very good presentations, great opportunity for networking<br />

Thomas Lange, Underwriter, Financial Lines, Munich Re (Delegate, 2011)<br />

I found it very useful for my day-to-day business, (to) keep up to date on new hot topics in the market, issues of<br />

concern that I can communicate to clients and work together with them to find a solution which best suits their needs<br />

Lot Goris, Client Advisor, Aon (Delegate, 2011)<br />

Fax order form to +44 (0) 20 7878 6885 or register online at www.<strong>C5</strong>-Online.com/Directors<br />

Interesting to pick up issues in the field of D&O, looking at the topic from a client perspective<br />

Gunnel Lagerstedt, Manager Casualty Business, Skanska (Delegate, 2011)<br />

©<strong>C5</strong>, 2011

21st Forum on<br />

D&O <strong>Liability</strong> <strong>Insurance</strong><br />

Latest Underwriting, Claims and Coverage Strategies for Minimising Risk, Growing Your Business<br />

and Meeting <strong>Insurance</strong> Buyers’ Needs<br />

Business Information<br />

In A Global Context<br />

Priority Service Code<br />

672I12.E<br />

FEE PER DELEGATE Register & Pay by 28 February, 2012 Register & Pay after 28 February, 2012<br />

ELITEPASS*: Conference & Workshop £1998 £2098<br />

Conference Only £1499 £1599<br />

DELEGATE DETAILS<br />

NAME<br />

TEAM DISCOUNTS: Booking 3 or more delegates Call +44 (0) 20 7878 6888 for details<br />

PLEASE ADD VAT TO ALL ORDERS<br />

*ELITEPASS is recommended for maximum learning and networking value.<br />

POSITION<br />

5 EASY WAYS TO REGISTER<br />

<br />

℡<br />

<br />

<br />

<br />

WEBSITE: www.<strong>C5</strong>-Online.com/Directors<br />

REGISTRATIONS & ENQUIRIES<br />

+44 20 7878 6888<br />

EMAIL: registrations@<strong>C5</strong>-Online.com<br />

FAX: +44 20 7878 6885<br />

PLEASE RETURN TO<br />

<strong>C5</strong>, Customer Service<br />

6th Floor, Trans-World House, 100 City Road<br />

London EC1Y 2BP, UK<br />

ADMINISTRATIVE DETAILS<br />

Date: 27 – 28 March, 2012<br />

Time: 8.30 – 5.30<br />

Venue: Grange Tower Bridge Hotel, London<br />

Address: 45 Prescot Street, London, E1 8GP, United Kingdom<br />

Telephone: +44 (0)20 7959 5000<br />

APPROVING MANAGER<br />

ORGANIZATION<br />

ADDRESS<br />

POSITION<br />

An allocation of bedrooms is being held for delegates at a negotiated rate until<br />

24 February 2012. To book your accommodation please call Venue Search on tel:<br />

+44 (0) 20 8541 5656 or e-mail beds@venuesearch.co.uk. Please note, lower<br />

rates may be available when booking via the internet or direct with the hotel,<br />

but different cancellation policies will apply.<br />

CITY<br />

POSTCODE<br />

PHONE<br />

EMAIL<br />

TYPE OF BUSINESS<br />

FOR MULTIPLE DELEGATE BOOKINGS PLEASE COPY THIS FORM<br />

PAYMENT DETAILS<br />

BY CREDIT CARD<br />

Please charge my ○ AMEX ○ VISA ○ MasterCard<br />

NUMBER<br />

CARDHOLDER<br />

BY CHEQUE<br />

I have enclosed a cheque for £ ___________ made payable to <strong>C5</strong><br />

BY BANK TRANSFER<br />

<strong>C5</strong> Communications Limited<br />

Account Name: <strong>C5</strong> Communications Limited<br />

Bank Name: HSBC BANK Plc<br />

Bank Address: 31 Chequer Street, St Albans Herts AL1 3YN, UK<br />

Bank Branch: St Albans Branch<br />

BIC ( Bank Identifier Code ): MIDLGB22<br />

GBP Account (VAT num: 913 0992 30)<br />

IBAN: GB41 MID L 4040 0182 1816 22<br />

Sort Code: 40-40-01<br />

COUNTRY<br />

EXP. DATE<br />

If you wish to pay in Euros€ or USD$ please contact Customer Service<br />

FAX<br />

Event Code: 672I12-LON<br />

DOCUMENTATION IS PROVIDED<br />

The documentation provided at the event will be available via web link. If you<br />

are not able to attend, you can purchase a link to the presentations provided<br />

to delegates on the day of the event. Please send us this completed booking<br />

form together with payment of £350 per copy requested. For further information<br />

please call +44 (0) 207 878 6888 or email enquiries@<strong>C5</strong>-Online.com.<br />

CONTINUING EDUCATION<br />

12 hours (conference only) plus 2.25 hours per master class towards Continuing<br />

Professional Developments hours (Solicitors Regulation Authority). Please contact<br />

<strong>C5</strong> for further information on claiming your CPD points.<br />

PAYMENT POLICY<br />

Payment is due in full upon your registration. Full payment must be received<br />

prior to the event otherwise entry will be denied. All discounts will be applied to<br />

the Main Conference Only fee (excluding add-ons), cannot be combined with any<br />

other offer, and must be paid in full at time of order. Group discounts available to<br />

individuals employed by the same organisation.<br />

TERMS AND CONDITIONS<br />

You must notify us by email at least 48 hours in advance if you wish to send<br />

a substitute participant. Delegates may not “share” a pass between multiple<br />

attendees without prior authorization. If you are unable to find a substitute,<br />

please notify <strong>C5</strong> in writing no later than 10 days prior to the conference date<br />

and a credit voucher will be issued to you for the full amount paid, redeemable<br />

against any other <strong>C5</strong> conference. If you prefer, you may request a refund of<br />

fees paid less a 25% service charge. No credits or refunds will be given for<br />

cancellations received after 10 days prior to the conference date. <strong>C5</strong> reserves<br />

the right to cancel any conference for any reason and will not be responsible for<br />

airfare, hotel or any other costs incurred by attendees. No liability is assumed by<br />

<strong>C5</strong> for changes in programme date, content, speakers or venue.<br />

INCORRECT MAILING INFORMATION<br />

If you receive a duplicate mailing of this brochure or would like us to change<br />

any of your details, please email data@<strong>C5</strong>-Online.com or fax the label on<br />

this brochure to +44 (0) 20 7878 6887. To view our privacy policy go to<br />

www.<strong>C5</strong>-Online.com/privacy_policy_statement.