printmgr file

printmgr file

printmgr file

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHECK POINT SOFTWARE<br />

FORM 20-F DFN ON-BOA<br />

ˆ200FDMqk04h2RFN7!Š<br />

200FDMqk04h2RFN7<br />

RR Donnelley ProFile wcrdoc1<br />

10.10.12 WCRsinhm0in 26-Mar-2012 19:25 EST<br />

229899 FIN 11 4*<br />

PAL<br />

09-Apr-2012 13:21 EST CURR<br />

PS PMT 1C<br />

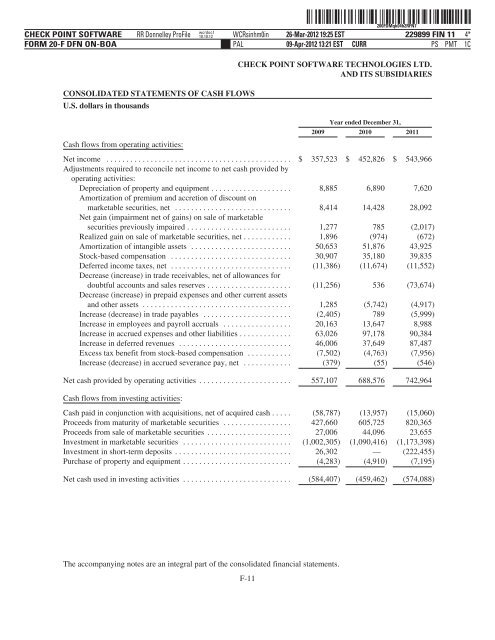

CONSOLIDATED STATEMENTS OF CASH FLOWS<br />

U.S. dollars in thousands<br />

CHECK POINT SOFTWARE TECHNOLOGIES LTD.<br />

AND ITS SUBSIDIARIES<br />

2009<br />

Year ended December 31,<br />

2010 2011<br />

Cash flows from operating activities:<br />

Net income ..............................................<br />

Adjustments required to reconcile net income to net cash provided by<br />

operating activities:<br />

$ 357,523 $ 452,826 $ 543,966<br />

Depreciation of property and equipment ....................<br />

Amortization of premium and accretion of discount on<br />

8,885 6,890 7,620<br />

marketable securities, net .............................<br />

Net gain (impairment net of gains) on sale of marketable<br />

8,414 14,428 28,092<br />

securities previously impaired .......................... 1,277 785 (2,017)<br />

Realized gain on sale of marketable securities, net ............ 1,896 (974) (672)<br />

Amortization of intangible assets ......................... 50,653 51,876 43,925<br />

Stock-based compensation .............................. 30,907 35,180 39,835<br />

Deferred income taxes, net ..............................<br />

Decrease (increase) in trade receivables, net of allowances for<br />

(11,386) (11,674) (11,552)<br />

doubtful accounts and sales reserves .....................<br />

Decrease (increase) in prepaid expenses and other current assets<br />

(11,256) 536 (73,674)<br />

and other assets ..................................... 1,285 (5,742) (4,917)<br />

Increase (decrease) in trade payables ...................... (2,405) 789 (5,999)<br />

Increase in employees and payroll accruals ................. 20,163 13,647 8,988<br />

Increase in accrued expenses and other liabilities ............. 63,026 97,178 90,384<br />

Increase in deferred revenues ............................ 46,006 37,649 87,487<br />

Excess tax benefit from stock-based compensation ........... (7,502) (4,763) (7,956)<br />

Increase (decrease) in accrued severance pay, net ............ (379) (55) (546)<br />

Net cash provided by operating activities ....................... 557,107 688,576 742,964<br />

Cash flows from investing activities:<br />

Cash paid in conjunction with acquisitions, net of acquired cash ..... (58,787) (13,957) (15,060)<br />

Proceeds from maturity of marketable securities ................. 427,660 605,725 820,365<br />

Proceeds from sale of marketable securities ..................... 27,006 44,096 23,655<br />

Investment in marketable securities ........................... (1,002,305) (1,090,416) (1,173,398)<br />

Investment in short-term deposits ............................. 26,302 — (222,455)<br />

Purchase of property and equipment ........................... (4,283) (4,910) (7,195)<br />

Net cash used in investing activities ........................... (584,407) (459,462) (574,088)<br />

The accompanying notes are an integral part of the consolidated financial statements.<br />

F-11