D&O Liability Insurance - C5

D&O Liability Insurance - C5

D&O Liability Insurance - C5

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

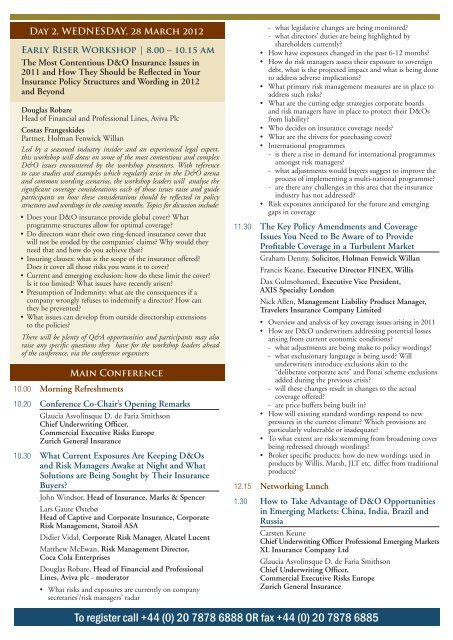

Day 2, WEDNESDAY, 28 March 2012<br />

Early Riser Workshop | 8.00 – 10.15 am<br />

The Most Contentious D&O <strong>Insurance</strong> Issues in<br />

2011 and How They Should be Reflected in Your<br />

<strong>Insurance</strong> Policy Structures and Wording in 2012<br />

and Beyond<br />

Douglas Robare<br />

Head of Financial and Professional Lines, Aviva Plc<br />

Costas Frangeskides<br />

Partner, Holman Fenwick Willan<br />

Led by a seasoned industry insider and an experienced legal expert,<br />

this workshop will draw on some of the most contentious and complex<br />

D&O issues encountered by the workshop presenters. With reference<br />

to case studies and examples which regularly arise in the D&O arena<br />

and common wording scenarios, the workshop leaders will analyse the<br />

significant coverage considerations each of those issues raise and guide<br />

participants on how these considerations should be refl ected in policy<br />

structures and wordings in the coming months. Topics for dicussion include:<br />

• Does your D&O insurance provide global cover What<br />

programme structures allow for optimal coverage<br />

• Do directors want their own ring-fenced insurance cover that<br />

will not be eroded by the companies’ claims Why would they<br />

need that and how do you achieve that<br />

• Insuring clauses: what is the scope of the insurance offered<br />

Does it cover all those risks you want it to cover<br />

• Current and emerging exclusion: how do these limit the cover<br />

Is it too limited What issues have recently arisen<br />

• Presumption of Indemnity: what are the consequences if a<br />

company wrongly refuses to indemnify a director How can<br />

they be prevented<br />

• What issues can develop from outside directorship extensions<br />

to the policies<br />

There will be plenty of Q&A opportunities and participants may also<br />

raise any specific questions they have for the workshop leaders ahead<br />

of the conference, via the conference organisers<br />

Main Conference<br />

10.00 Morning Refreshments<br />

10.20 Conference Co-Chair’s Opening Remarks<br />

Glaucia Asvolinsque D. de Faria Smithson<br />

Chief Underwriting Officer,<br />

Commercial Executive Risks Europe<br />

Zurich General <strong>Insurance</strong><br />

10.30 What Current Exposures Are Keeping D&Os<br />

and Risk Managers Awake at Night and What<br />

Solutions are Being Sought by Their <strong>Insurance</strong><br />

Buyers<br />

John Windsor, Head of <strong>Insurance</strong>, Marks & Spencer<br />

Lars Gaute Østebø<br />

Head of Captive and Corporate <strong>Insurance</strong>, Corporate<br />

Risk Management, Statoil ASA<br />

Didier Vidal, Corporate Risk Manager, Alcatel Lucent<br />

Matthew McEwan, Risk Management Director,<br />

Coca Cola Enterprises<br />

Douglas Robare, Head of Financial and Professional<br />

Lines, Aviva plc - moderator<br />

• What risks and exposures are currently on company<br />

secretaries’/risk managers’ radar<br />

- what legislative changes are being monitored<br />

- what directors’ duties are being highlighted by<br />

shareholders currently<br />

• How have exposures changed in the past 6-12 months<br />

• How do risk managers assess their exposure to sovereign<br />

debt, what is the projected impact and what is being done<br />

to address adverse implications<br />

• What primary risk management measures are in place to<br />

address such risks<br />

• What are the cutting edge strategies corporate boards<br />

and risk managers have in place to protect their D&Os<br />

from liability<br />

• Who decides on insurance coverage needs<br />

• What are the drivers for purchasing cover<br />

• International programmes<br />

- is there a rise in demand for international programmes<br />

amongst risk managers<br />

- what adjustments would buyers suggest to improve the<br />

process of implementing a multi-national programme<br />

- are there any challenges in this area that the insurance<br />

industry has not addressed<br />

• Risk exposures anticipated for the future and emerging<br />

gaps in coverage<br />

11.30 The Key Policy Amendments and Coverage<br />

Issues You Need to Be Aware of to Provide<br />

Profitable Coverage in a Turbulent Market<br />

Graham Denny, Solicitor, Holman Fenwick Willan<br />

Francis Keane, Executive Director FINEX, Willis<br />

Dax Gulmohamed, Executive Vice President,<br />

AXIS Specialty London<br />

Nick Allen, Management <strong>Liability</strong> Product Manager,<br />

Travelers <strong>Insurance</strong> Company Limited<br />

• Overview and analysis of key coverage issues arising in 2011<br />

• How are D&O underwriters addressing potential losses<br />

arising from current economic conditions<br />

- what adjustments are being make to policy wordings<br />

- what exclusionary language is being used Will<br />

underwriters introduce exclusions akin to the<br />

“deliberate corporate acts” and Ponzi scheme exclusions<br />

added during the previous crisis<br />

- will these changes result in changes to the actual<br />

coverage offered<br />

- are price buffers being built in<br />

• How will existing standard wordings respond to new<br />

pressures in the current climate Which provisions are<br />

particularly vulnerable or inadequate<br />

• To what extent are risks stemming from broadening cover<br />

being redressed through wordings<br />

• Broker specific products: how do new wordings used in<br />

products by Willis, Marsh, JLT etc. differ from traditional<br />

products<br />

12.15 Networking Lunch<br />

1.30 How to Take Advantage of D&O Opportunities<br />

in Emerging Markets: China, India, Brazil and<br />

Russia<br />

Carsten Keune<br />

Chief Underwriting Officer Professional Emerging Markets<br />

XL <strong>Insurance</strong> Company Ltd<br />

Glaucia Asvolinsque D. de Faria Smithson<br />

Chief Underwriting Officer,<br />

Commercial Executive Risks Europe<br />

Zurich General <strong>Insurance</strong><br />

To register call +44 (0) 20 7878 6888 OR fax +44 (0) 20 7878 6885