printmgr file

printmgr file

printmgr file

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CHECK POINT SOFTWARE<br />

FORM 20-F DFN ON-BOA<br />

ˆ200FDMqk04daHT1h)Š<br />

200FDMqk04daHT1h<br />

RR Donnelley ProFile wcrdoc1<br />

10.10 WCRjacis0in 26-Mar-2012 14:40 EST<br />

229899 TX 5 1*<br />

PAL<br />

09-Apr-2012 13:21 EST CURR<br />

PS IFV 1C<br />

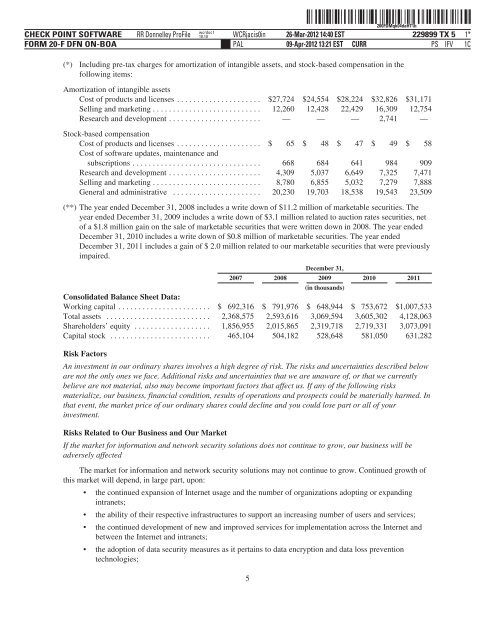

(*) Including pre-tax charges for amortization of intangible assets, and stock-based compensation in the<br />

following items:<br />

Amortization of intangible assets<br />

Cost of products and licenses ..................... $27,724 $24,554 $28,224 $32,826 $31,171<br />

Selling and marketing ........................... 12,260 12,428 22,429 16,309 12,754<br />

Research and development ....................... — — — 2,741 —<br />

Stock-based compensation<br />

Cost of products and licenses ..................... $ 65 $ 48 $ 47 $ 49 $ 58<br />

Cost of software updates, maintenance and<br />

subscriptions ................................ 668 684 641 984 909<br />

Research and development ....................... 4,309 5,037 6,649 7,325 7,471<br />

Selling and marketing ........................... 8,780 6,855 5,032 7,279 7,888<br />

General and administrative ...................... 20,230 19,703 18,538 19,543 23,509<br />

(**) The year ended December 31, 2008 includes a write down of $11.2 million of marketable securities. The<br />

year ended December 31, 2009 includes a write down of $3.1 million related to auction rates securities, net<br />

of a $1.8 million gain on the sale of marketable securities that were written down in 2008. The year ended<br />

December 31, 2010 includes a write down of $0.8 million of marketable securities. The year ended<br />

December 31, 2011 includes a gain of $ 2.0 million related to our marketable securities that were previously<br />

impaired.<br />

2007 2008<br />

December 31,<br />

2009<br />

(in thousands)<br />

2010 2011<br />

Consolidated Balance Sheet Data:<br />

Working capital ....................... $ 692,316 $ 791,976 $ 648,944 $ 753,672 $1,007,533<br />

Total assets .......................... 2,368,575 2,593,616 3,069,594 3,605,302 4,128,063<br />

Shareholders’ equity ................... 1,856,955 2,015,865 2,319,718 2,719,331 3,073,091<br />

Capital stock ......................... 465,104 504,182 528,648 581,050 631,282<br />

Risk Factors<br />

An investment in our ordinary shares involves a high degree of risk. The risks and uncertainties described below<br />

are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently<br />

believe are not material, also may become important factors that affect us. If any of the following risks<br />

materialize, our business, financial condition, results of operations and prospects could be materially harmed. In<br />

that event, the market price of our ordinary shares could decline and you could lose part or all of your<br />

investment.<br />

Risks Related to Our Business and Our Market<br />

If the market for information and network security solutions does not continue to grow, our business will be<br />

adversely affected<br />

The market for information and network security solutions may not continue to grow. Continued growth of<br />

this market will depend, in large part, upon:<br />

• the continued expansion of Internet usage and the number of organizations adopting or expanding<br />

intranets;<br />

• the ability of their respective infrastructures to support an increasing number of users and services;<br />

• the continued development of new and improved services for implementation across the Internet and<br />

between the Internet and intranets;<br />

• the adoption of data security measures as it pertains to data encryption and data loss prevention<br />

technologies;<br />

5