printmgr file

printmgr file

printmgr file

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHECK POINT SOFTWARE<br />

FORM 20-F DFN ON-BOA<br />

ˆ200FDMqk04fMoR=7nŠ<br />

200FDMqk04fMoR=7<br />

RR Donnelley ProFile wcrdoc1<br />

10.10.12 WCRpf_rend 26-Mar-2012 17:27 EST<br />

229899 TX 50 3*<br />

PAL<br />

09-Apr-2012 13:21 EST CURR<br />

PS PMT 1C<br />

Research and Development, Patents and Licenses, etc.<br />

Additional details are provided in this Item 5, under the caption “Results of operations”.<br />

Trend Information<br />

Additional details are provided in this Item 5, under the caption “Results of operations”.<br />

Off-Balance Sheet Arrangements<br />

We are not a party to any off-balance sheet arrangements. In addition, we have no unconsolidated special<br />

purpose financing or partnership entities that are likely to create contingent obligations.<br />

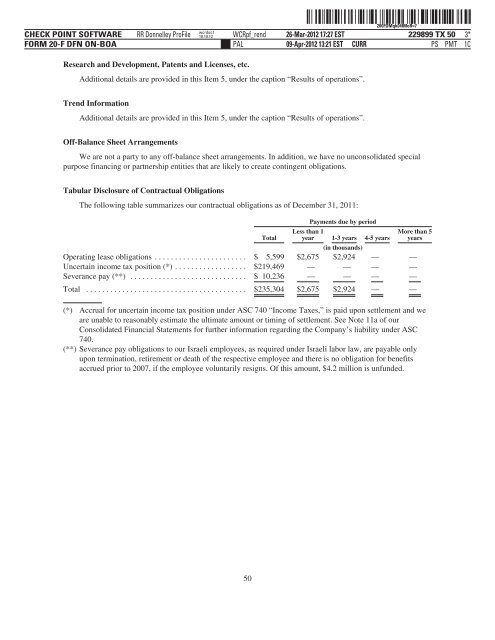

Tabular Disclosure of Contractual Obligations<br />

The following table summarizes our contractual obligations as of December 31, 2011:<br />

Payments due by period<br />

Less than 1<br />

More than 5<br />

Total year 1-3 years<br />

(in thousands)<br />

4-5 years years<br />

Operating lease obligations ....................... $ 5,599 $2,675 $2,924 — —<br />

Uncertain income tax position (*) .................. $219,469 — — — —<br />

Severance pay (**) ............................. $ 10,236 — — — —<br />

Total ........................................ $235,304 $2,675 $2,924 — —<br />

(*) Accrual for uncertain income tax position under ASC 740 “Income Taxes,” is paid upon settlement and we<br />

are unable to reasonably estimate the ultimate amount or timing of settlement. See Note 11a of our<br />

Consolidated Financial Statements for further information regarding the Company’s liability under ASC<br />

740.<br />

(**) Severance pay obligations to our Israeli employees, as required under Israeli labor law, are payable only<br />

upon termination, retirement or death of the respective employee and there is no obligation for benefits<br />

accrued prior to 2007, if the employee voluntarily resigns. Of this amount, $4.2 million is unfunded.<br />

50