printmgr file

printmgr file

printmgr file

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CHECK POINT SOFTWARE<br />

FORM 20-F DFN ON-BOA<br />

RR Donnelley ProFile wcrdoc1<br />

10.10.12 WCRgildt0px<br />

START PAGE<br />

PAL<br />

ˆ200FDMqj#xezK9T7gŠ<br />

200FDMqj#xezK9T7<br />

30-Mar-2012 01:07 EST<br />

229899 TX 63 3*<br />

09-Apr-2012 13:21 EST CURR<br />

PS PMT 1C<br />

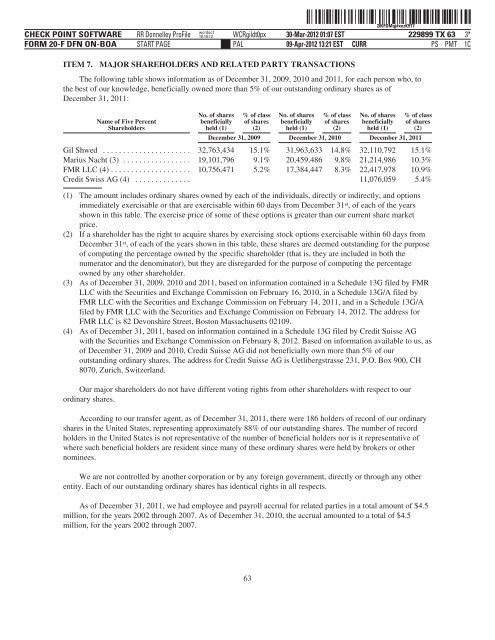

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS<br />

The following table shows information as of December 31, 2009, 2010 and 2011, for each person who, to<br />

the best of our knowledge, beneficially owned more than 5% of our outstanding ordinary shares as of<br />

December 31, 2011:<br />

Name of Five Percent<br />

Shareholders<br />

No. of shares<br />

beneficially<br />

held (1)<br />

% of class<br />

of shares<br />

(2)<br />

No. of shares<br />

beneficially<br />

held (1)<br />

% of class<br />

of shares<br />

(2)<br />

No. of shares<br />

beneficially<br />

held (1)<br />

% of class<br />

of shares<br />

(2)<br />

December 31, 2009 December 31, 2010 December 31, 2011<br />

Gil Shwed ...................... 32,763,434 15.1% 31,963,633 14.8% 32,110,792 15.1%<br />

Marius Nacht (3) ................. 19,101,796 9.1% 20,459,486 9.8% 21,214,986 10.3%<br />

FMRLLC(4).................... 10,756,471 5.2% 17,384,447 8.3% 22,417,978 10.9%<br />

Credit Swiss AG (4) .............. 11,076,059 5.4%<br />

(1) The amount includes ordinary shares owned by each of the individuals, directly or indirectly, and options<br />

immediately exercisable or that are exercisable within 60 days from December 31 st , of each of the years<br />

shown in this table. The exercise price of some of these options is greater than our current share market<br />

price.<br />

(2) If a shareholder has the right to acquire shares by exercising stock options exercisable within 60 days from<br />

December 31 st , of each of the years shown in this table, these shares are deemed outstanding for the purpose<br />

of computing the percentage owned by the specific shareholder (that is, they are included in both the<br />

numerator and the denominator), but they are disregarded for the purpose of computing the percentage<br />

owned by any other shareholder.<br />

(3) As of December 31, 2009, 2010 and 2011, based on information contained in a Schedule 13G <strong>file</strong>d by FMR<br />

LLC with the Securities and Exchange Commission on February 16, 2010, in a Schedule 13G/A <strong>file</strong>d by<br />

FMR LLC with the Securities and Exchange Commission on February 14, 2011, and in a Schedule 13G/A<br />

<strong>file</strong>d by FMR LLC with the Securities and Exchange Commission on February 14, 2012. The address for<br />

FMR LLC is 82 Devonshire Street, Boston Massachusetts 02109.<br />

(4) As of December 31, 2011, based on information contained in a Schedule 13G <strong>file</strong>d by Credit Suisse AG<br />

with the Securities and Exchange Commission on February 8, 2012. Based on information available to us, as<br />

of December 31, 2009 and 2010, Credit Suisse AG did not beneficially own more than 5% of our<br />

outstanding ordinary shares. The address for Credit Suisse AG is Uetlibergstrasse 231, P.O. Box 900, CH<br />

8070, Zurich, Switzerland.<br />

Our major shareholders do not have different voting rights from other shareholders with respect to our<br />

ordinary shares.<br />

According to our transfer agent, as of December 31, 2011, there were 186 holders of record of our ordinary<br />

shares in the United States, representing approximately 88% of our outstanding shares. The number of record<br />

holders in the United States is not representative of the number of beneficial holders nor is it representative of<br />

where such beneficial holders are resident since many of these ordinary shares were held by brokers or other<br />

nominees.<br />

We are not controlled by another corporation or by any foreign government, directly or through any other<br />

entity. Each of our outstanding ordinary shares has identical rights in all respects.<br />

As of December 31, 2011, we had employee and payroll accrual for related parties in a total amount of $4.5<br />

million, for the years 2002 through 2007. As of December 31, 2010, the accrual amounted to a total of $4.5<br />

million, for the years 2002 through 2007.<br />

63