D&O Liability Insurance - C5

D&O Liability Insurance - C5

D&O Liability Insurance - C5

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

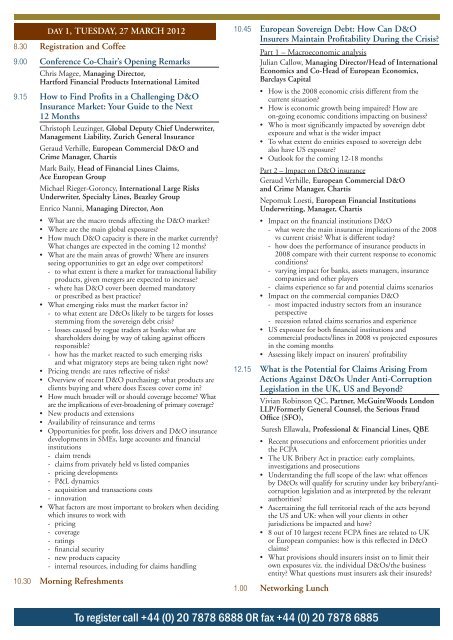

DAY 1, TUESDAY, 27 MARCH 2012<br />

8.30 Registration and Coffee<br />

9.00 Conference Co-Chair’s Opening Remarks<br />

Chris Magee, Managing Director,<br />

Hartford Financial Products International Limited<br />

9.15 How to Find Profits in a Challenging D&O<br />

<strong>Insurance</strong> Market: Your Guide to the Next<br />

12 Months<br />

Christoph Leuzinger, Global Deputy Chief Underwriter,<br />

Management <strong>Liability</strong>, Zurich General <strong>Insurance</strong><br />

Geraud Verhille, European Commercial D&O and<br />

Crime Manager, Chartis<br />

Mark Baily, Head of Financial Lines Claims,<br />

Ace European Group<br />

Michael Rieger-Goroncy, International Large Risks<br />

Underwriter, Specialty Lines, Beazley Group<br />

Enrico Nanni, Managing Director, Aon<br />

• What are the macro trends affecting the D&O market<br />

• Where are the main global exposures<br />

• How much D&O capacity is there in the market currently<br />

What changes are expected in the coming 12 months<br />

• What are the main areas of growth Where are insurers<br />

seeing opportunities to get an edge over competitors<br />

- to what extent is there a market for transactional liability<br />

products, given mergers are expected to increase<br />

- where has D&O cover been deemed mandatory<br />

or prescribed as best practice<br />

• What emerging risks must the market factor in<br />

- to what extent are D&Os likely to be targets for losses<br />

stemming from the sovereign debt crisis<br />

- losses caused by rogue traders at banks: what are<br />

shareholders doing by way of taking against officers<br />

responsible<br />

- how has the market reacted to such emerging risks<br />

and what migratory steps are being taken right now<br />

• Pricing trends: are rates reflective of risks<br />

• Overview of recent D&O purchasing: what products are<br />

clients buying and where does Excess cover come in<br />

• How much broader will or should coverage become What<br />

are the implications of ever-broadening of primary coverage<br />

• New products and extensions<br />

• Availability of reinsurance and terms<br />

• Opportunities for profit, loss drivers and D&O insurance<br />

developments in SMEs, large accounts and financial<br />

institutions<br />

- claim trends<br />

- claims from privately held vs listed companies<br />

- pricing developments<br />

- P&L dynamics<br />

- acquisition and transactions costs<br />

- innovation<br />

• What factors are most important to brokers when deciding<br />

which insures to work with<br />

- pricing<br />

- coverage<br />

- ratings<br />

- financial security<br />

- new products capacity<br />

- internal resources, including for claims handling<br />

10.30 Morning Refreshments<br />

10.45 European Sovereign Debt: How Can D&O<br />

Insurers Maintain Profitability During the Crisis<br />

Part 1 – Macroeconomic analysis<br />

Julian Callow, Managing Director/Head of International<br />

Economics and Co-Head of European Economics,<br />

Barclays Capital<br />

• How is the 2008 economic crisis different from the<br />

current situation<br />

• How is economic growth being impaired How are<br />

on-going economic conditions impacting on business<br />

• Who is most significantly impacted by sovereign debt<br />

exposure and what is the wider impact<br />

• To what extent do entities exposed to sovereign debt<br />

also have US exposure<br />

• Outlook for the coming 12-18 months<br />

Part 2 – Impact on D&O insurance<br />

Geraud Verhille, European Commercial D&O<br />

and Crime Manager, Chartis<br />

Nepomuk Loesti, European Financial Institutions<br />

Underwriting, Manager, Chartis<br />

• Impact on the financial institutions D&O<br />

- what were the main insurance implications of the 2008<br />

vs current crisis What is different today<br />

- how does the performance of insurance products in<br />

2008 compare with their current response to economic<br />

conditions<br />

- varying impact for banks, assets managers, insurance<br />

companies and other players<br />

- claims experience so far and potential claims scenarios<br />

• Impact on the commercial companies D&O<br />

- most impacted industry sectors from an insurance<br />

perspective<br />

- recession related claims scenarios and experience<br />

• US exposure for both financial institutions and<br />

commercial products/lines in 2008 vs projected exposures<br />

in the coming months<br />

• Assessing likely impact on insurers’ profitability<br />

12.15 What is the Potential for Claims Arising From<br />

Actions Against D&Os Under Anti-Corruption<br />

Legislation in the UK, US and Beyond<br />

Vivian Robinson QC, Partner, McGuireWoods London<br />

LLP/Formerly General Counsel, the Serious Fraud<br />

Office (SFO),<br />

Suresh Ellawala, Professional & Financial Lines, QBE<br />

• Recent prosecutions and enforcement priorities under<br />

the FCPA<br />

• The UK Bribery Act in practice: early complaints,<br />

investigations and prosecutions<br />

• Understanding the full scope of the law: what offences<br />

by D&Os will qualify for scrutiny under key bribery/anticorruption<br />

legislation and as interpreted by the relevant<br />

authorities<br />

• Ascertaining the full territorial reach of the acts beyond<br />

the US and UK: when will your clients in other<br />

jurisdictions be impacted and how<br />

• 8 out of 10 largest recent FCPA fines are related to UK<br />

or European companies: how is this reflected in D&O<br />

claims<br />

• What provisions should insurers insist on to limit their<br />

own exposures viz. the individual D&Os/the business<br />

entity What questions must insurers ask their insureds<br />

1.00 Networking Lunch<br />

To register call +44 (0) 20 7878 6888 OR fax +44 (0) 20 7878 6885