printmgr file

printmgr file

printmgr file

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHECK POINT SOFTWARE<br />

FORM 20-F DFN ON-BOA<br />

ˆ200FDMqk04fLlGh7#Š<br />

200FDMqk04fLlGh7<br />

RR Donnelley ProFile wcrdoc1<br />

10.10.12 WCRpf_rend 26-Mar-2012 17:26 EST<br />

229899 TX 41 3*<br />

PAL<br />

09-Apr-2012 13:21 EST CURR<br />

PS PMT 1C<br />

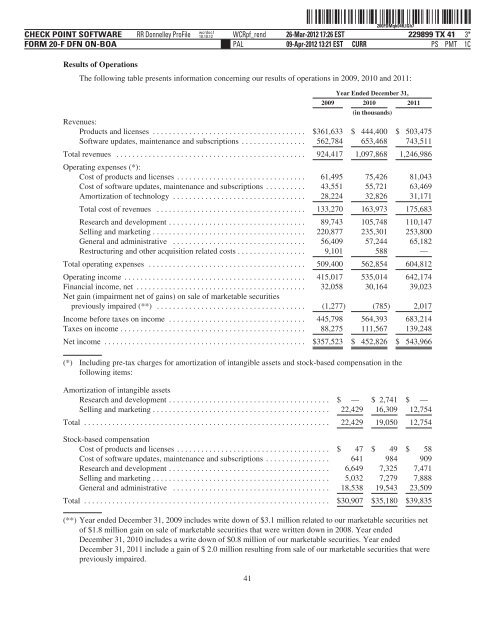

Results of Operations<br />

The following table presents information concerning our results of operations in 2009, 2010 and 2011:<br />

Year Ended December 31,<br />

2009 2010<br />

(in thousands)<br />

2011<br />

Revenues:<br />

Products and licenses ...................................... $361,633 $ 444,400 $ 503,475<br />

Software updates, maintenance and subscriptions ................ 562,784 653,468 743,511<br />

Total revenues ............................................... 924,417 1,097,868 1,246,986<br />

Operating expenses (*):<br />

Cost of products and licenses ................................ 61,495 75,426 81,043<br />

Cost of software updates, maintenance and subscriptions .......... 43,551 55,721 63,469<br />

Amortization of technology ................................. 28,224 32,826 31,171<br />

Total cost of revenues ..................................... 133,270 163,973 175,683<br />

Research and development .................................. 89,743 105,748 110,147<br />

Selling and marketing ...................................... 220,877 235,301 253,800<br />

General and administrative ................................. 56,409 57,244 65,182<br />

Restructuring and other acquisition related costs ................. 9,101 588 —<br />

Total operating expenses ....................................... 509,400 562,854 604,812<br />

Operating income ............................................. 415,017 535,014 642,174<br />

Financial income, net .......................................... 32,058 30,164 39,023<br />

Net gain (impairment net of gains) on sale of marketable securities<br />

previously impaired (**) ..................................... (1,277) (785) 2,017<br />

Income before taxes on income .................................. 445,798 564,393 683,214<br />

Taxes on income .............................................. 88,275 111,567 139,248<br />

Net income .................................................. $357,523 $ 452,826 $ 543,966<br />

(*) Including pre-tax charges for amortization of intangible assets and stock-based compensation in the<br />

following items:<br />

Amortization of intangible assets<br />

Research and development ........................................ $ — $ 2,741 $ —<br />

Selling and marketing ............................................ 22,429 16,309 12,754<br />

Total ............................................................. 22,429 19,050 12,754<br />

Stock-based compensation<br />

Cost of products and licenses ...................................... $ 47 $ 49 $ 58<br />

Cost of software updates, maintenance and subscriptions ................ 641 984 909<br />

Research and development ........................................ 6,649 7,325 7,471<br />

Selling and marketing ............................................ 5,032 7,279 7,888<br />

General and administrative ....................................... 18,538 19,543 23,509<br />

Total ............................................................. $30,907 $35,180 $39,835<br />

(**) Year ended December 31, 2009 includes write down of $3.1 million related to our marketable securities net<br />

of $1.8 million gain on sale of marketable securities that were written down in 2008. Year ended<br />

December 31, 2010 includes a write down of $0.8 million of our marketable securities. Year ended<br />

December 31, 2011 include a gain of $ 2.0 million resulting from sale of our marketable securities that were<br />

previously impaired.<br />

41